Computacenter falls after tough conditions in UK

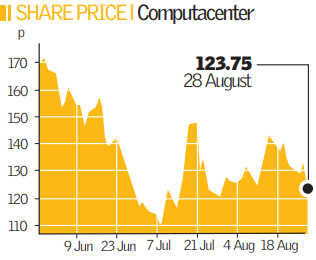

IT services firm Computacenter yesterday cited poor performance in the UK as the reason for a 14.2 per cent dip in profits, hammering its shares which plunged by almost 13 per cent in early trading.

A lacklustre set of numbers across the channel in France also hurt the firm, it said, reporting profit before tax of £11m compared to £12.8m in the same period last year.

Although revenues were up by 7.8 per cent to £1.25bn, interest charges relating to its share buyback scheme also shaved £400,000 off of its bottom line.

Computacenter hoped to reassure investors by announcing an increased interim dividend of 2.7p a share to be paid on 16 October to shareholders who have held stock since 19 September.

The company said it was confident of meeting forecasts, providing there was no deterioration in its market.

Investec analyst Julian Yates warned that the company was still a risky punt: “These results clearly indicate that there is significant progress to be made. We expect a profit pickup in the second half but still see a degree of risk around our forecasts, making a positive stance untenable in our view,” he said.