Cost of UK energy imports more than doubles as North Sea body urges government to back British oil and gas

The UK’s energy import bill more than double last year, with the country increasingly reliant on expensive overseas supplies to meet its energy needs, revealed industry body Offshore Energies UK.

OEUK has reported that the cost of imports soared from £54bn in 2021 to £117bn last year, breaking the £100bn barrier for the first time.

In its new Business Outlook Report, it warns UK consumers and businesses could face similar import bills this year and in future years – especially if the windfall tax imposed on UK oil and gas operators remains unmodified.

The industry body has also called for the UK’s North Sea to be made the bedrock of the nation’s energy security – from oil and gas in the present, to expanding offshore wind and other low carbon resources for the future

OEUK calculates the North Sea still has oil and gas reserves equivalent to 15bn barrels of oil – enough to support the nation’s needs for the three decades needed to build the offshore wind and other low carbon energy systems essential to power the future.

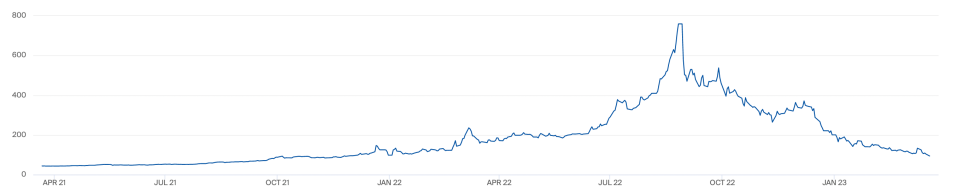

It argues last year’s surge was driven partly by global price rises linked to the Ukraine conflict alongside inflation and higher worldwide demand after the pandemic.

However, it was also caused by the UK’s growing reliance on costly liquefied natural gas shipments, interconnectors and overseas vendors to meet demand.

In the report, OEUK said: “The UK has been a net importer of energy since 2004, meaning that the country uses more energy than it can supply from domestic resources, so it relies on other countries to meet its energy needs.

“Being so reliant on other countries for our energy leaves the UK exposed to disruptions to supply, and volatility in international markets. Last year for instance the overall cost of fuel imports doubled to £117bn.”

Import costs skyrockets amid energy crisis

In 2022, the UK spent about £63bn on crude oil, petrol, diesel, and other oil-based fuels, with another £49 billion spent on buying gas.

The rest was spent on imports of coal and electricity – making a total of £117bn, which equates to £4,200 per UK household.

For comparison, in 2019 – before the pandemic and Russia’s invasion of Ukraine – the UK spent £48bn on total energy imports, which created an average of £1,700 per household).

Roughly £40bn went on oil and £7bn on gas, while he rest went on coal and electricity.

Ross Dornan, OEUK’s markets intelligence manager, who oversaw the report, said: “We now rely on other countries for about half that supply, a proportion that will increase rapidly, especially if North Sea production is allowed to decline faster than UK consumption. The UK is on a three-decade journey to net zero and self-reliance but that needs long-term planning to reduce the demand for oil and gas.

David Whitehouse, OEUK’s chief executive, said : “As a result of the war in Ukraine, we have seen a period of huge price volatility but when prices fall, the windfall tax should go. We have a great British energy industry of our own, but its future depends on moving back to a fair, balanced, and predictable tax regime and the continued issuing of exploration licences.

“Otherwise, energy import bills exceeding £100 billion-plus will become a regular event – that’s money flowing out of UK homes and businesses to support the jobs, industries, and economies of other countries. The whole of the UK will be all the poorer for it. We surely cannot allow that.”

The government has been approached for comment.