Climate progress tracker improves on higher carbon prices and electric vehicle sales

Last week, the Intergovernmental Panel on Climate Change, issued a landmark scientific report that serves as a “code red for humanity”, according to the UN Secretary General, Antonio Guterres.

It comes three months before the 26th Conference of the Parties (COP26), warns of climate catastrophe and lays the blame firmly at the door of human activity.

It forecasts that even in the best case scenario, temperatures will rise by more than 1.5 degrees in the next 20 years, causing more of the extreme weather-related events we have witnessed recently.

This is unless massive and rapid progress can be made in reducing carbon emissions.

What does our climate tracker imply?

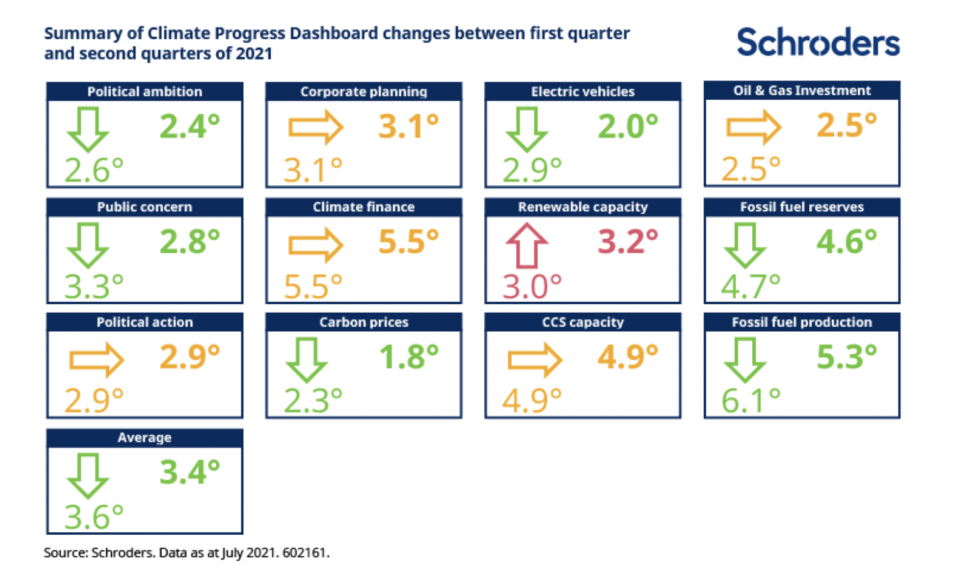

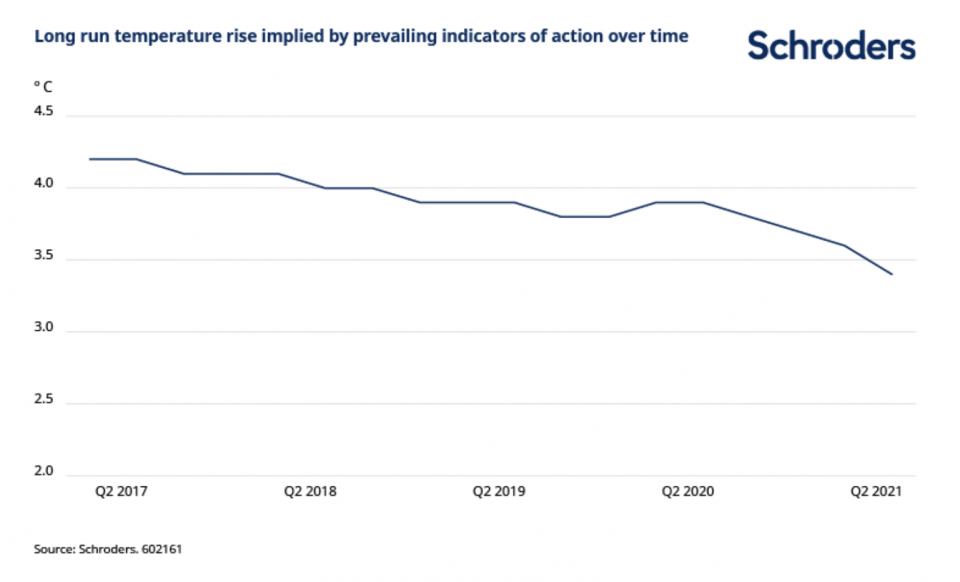

The latest reading of Schroders’ Climate Progress Dashboard points to a long run temperature rise of around 3.4 degrees over pre-industrial levels.

