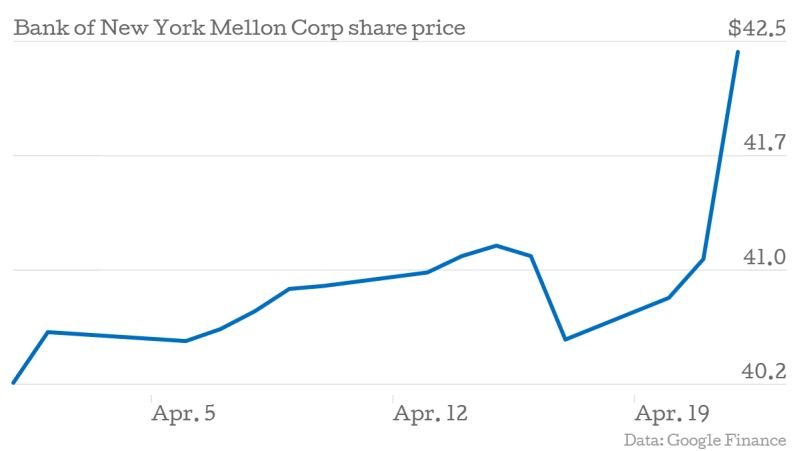

Cost cuts and volatile currencies push up BNY Mellon’s profits

Profits jumped 16 per cent at BNY Mellon in the first quarter, as the world’s largest custody bank benefited from increased foreign exchange trading.

It also saw fee income rise as asset inflows improved, and managed to cut costs after coming under pressure from investors to create a leaner operation.

Profits came in at $776m (£509m) for the first quarter, up from $661m in the same period of 2014.

Revenues climbed six per cent to $3.9bn, with investment service fees up three per cent and investment management and performance fees up one per cent. But the star performer was foreign exchange, with revenues rocketing 67 per cent to $229m on higher volumes and volatility.

Costs fell one per cent, in part due to a two per cent cut in headcount.