Closing time: UK brewers calling last orders with the North and Wales hit hardest

The number of brewery closures during 2023 continued to fall – with the North and Wales hit the hardest, according to new figures.

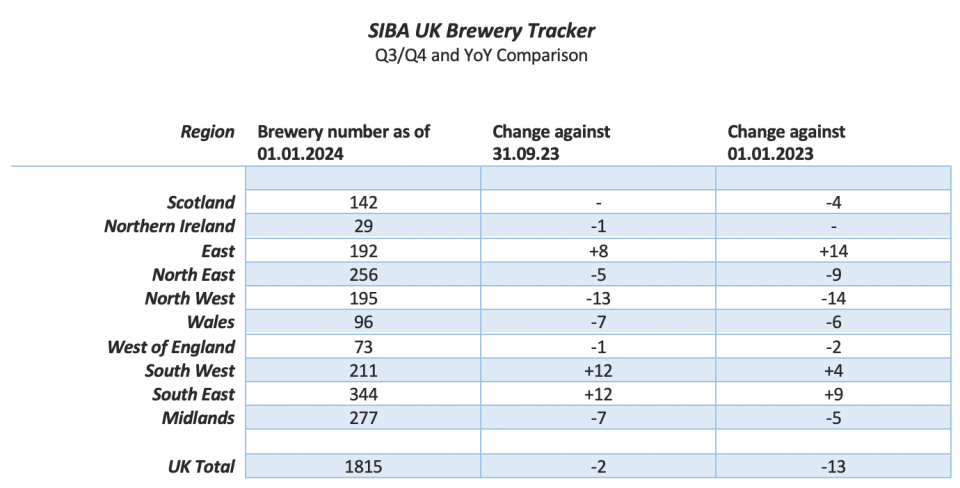

Newly-released figures by the SIBA UK Brewery Tracker show that the number of active brewers fell from 1828 to 1815 in the year to January 2024.

Despite a promising third quarter where numbers rose slightly, the tracker finished the year with a -2 net closure rate in the fourth quarter, leading to an overall net closure rate of -13 for 2023.

The North West had by far the toughest twelve months, with a -14 net closure rate across 2023, with a -13 net closure rate in the final three months alone – the highest of any region for any quarter.

The North East also saw a –9 net closure rate in 2023, with -5 net closures coming in Q4.

The Welsh brewing industry also struggled with a -6 net closure rate for 2023, a -7 net closure rate in the fourth quarter swinging the dial into the red for the country which began Q4 with a +1 overall.

It was a similar story for the Midlands which ended the year with a -5 net closure rate following a -7 closure rate in Q4, which started on +2.

The West of England finished 2023 with a -2 net closure rate after a further -1 closure rate in Q4, and Northern Ireland managed a flat open/close rate for 2023 despite a -1 Net closure rate in Q4.

However, the South West which achieved a +4 net growth rate, having finished the year with a +12 net opening rate in Q4.

The South East also had a positive year, with +9 growth overall following a Q4 net growth rate which equalled the South West at +12.

But it was the East of England that led the pack with the highest brewery growth rate anywhere in the UK, finishing 2023 with a net growth rate of +14 after a strong finish to the year, clocking a +8 net growth rate in Q4.

SIBA chief executive Andy Slee said: “There is still so much that needs to be done to protect independent breweries across the UK, with help from government on a range of issues now more important than ever if we want to turn the tide and see a growing beer industry in 2024.

“Trading has been incredibly tough for independent breweries, and whilst the government’s welcome introduction of draught relief for beer sold in pubs and taprooms last year was welcome we would like to see it extended in 2024 to a significant 20 per cent discount.”

He added: “What is perhaps most worrying about the figures are the level of closures being experienced in the North of England – with the North West seeing a net closure rate that is higher than the national figure at a huge -14, and the North East didn’t fare much better, with the second highest in the UK and a -9 net closure rate for 2023.

“It is in these areas where the combined effect of rising production costs hurting margins and the cost-of-living crisis lowering sales appear to be hitting brewery businesses the hardest, with worrying independent brewery closure rates across the North.”