Clinton slips into the red

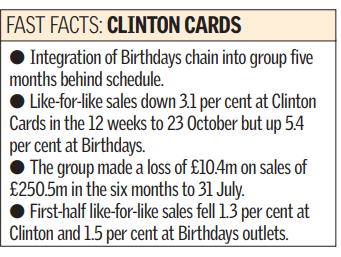

Clinton Cards was one of the day’s biggest fallers yesterday after the retailer revealed the integration of its new charge, Birthdays, was running five months behind schedule and announcing a slump in recent sales.

The company posted a loss of £10.4m on sales of £250.5m in the six months to 31 July. Like-for-like sales were down 1.3 per cent at Clinton stores and 1.5 per cent at Birthdays over the period.

Shares slipped 4 per cent to close at 65p after the card retailer admitted that the restructuring and repositioning of the business was “taking longer to achieve than originally anticipated”.

Clinton acquired the Scottish value card retailer for an estimated £90m last December. Managing director Clinton Lewin said the merger was running behind schedule due to problems associated with relocating the Glasgow based head office, hiring new staff as well as IT and supplier issues.

“We are very happy with the acquisition,” Lewin said. “But we are five months behind where we would have liked to have been.”

The difficulties absorbing the new business came as trading slowed at the core chain. Like-for-like sales at Clinton Cards were down 3.1 per cent in the 12 weeks to 23 October.

However the birthdays business showed signs that new ranges being introduced were having the desired effect with like-for-like sales up 5.4 per cent over the period.

Lewin said the weak trading environment had encouraged it to press ahead with rationalising the enlarged store base with plans to close up to 45 marginal outlets in the second half.

Seymour Pierce analyst Rhys Williams said: “Overall a disappointing performance, with the Birthday acquisition taking longer to turnaround than originally expected and its Clinton brand continuing to struggle.”