Coinbase’s Nasdaq debut powers retail crypto trading frenzy

On April 1, crypto exchange Coinbase announced that its Class A common stock would begin trading on Nasdaq Global Select Market under the ticker symbol “COIN” on April 14.

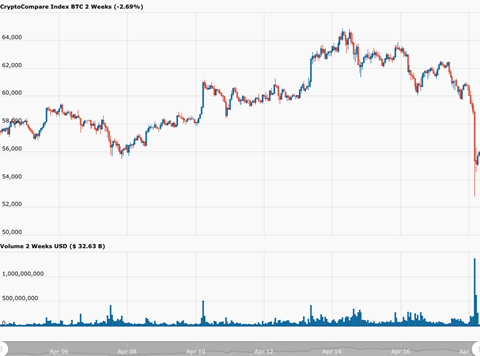

However, data from CryptoCompare suggests that the pre-listing rally in the crypto markets did not really start until one week before the listing date. On April 7, Bitcoin and Ether were trading as low as $55,467 and $1,931 respectively.

The rally that started on April 7 took Bitcoin to a new all-time high of $64,859 on April 14.

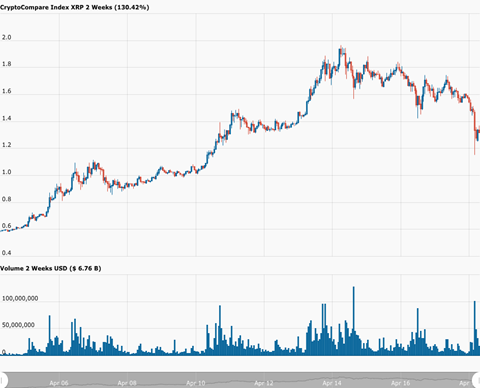

Another heavily-traded coin that managed to set a new all-time high on this day was XRP, which was helped by the Wanchain team announcing on April 12 that now “XRP token holders can put their XRP to work and engage with the world’s many DeFi applications”.

Wanchain is a blockchain interoperability platform. Since “Wan” means “ten thousand” in Chinese, the brand name “Wanchain” translates to “ten thousand blockchains”. This makes sense when you consider that the goal of Wanchain is to connect “the world’s many isolated blockchains”.

Temujin Louie, Director of Marketing at Wanchain, said in a blog post published on April 12 that “cross-chain bridges connecting XRP Ledger, Wanchain and Ethereum are live and operational on each network’s mainnet”. This means that XRP holders can now “securely use their XRP to farm, mine and provide liquidity rather than simply leaving their tokens, inactive, in wallets and exchanges”.

Thomas Lee, Head of Research at Fundstrat Global Advisors, had this to say on Twitter on April 13 about the pre-listing rally in the crypto markets:

“Part of the rally in #crypto in front of the $COIN direct listing is a “sellers strike” – Nobody wants to sell their $BTC $ETH #bitcoin in front of a major debut”

Coinbase shares start trading on Nasdaq

On Tuesday April 13 – the day before Coinbase’s stock market debut – Nasdaq assigned to COIN a reference price of $250.

Coinbase shares had quite an exciting first day. Trading of COIN went live roughly four hours after the market opened with a starting price of $381. They got as high as $429.54 before closing at $328.

Although Bitcoin had registered a new all-time high ($64,859) around 06:00 UTC on April 14, by the end of this day, it was trading roughly $2,000 lower. Bearish investor sentiment around Bitcoin was probably partly due to a slightly disappointing first day for Coinbase shares and partly due to CNBC’s Jim Cramer revealing that during Bitcoin’s rally to the mid 60s he had sold half of his BTC holdings to pay off the mortgage on a house.

A few minutes after the US stock market closed, Brian Armstrong, co-founder and CEO at Coinbase, said on Twitter that Coinbase’s debut on Nasdaq was “a big moment” not just for Coinbase but for the entire crypto space, and said that it “all started with the Bitcoin whitepaper 12 years ago, a deceptively simple nine page document by Satoshi Nakamoto that ignited a global movement”.

His fellow Coinbase founder, Fred Ehrsam, said on Twitter that when he and Armstrong started Coinbase in 2012, “a #bitcoin was worth $6 and only known by a few nerds on the internet.”

He went on to say: “And crypto is just getting started. We are ~1% into the most important technology of the coming decades. Crypto will redefine money and information, the two fundamental ways the world coordinates.”

Ethereum and Dogecoin set new all-time highs on April 16

Bitcoin chose to catch its breath and consolidate around the $63,000 level after the listing of Coinbase shares on Nasdaq.

On Thursday (April 15), Ki Young Ju, the CEO of South Korean crypto analytics startup CryptoQuant, warned that there might be too much greed in the Bitcoin market based on the fact that one of their Bitcoin metrics – Estimated Leverage Ratio (across all crypto derivatives exchanges) – was at a record high…

However, many altcoins continued rallying, led by Ethereum, which recorded a new all-time high of $2,547 on Friday (April 16).

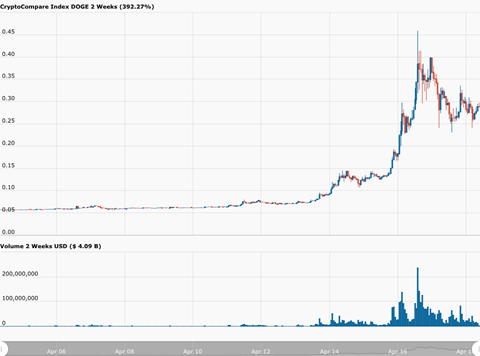

However, the altcoin that got the most attention last week was Dogecoin ($DOGE), Tesla CEO Elon Musk’s favorite cryptocurrency, which managed to set an insane new all-time high – $0.4592 – at 13:00 UTC on Friday, thereby temporarily becoming the fifth most valuable cryptoasset by market cap.

David Grider, Lead Digital Asset Strategist at Fundstrat, took to Twitter to say that he was seeing some signs of cooling of institutional investors’ interest in crypto but increasing interest from retail investors:

And finally, on Friday, crypto markets were dealt a blow by Turkey’s central bank announcing a ban on the use of cryptoassets for payments. This ban does not affect local crypto exchanges in Turkey since these have relationships with Turkish banks that provide their customers with fiat (Turkish Lira) on/off ramps, but it hurts foreign crypto exchanges, such as Binance, since these have been relying on Turkey-based payment service providers, such as Papara, for fiat deposits and withdrawals.

Featured Image by “bridgesward” via Pixabay.com