This is clearly well above the “below two degrees” target agreed to by global leaders in 2015 and the subsequent “ideal” 1.5 degree goal.

But it is also much better than the 4.2 degree rise the Schroders climate tracker indicated in Q1 2017 and indeed lower than the 3.9 degree increase implied by the Q2 2020 reading a year ago.

For more visit Schroders or click on the links below:

– IPCC report: why the detail matters to energy investors

– Q&A: Why are heat pumps so important for the energy transition?

– Video – The company using agricultural waste to power your car

What is the Climate Progress Dashboard?

We developed the Climate Progress Dashboard to provide an objective measure of the long run temperature rises implied by the myriad levers global policymakers, societies and companies will need to pull to tackle climate change.

The Climate Progress Dashboard examines progress across a wide range of areas to track the rate of progress toward the commitments global leaders made in Paris in 2015.

The long-run temperature rise implied by our indicators has been on a downward trend since we began tracking in 2017. The decline has picked up pace over the last year.

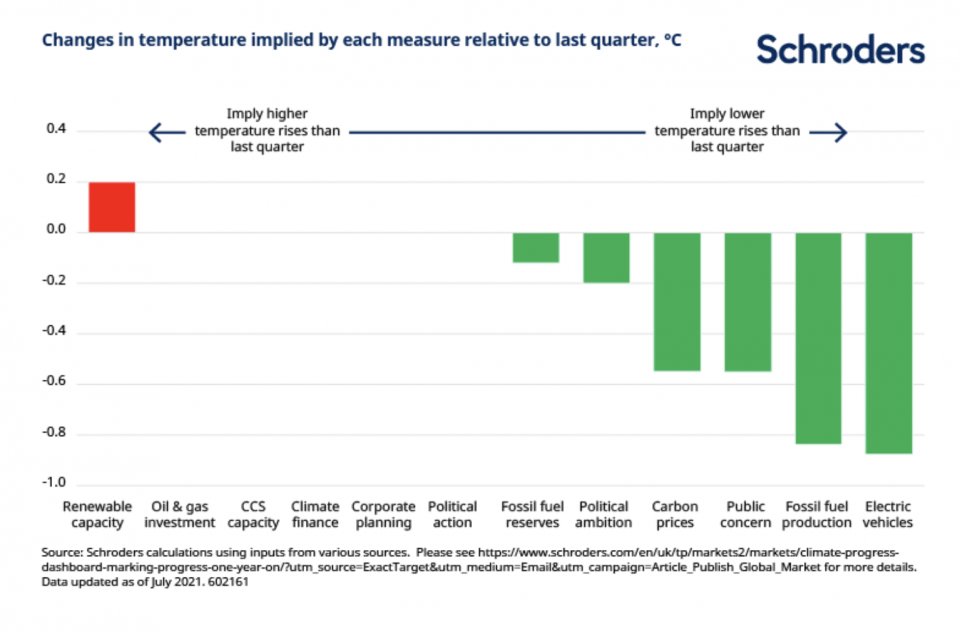

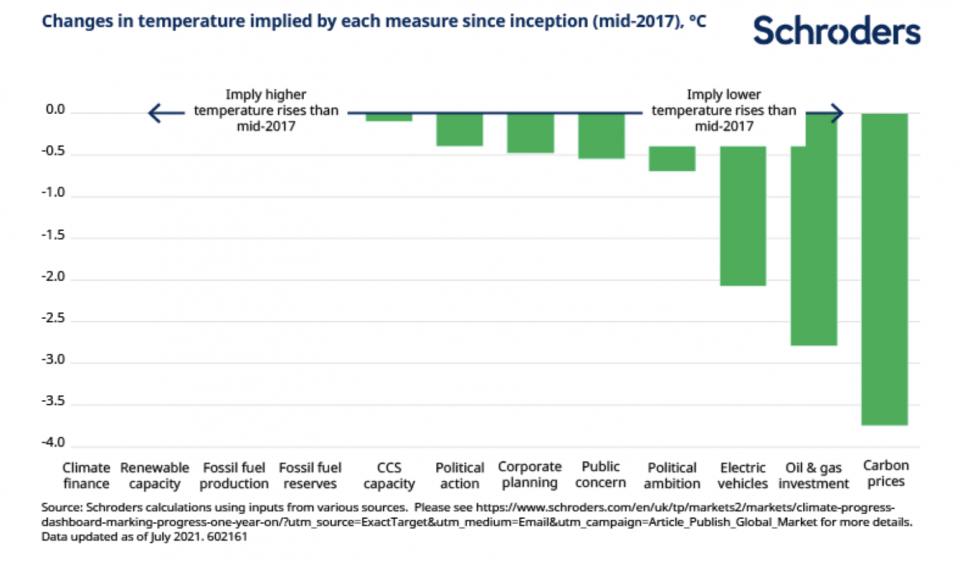

Higher carbon prices and strong electric vehicle sales behind recent improvement

Continued increases in carbon prices were the biggest driver of change over the last quarter, with carbon prices on the European Emissions Trading Scheme (ETS) – the world’s largest exchange – reaching new highs in July, approaching €60/t.

