Consumer price cap could spike to £3,000 per year warns Investec

The consumer price cap could spike to £3,000 per year in October, warned Investec, following Russia’s invasion of Ukraine.

Energy prices have soared across the continent amid renewed fears of supply shortages from energy sanctions, Kremlin retaliation, and conflict driven disruption.

Oil prices have topped $100 per barrel for the first time since 2014, while gas prices have spiked across the continent.

The report from senior analyst Martin Young warns the jump in prices have a sustained effect on energy costs.

He said: “Granted this assumes no change in prices over the remainder of the observation window, but absent sharp and significant declines in wholesale prices, we expect a significant jump in the cap in October.”

While the EU and UK has avoided specific energy sanctions so far, US President Joe Biden has placed sanctions on Nord Stream 2’s operating company while German Chancellor Olaf Scholz has suspended the approval process for the pipeline.

The continent has staved off fears of blackouts this winter with top-ups in LNG from the US, amid decade lows in Gazprom supplies in its European storage.

It remains unclear whether Russia will eventually cut off gas and oil supplies into Europe, with mixed signals from the Kremlin in recent weeks.

However, the potential for conflict-driven disruption is evident, with key gas flows channelled through Ukraine.

Young said: “This could be devastating for UK households with elevated fuel poverty, and an ‘eat or heat’ dilemma. The political crisis will intensify, and

government will need go further than current measures, and be more targeted.”

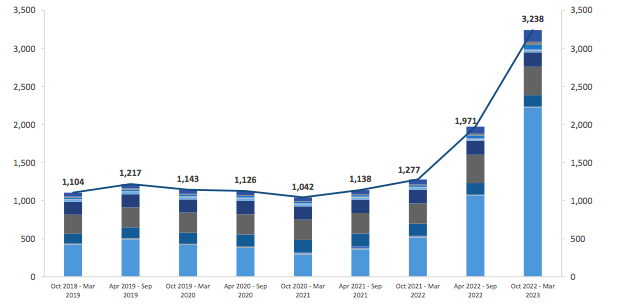

The price cap will already rise 50 per cent from April to nearly £2,000, with the UK energy market suffering heavy shocks this winter – with 29 suppliers exiting the sector since August.

Energy industry leader Emma Pinchbeck and analysts Cornwall Insight have both previously warned of potential price hikes this October.