Complacent monetary policy has driven an inflation crisis, not businesses’ price hikes

Inflation hit 5.4 per cent in December, its highest level since 1992. It is widely expected to reach seven per cent in the next few months – it has already reached that level in the US.

There are several reasons why inflation has raised its ugly head again. Demand for gas and oil has outstripped supply. The cost of shipping rose fourfold during the pandemic, from less than $2,000 per container to $10,000. Covid-19 restrictions limited production and created scarcity.

When restrictions were eased, pent-up demand was unleashed as consumers began to spend again.

Above all, governments have been printing money like there is no tomorrow. Twenty per cent of all the US dollars in existence were printed in 2020. Joe Biden’s Covid-19 relief programme has cost a staggering $5.2tn. The Bank of England has purchased over £400bn of government debt since March 2020.

Printing money does not inevitably cause inflation, and in the digital age most of the money is not literally printed. But when vast sums of money are created out of thin air, inflation can be expected. This is especially true when the supply of goods and services has been constricted. It is a classic case of too much money chasing too few goods.

No serious economist would be surprised by this.

What is surprising is the reaction from people who should know better. When the inflationary chickens came home to roost last autumn, Robert Reich, a professor of public policy in California, insisted that it was not ultra-loose monetary policy that was to blame. Instead, it was the fault of greedy corporations which have “so much market power they can raise prices with impunity”.

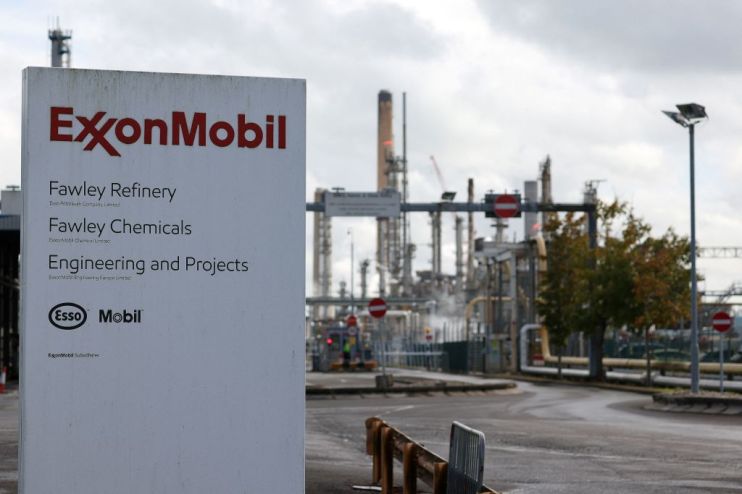

Reich was not alone in this belief. When the US faced high petrol prices in November, the obvious explanation was that the price of oil had doubled in the space of a year. Not so, claimed Senator Elizabeth Warren, instead blaming “price gouging” by Chevron and ExxonMobil.

Cartels can exist but there is no reason to think they have suddenly taken over large parts of the American economy. If these markets are so uncompetitive and the companies so powerful, why did they not raise their prices earlier? Why are they not raising prices even more? The answer is that there is ample competition but companies cannot avoid passing on the higher cost of raw materials to their customers indefinitely.

The rising cost of living has only come as a shock to those who were lulled into a false sense of security by 25 years of relatively low inflation. They had started to believe that pouring vast quantities of cash into an overheated economy would have no ill effects. Blaming greedy corporations for raising prices is part of their coping mechanism.

It would be wonderful if we could print money with impunity. It would solve the central problem in economics: the scarcity of resources.

If there are unlimited resources, there is no need for economics. Alas, although money can be created at the click of a central banker’s mouse, resources cannot. The laws of economics remain inviolable.