Construction industry output ‘drops like a brick’ to a decade low

Britain’s construction industry suffered its sharpest decline in new work in more than a decade last month, as economic uncertainty hampered decision making among customers.

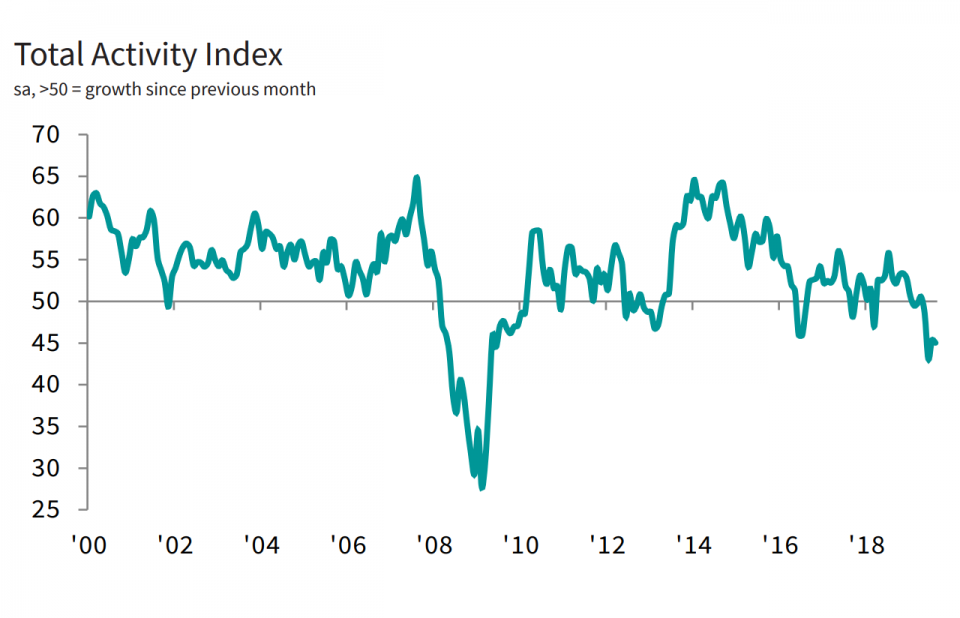

New orders slumped at their worst rate since March 2009, according to closely-followed industry barometer the IHS Markit Purchasing Managers’ Index (PMI), which read just 40 for the category where anything below 50 indicates contraction. The sector’s overall PMI score for August was 45.

Read more: UK construction sector suffers worst output in 10 years

The drop in new orders meant businesses were at their gloomiest since the global financial crisis as confidence fell to its lowest rate since December 2008.

Their concerns were “overwhelmingly attributed to domestic political uncertainty and a corresponding drop in client spending”, according to IHS Markit.

Duncan Brock, director at the Chartered Institute of Procurement & Supply said: “The sector fell deeper into contraction as continuing uncertainty and a weakened UK economy took a sizeable bite out of this month’s construction activity.

“Inevitably business confidence followed suit, dropping like a brick to its worst since December 2008 and close to the lowest depth seen in the previous recession.

“As Brexit creeps closer and confusion still reigns, this will undoubtedly heap more pressure on the UK government to create much-needed clarity in the market.

‘Thoroughly disappointing’

All three categories of work decreased in August. Commercial building suffered the most, as clients avoided taking any risks and were limited by tighter budgets than in previous months.

Civil engineering also dropped at a “relatively sharp pace”, while house building fell slightly, with the rate of decline “the least marked since the downturn began in June”.

Firms told researchers that weak demand had led to a lack of tenders and fierce competition for new work, particularly in the commercial sector.

Economist at EY Item Club Howard Archer said the report was “thoroughly disappointing and adds to the current stream of weak news on the economy”.

“Not only does the survey point to further marked contraction in construction activity in August but it offers little – if any- foundations on which to build hopes that the sector is headed for better times any time soon.

“The construction sector will likely be hoping that the budget later this year will contain major measures aimed at boosting infrastructure projects and also the housing market.”

Could things improve?

Despite the gloom which has taken hold of the industry in recent months, analysts said there is hope for a swift reprieve if the government strikes a Brexit deal with the European Union.

Economist at Pantheon Macroeconomics Samuel Tombs said the industry “could revive quickly if the risk of a no-deal Brexit subsided”.

“Commercial clients are putting off projects due to Brexit tail risk, not insufficient funds. In addition, new work in the housing sector should start to pick up again, given that new mortgage rates have fallen over the last six months, fostering demand.”

Meanwhile Federation of Master Builders chief executive Brian Berry, who represents smaller constructors, said: “More than half of small construction companies believe that leaving the EU without a deal would cause material prices to sky-rocket, and just under a third believe it would lead to lower workloads.”

“The government must secure a new deal with the EU which parliament can accept to deliver certainty, and give an injection of confidence to the sector.”

But Naismiths director Gareth Belsham said: “The flow of new orders has dried up from a drip to a desert.

“We’re fast approaching the critical point where the pipeline of new work isn’t close to keeping up with the pace at which projects are being completed.

“Whether the Brexit endgame brings an election, a ‘no-deal’ or both remains largely moot. For now all the construction industry can do is to batten down the hatches, complete existing projects and retain its capability in the hope that the final months of the year see an unblocking of three years of deferred investment.”

More legal disputes on the way?

Mayer Brown construction partner Jonathan Hosie said: “A reduced workload for the construction sector tends to expose over-capacity which can drive bid prices down to uneconomic levels, as current available resources search for a diminishing amount of work.

“This sort of behaviour in the past has produced a tsunami of commercial disputes further down the line, as contractors struggle to maintain required profit margins and have to resort to claims against owners in order to avoid losses.

“It also means that contractors may be tempted to take on riskier jobs, simply to maintain the required volume of work to cover their overhead costs. Short term buying on the cheap is a recipe for more commercial disputes in the medium to long term.”

All images: Getty