Coronavirus: Cineworld shares crash on debt breach warning

Cineworld’s shares spiralled today as it warned a worst-case scenario for coronavirus could throw its future into doubt.

If a worst-case scenario transpires, Cineworld said it could breach its debt terms as it would be forced to close cinemas for up to three months.

Were that to happen, Cineworld would lose up to three months’ worth of revenue.

That would mean “there is a risk of breaching the group’s financial covenants, unless a waiver agreement is reached with the required majority of lenders within the going concern period”, Cineworld said.

Today’s warning triggered a 34 per cent plunge in Cineworld’s share price to under 60p.

Cineworld said such a scenario was unlikely. “However, it is difficult to predict the overall outcome and impact of COVID-19 at this stage,” it told investors.

If the UK coronavirus crisis does worsen significantly, this “would indicate the existence of a material uncertainty which may cast significant doubt about the group’s ability to continue as a going concern”.

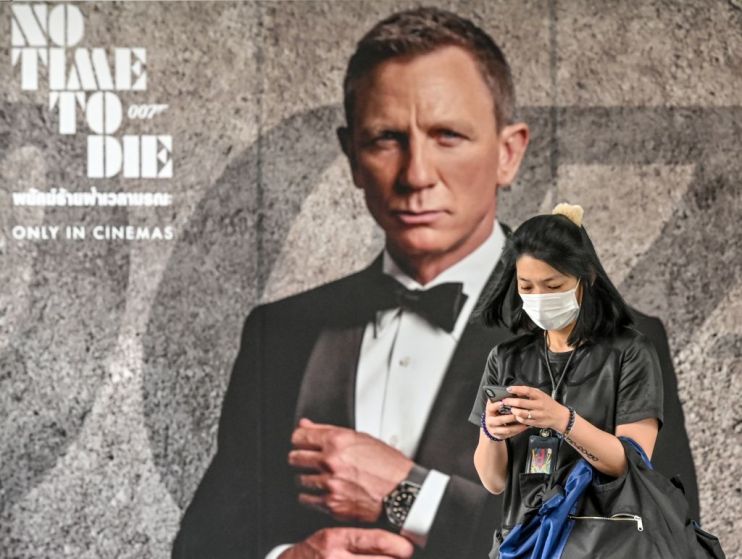

Cineworld’s stock has already dropped on the delay of the new James Bond movie, No Time to Die, from April to November.

That came as China closed cinemas to prevent the spread of coronavirus. And Italy has now taken the drastic step of forcing all stores save supermarkets and pharmacies to close in order to stem the outbreak.

Mooky Greidinger, chief executive of Cineworld, said coronavirus has so far only had a “minimal impact” on the business.

But he added: “There can be no certainty on its future impact on our activities, hence we are taking measures to ensure that we are prepared for all possible eventualities.

“Should conditions relating to [coronavirus] continue or worsen, we have measures at our disposal to reduce the impact on our business including, but not limited to, capex postponement, cost reduction, in order to maintain cash liquidity.”

Cineworld said its financing arrangements consist of a dollar/euro loan totalling $3.6bn and a revolving credit facility of $462.5m, of which it has drawn down $95m.

Covenants on the credit facility kick in if Cineworld uses over 35 per cent of it.