Construction in the City reaches five-year high

BUILDING activity in the City has reached a five-year high thanks to rising developer confidence buoyed by a shortage of prime office space in the Square Mile.

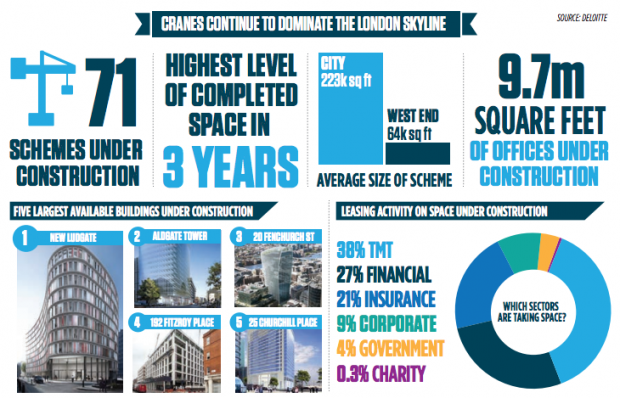

Deloitte’s latest London Office Crane Survey released yesterday shows that nine new projects got underway in the third quarter of the year with a combined floor plan of more than 1.3m square feet, including Land Securities’ 1&2 New Ludgate and Aldgate Development’s Aldgate Tower.

As a result over 5m square feet of new office space is now being developed in the City across 23 schemes.

Many companies that had previously shelved plans to move because of economic uncertainty have renewed their search, putting pressure on space and prompting developers to push ahead with schemes that had previously been delayed.

Asset management group Schroders ended its lengthy search for new offices last week after signing an agreement to lease the entirety of Brookfield and Oxford Properties’ One London Wall Place.

Meanwhile, rival fund manager M&G Investment is still on the hunt for a new building.

According to the survey, available office space in the City is now at a five-year low, having fallen from 4m sq ft to just 1.4m square feet.

This has in turn put pressure on rents, which rose for the first time in three years in August, to an average of £57.50 per square foot.

Deloitte Real Estate’s head of research Anthony Duggan said: “We are now seeing rents move forward again following a pause over the last couple of years and this prospect, along with continued appetite from investors for prime stock and the improving economic outlook, will encourage further development starts over the next six to 12 months.”

Meanwhile development across the wider London office market remains at a four-year high with 9.7m sq ft across 71 schemes now under construction.

Duggan said: “2014 is currently set to deliver the largest amount of space into the central London office market for 10 years.

“However, we do not expect a significant oversupply of office space next year as there are strong indications that tenants will commit to this space during construction and so the amount being delivered into the market and available to lease will continue to reduce.”