CMA rejects bank break-ups – but this one chart suggests big lenders are ripping customers off

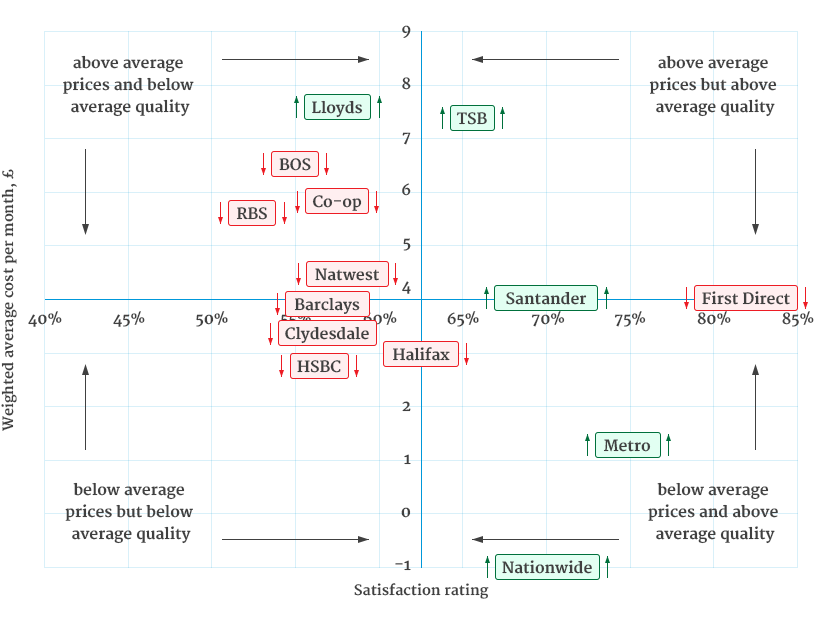

The competition watchdog may have ruled out breaking up Britain's biggest banks this morning – but this one chart shows customers are paying more money for poorer services from the "Big Four".

The Competition & Markets Authority (CMA) compared satisfaction ratings from the consumer group Which? with personal current account prices at different banks.

They found customers are getting the best bang for their buck at First Direct, Metro Bank and Nationwide – and the worst deal at Lloyds, RBS and Bank of Scotland.

Barclays and HSBC were somewhere in the middle, with lower than average prices but below-average quality.

Barclays and HSBC were somewhere in the middle, with lower than average prices but below-average quality.

The findings were published this morning as part of the CMA's preliminary results from its 18-month investigation into the retail banking sector. The watchdog originally launched the investigation over concerns that the so-called Big Four – Lloyds, RBS, HSBC and Barclays – had an overwhelming 77 per cent market share of active current accounts.