Commodities and banks drag FTSE 100 lower – London Report

BRITAIN’S top equity index drifted lower yesterday, hit by a drop in banks and commodity stocks, although improved sales for battered supermarkets lent support to the market.

Fresh signs of economic weakness in China, the world’s biggest consumer of metals, hit mining companies, with the FTSE 350 Mining Index down 2.8 per cent. It closed at 14,173.39.

Data yesterday showed China’s annual inflation fell to a five-year low in January and factory deflation worsened.

Concern over a further weakening of demand from China weakened oil and gas stocks, which dropped by 2.8 per cent.

The price of Brent crude fell below $58 a barrel as the International Energy Agency (IEA) predicted supply may hit a record high despite subdued demand.

“The weakness in the price of oil is not purely down to excess supply. The weakness we’re seeing in macro data, in China and elsewhere suggests there is a demand aspect to this, too,” said Jeremy Batstone-Carr, market analyst at Charles Stanley.

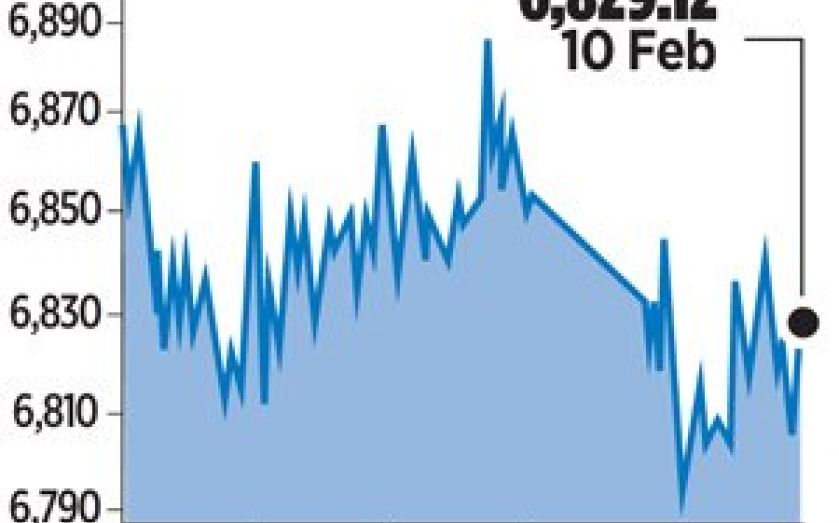

In all, mining and energy stocks combined to trim over 30 points off the FTSE 100, which closed down 8.03 points, or 0.1 per cent, at 6,829.12. It underperformed the Eurozone’s EuroSTOXX 50, up one per cent closing at 3,383.13, which benefited from its low exposure to commodity stocks as well as a rally in Greek assets. Greek stocks extended gains after several press reports pointed to a possible debt agreement between Greece and its creditors, with one report citing a six-month debt extension.

Royal Mail declined by 4.8 per cent — the worst performing FTSE stock in percentage terms — after investment bank JP Morgan cut its rating to “neutral” from “overweight”.

Grocers provided some support to the market, however, after Kantar trade data showed that Tesco posted its first sales growth in a year. The UK’s biggest supermarket rose 3.6 per cent, although it remains down over 25 per cent since the beginning of 2014.

WM Morrison rose 3.4 per cent after posting its best sales since December 2013. Marks & Spencer rose 4.9 per cent, making it the index’s top gainer, after brokerage RBC upgraded the stock to “outperform” from “sector perform”.