With industrial output set to strengthen as lockdowns ease, prompting more demand for the credits needed to deliver that rising output, the prospects for that market look robust.

The doubling in European carbon prices over the last year has pushed the economic equation in favour of clean investments in many markets.

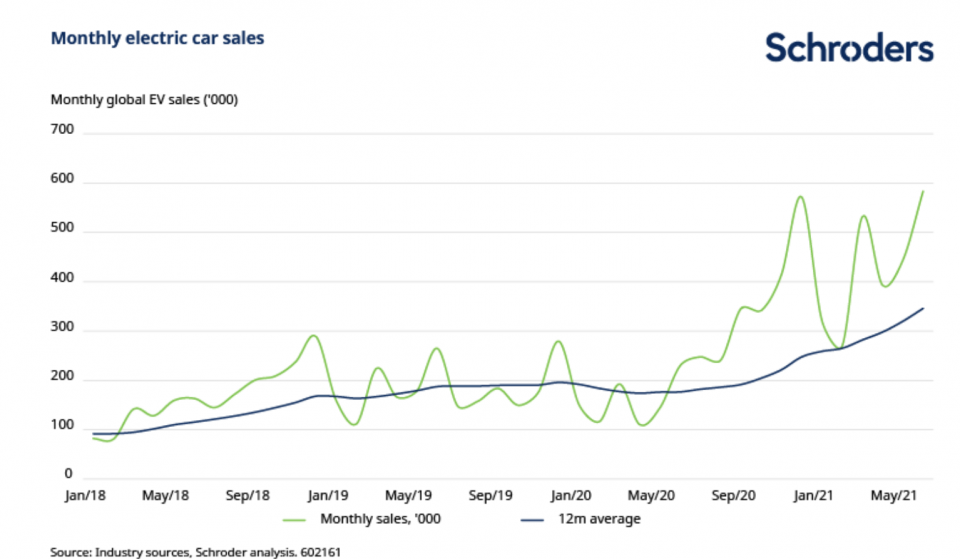

The other change that stands out is the remarkable strength in electric car sales in recent months.

Demand remained strong through lockdowns, even as the wider automotive industry suffered.

Our analysis indicates that year-to-date sales are over 150% higher than in the same period last year. Earlier this year, electric car sales reached 11% of all new car sales in China, the world’s largest market.

Passenger vehicles represent half of all emissions from transport, and around 11% of all global carbon emissions. Decarbonising that market will be key to delivering a low carbon transition.

The IPCC report is a stark reminder that we face an existential threat which requires national commitments and action to ratchet up. We expect to see social, political and corporate momentum to do so further strengthened at COP26 later this year.

Summary of changes

The chart below plots the changes in each indicator relative to the last update.

The chart below plots changes in each indicator since we launched the Climate Progress Dashboard in mid-2017.

– For more visit Schroders insights and follow Schroders on twitter.

Topics:

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.