Cost of living crisis has forced families to take on £1.1bn debt and dig into savings, says Bank of England

Families are saving far less than they did over the course of the Covid-19 pandemic and maxing on credit cards to maintain spending amid the cost of living crisis, official figures have revealed.

Brits set aside £3.5bn in January in savings accounts, a slight increase from December, but below the pre-pandemic monthly average increase of £4.6bn, according to the Bank of England.

Household finances are being crushed by the worst cost of living crisis in a generation, fuelled by inflation surging to a 40-year high.

The rate of price increases – running at 10.1 per cent, although lower for three straight months now – has outstripped pay growth, meaning households are having to either use up savings or borrow to maintain spending.

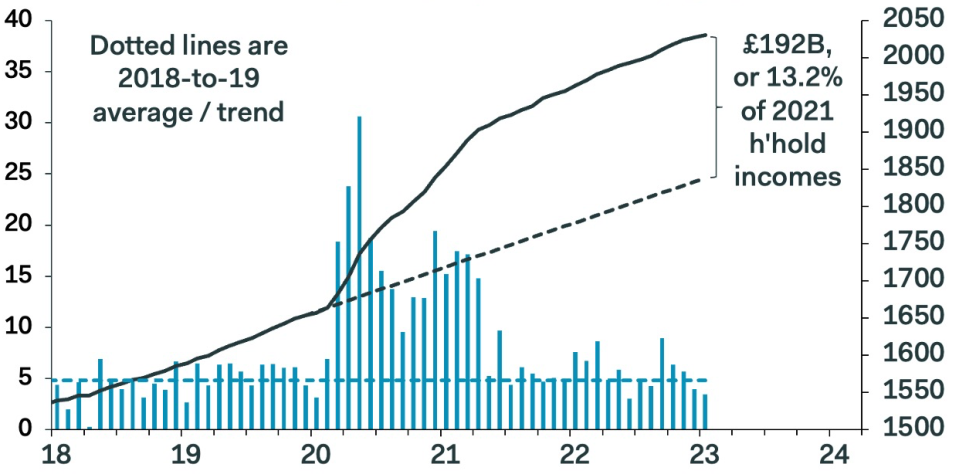

Economists have calculated the amount of extra cash set aside since the pandemic is around £200bn, raising expectations Brits could continue consuming despite their real incomes falling rapidly.

However, fears of a coming recession and being made unemployed has whacked consumer confidence, resulting in people being more cautious with their money.

“Households were more willing in January than in previous months to draw on savings and to borrow more to support their consumption, but it is too soon to call a decisive shift in their behaviour,” Samuel Tombs, chief UK economist at consultancy Pantheon Macroeconomics, said.

Excess savings have ballooned since Covid-19

“The combination of rising interest rates and low confidence continues to suggest that households will manage their finances cautiously over the coming months,” he added.

The flip side of those moves has been to ramp up rates on credit cards and mortgages.

But Brits showed no sign of turning their noses up at taking on debt to fund shopping, with credit card spending up £1.1bn in January, reversing a net £200m repayment in December.

Higher credit card spending indicates inflation has partially eroded the value of consumers’ savings, meaning those war chests risk being unable to allow Brits to maintain normal spending patterns.

“Household savings built up during pandemic have, in real terms, by and large been eroded,” Ashley Webb, UK economist at consultancy Capital Economics, said.

The UK’s top economic institutions including the Bank of England and Office for Budget Responsibility have assumed a run down in savings may support spending and cushion any recession in the country.

On Webb’s reasoning, spending is only likely to recover once real incomes begin to rise, which would require inflation to fall markedly.