OECD: UK economy to take world’s biggest hit from Covid-19

The UK will suffer the largest economic hit from the coronavirus pandemic among major nations this year, the Organisation for Economic Cooperation and Development (OECD) has warned.

Predicting that the UK economy could contract between 11.5 and 14 per cent in 2020, the organisation said Covid-19 represents the biggest peacetime economic downturn in a century and the “worst health and economic crisis since WWII”.

Read more: Markets live: FTSE 100 rebounds as focus shifts to Fed rates decision

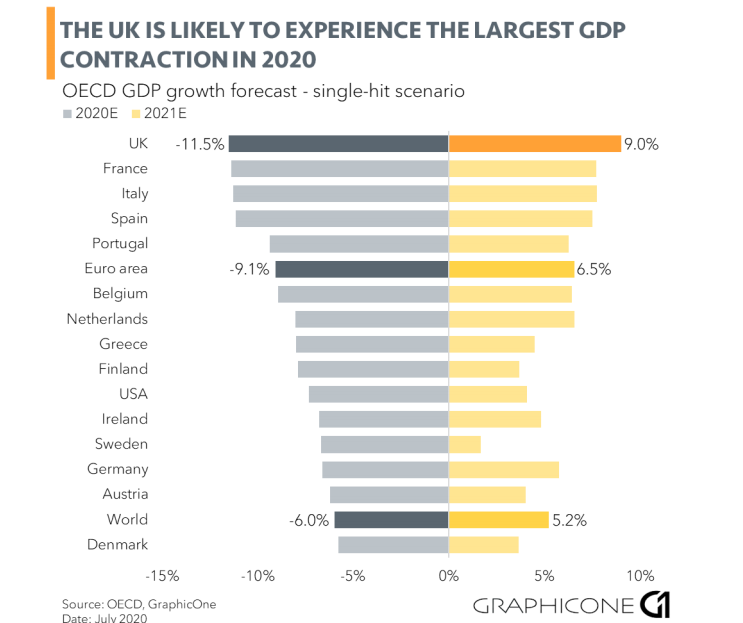

The OECD set out two “equally possible” forecasts for all G20 economies: the so-called double hit in which there is a second major coronavirus outbreak later in 2020, and a single hit outcome in which the virus is kept under control.

Under the single hit scenario, the UK is predicted to be the hardest hit major economy with GDP shrinking 11.5 per cent.

In the double hit scenario, the UK economy is expected to contract 14 per cent, just behind France at 14.1 per cent.

The OECD forecast the global economy would contract six per cent this year before bouncing back with 5.2 per cent growth in 2021, providing the outbreak is kept under control.

However, it predicted that a second wave of infections this year could see the global economy contract 7.6 per cent in 2020 before growing only 2.8 per cent next year.

‘Policymakers face tightrope walk’

“By the end of 2021, the loss of income exceeds that of any previous recession over the last 100 years outside wartime, with dire and long-lasting consequences for people, firms and governments,” said OECD chief economist Laurence Boone.

“As long as no vaccine or treatment is widely available, policymakers around the world will continue to walk on a tightrope,” she added.

Before the Open newsletter: Start your day with the City View podcast and key market data

With crisis responses set to shape economic and social prospects for the coming decade, Boone urged governments not to shy away from debt-financed spending to support low-paid workers and investment.

“Ultra-accommodative monetary policies and higher public debt are necessary and will be accepted as long as economic activity and inflation are depressed, and unemployment is high,” Boone said.

As the threat of a second wave of contagion keeps uncertainty high, Boone urged governments to cooperate on a treatment and vaccine for the virus.

Responding to the OECD predictions, Chancellor Rishi Sunak said the UK was “seeing the significant impact of coronavirus on our country and our economy”, alongside “many other economies around the world”.

“I’ve been clear that our top priority has always been to support people, jobs and businesses through this crisis- and this is what we’ve done,” he continued.

“The unprecedented action we’ve taken to provide lifelines that help people and businesses through the economic disruption will ensure our economic recovery is as strong and as swift as possible.”

The OECD’s grim predictions wiped out the small gains that the FTSE 100 had made in early trading, sending London and its European peers sharply into the red.

Read more: Coronavirus: UK economy set for ‘most severe downturn in modern times’

Spreadex’s Connor Campbell noted that while the OECD’s predictions for the UK “are, technically, better than the Bank of England’s internal forecasts, which have the economy contracting by 14 per cent.”

“However, that’s small comfort given that the OECD has stated the UK will likely suffer more than any other country in the ‘developed’ world,” he added.