Close Brothers faces uncertain future as FCA motor finance probe sparks crisis

Close Brothers, one of the UK’s oldest merchant banking groups, is in the throes of a crisis.

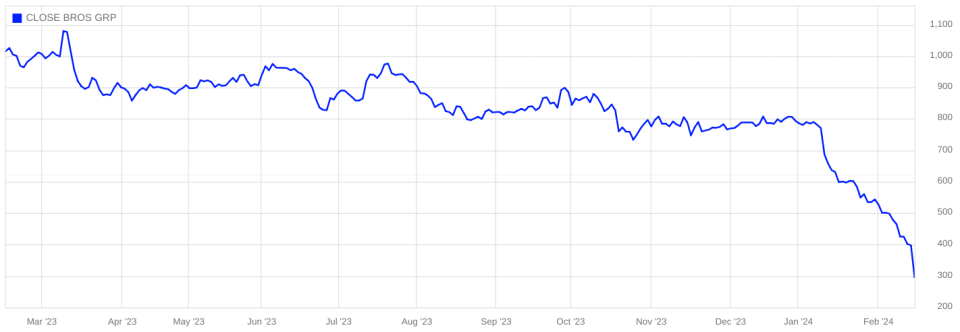

Its shares collapsed on Thursday after it cancelled its dividend for the current financial year and announced that 2025 payouts would be placed under review amid a City watchdog probe into motor finance – a major part of its business model.

Although this kind of announcement had been widely anticipated, more than £150m has been wiped off Close Brothers’ market capitalisation as investors digested the news.

Following a spike in complaints, the Financial Conduct Authority (FCA) confirmed last month that it was reviewing now-banned commission arrangements between 2007 and 2021 which allowed brokers and dealers to raise customers’ interest rates.

Analysts have estimated that the auto lending industry could be on the hook for up to £16bn in compensation payouts.

According to the Finance & Leasing Association, the value of new business in the motor finance market was nearly £39bn in 2023 – the second-highest on record.

Lloyds, the owner of the UK’s largest auto lender Black Horse, is predicted to take the biggest hit at up to £2bn, according to RBC.

RBC also expects worse-case scenarios of £250m for Barclays – which provided motor lending between 2010 and 2019 – and £850m for Santander.

Close Brothers has been recognised as the firm most exposed in relative terms, with a bill that could go up to £200m.

Auto lending makes up around a fifth of Close Brothers’ loan book at £1.95bn as of last July. Its website claims that every year it helps more than 100,000 Britons pay monthly for their vehicle.

The group, which employs around 4,000 people, has previously been unwilling to discuss its exposure to the probe but said in an unscheduled trading update this morning that the “significant uncertainty about the outcome of the FCA’s review, and the timing, scope and quantum of any potential financial impact on the group cannot be reliably estimated at present”.

“The cutting of the dividend tells us that in a downside scenario the impact from the FCA review of discretionary commissions in motor finance, would be significant enough to bring capital below managements target range,” Benjamin Toms, an analyst at RBC, told City A.M.

“Whilst it gives us insight into the potential magnitude of the problem, it does not in our view tell us anything about the likelihood of the event occurring.”

He noted that many of Close Brothers’ shareholders are income investors, meaning the dividend outlook is “very important to them”.

Close Brothers was founded in 1878 by then 25-year-old William Brooks Close and his brothers Fred and James, with the business initially focused on US investment.

The group listed on the London Stock Exchange in 1984 and is currently a member of the FTSE 250 index, cementing its status as one of the UK’s leading financial services players.

Its has been led by chief executive Adrian Sainsbury since September 2020.

Martin Lewis, the founder of MoneySavingExpert, posted on X/Twitter last week that he had received more than a quarter of a million emails just one day after his website launched a free motor finance reclaim tool.

“I’ve never seen anything like it, even the final days of PPI weren’t like this,” he said on ITV’s Good Morning Britain.

While some experts have compared the potential motor finance scandal to the controversy over missold payment protection insurance policies that cost British banks some £50bn, others have pointed out that banks did not benefit from discretionary commissions in the same way they did from PPI.

As a result, much of the compensation payouts are expected to fall outside of the listed banking sector.

“The banking sector has a habit of being embroiled in scandals. Just as the dust settles on one scandal, along comes another, and that cycle has been repeating for decades,” said Russ Mould, investment director at AJ Bell.

“It looks like we’re on the cusp of a new one and the potential fines and compensation payments could be huge.”

Close Brothers’ shares were already suffering long before the FCA announced its probe. The Covid-19 pandemic saw the stock slump after it joined other banks in cancelling its dividend in line with guidance from the Bank of England, later restoring payouts at a lower level that September.

Some investors have raised concerns over the group’s sprawling business model, which includes lending, deposits, asset management, securities trading and premium finance.

Close Brothers reportedly explored selling its wealth management arm last summer as part of a review of the business with Goldman Sachs.

The group’s pretax profit plunged 52 per cent last year to £112m, from £232.8m in 2022, after it set aside £114.6m for bad loans from Novitas, which Close Brothers acquired in 2017.

Excluding the Novitas provisions, operating profit still fell year-on-year as its market-making business Winterflood continued to struggle in difficult conditions. The division posted a 75 per cent drop in adjusted profit.

Close Brothers said last November that “unfavourable market conditions” would hit its asset management and market-making divisions in the first quarter of the 2024 financial year, with the group planning to hire more staff and make acquisitions to drive growth.

Adding further pressure, the FCA confirmed in a letter to the Treasury Committee last month that it was looking at the premium finance sector – which makes up around 10 per cent of Close Brothers’ loan book.

The regulator has said it is closely “monitoring” a sharp rise in insurance costs, noting that consumers had already seen annual premiums rise 21 per cent on average since June 2022.

Close Brothers did not respond to a request for comment. It has previously told City A.M. that it does not comment on share reaction or analyst estimates.

The FCA plans to set out its next steps for the motor finance probe in the third quarter of 2024.