CMA investigates publisher Penguin’s $2.2bn takeover of Simon & Schuster

The competition watchdog is investigating if the $2.18bn takeover of Simon & Schuster by publisher Penguin Random House may hurt competition.

The Competition and Markets Authority (CMA) has until 19 May to decide whether to refer the merger to a more in-depth ‘phase two’ investigation,

A spokesperson for Penguin Random House said: “We announced last November that Penguin Random House is purchasing Simon & Schuster from ViacomCBS.

“The announcement stated that regulatory filings would be made. We have notified the acquisition of Simon & Schuster to the UK Competition and Markets Authority as is normal in such circumstances and we are working with the CMA in its review.”

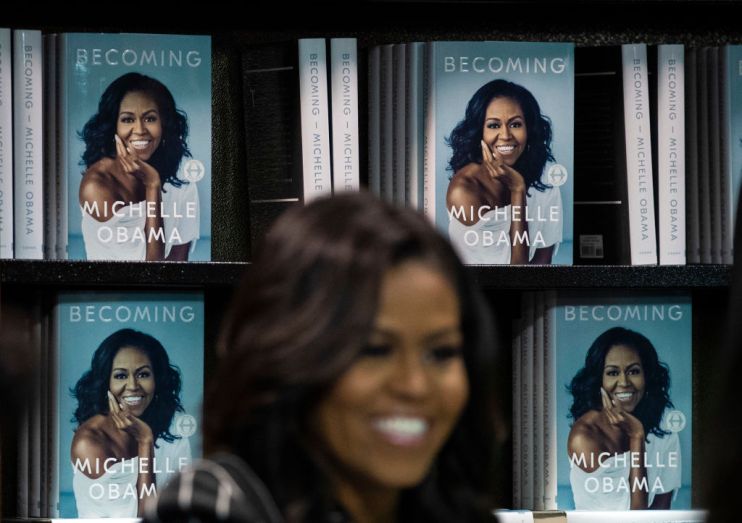

Penguin-owner Bertelsmann outbid Rupert Murdoch’s News Corp in a contest for the Penguin, publisher of Dan Brown, Hillary Clinton and Stephen King.

The move by Penguin was carried out to beef up its US presence

The deal is the second major move by chief executive Thomas Rabe’s drive to consolidate Bertelsmann as the world’s biggest bookseller after the 185-year-old publisher took full control of Penguin Random House from Pearson.

He had said the merged entity would have a US market share of less than 20 per cent, making the transaction “approvable”.

However, News Corp CEO Robert Thomson had criticised the deal saying Bertelsmann was “buying market dominance as a book behemoth” and it had an “anti-market logic”.

The Authors Guild said last year that the deal would mean fewer competing bidders for manuscripts and lower pay, urging the Department of Justice to challenge it as well as refuse to allow further deals in the U.S. publishing industry.

It said the number of large mainstream publishing houses would go down from five to just four.

Penguin, the world’s biggest trade publishing group, has more than 15,000 new publications and sells more than 600 million books a year.