Climate Progress Dashboard forecasts global warming of 3.9°C despite Covid-19 crisis

The latest update to our Climate Progress Dashboard suggests the current pace of change will result in temperatures rising by 3.9°C above pre-industrial levels.

Global temperatures are on course to rise by 3.9°C, almost twice the Paris Agreement target, according to our analysis of indicators from the second quarter of the year.

Huge reductions in air and road travel from Covid-19 lockdowns around the world have slashed emissions but structural changes will be vital.

There’s a myriad of levers global policymakers, societies and companies will need to pull to tackle climate change and the transition to a low-carbon economy.

The threat climate change poses will require more aggressive policies, faster capital re-allocation and stronger financial incentives, among other measures.

The Covid-19 crisis has upended the global economy and political priorities – and disentangling short-term impacts from structural changes is more important than ever.

Discover more:

– Learn: What could a Biden presidency mean for climate change investing?

– Read: Sustainability: six ways the corporate world will have to change

– Visit: Schroders’ Sustainability home page to find out more

Global warming forecast unchanged despite Covid-19

We developed our Climate Progress Dashboard in 2017 to provide an objective measure of the long-run temperature rises implied by a range of factors.

It is designed to give investors an insight into the progress governments and industries are making towards meeting the Paris Agreement target set in 2015. The Paris Agreement aims to keep increases in global temperature during this century to less than 2°C above pre-industrial levels.

We use a framework of 12 indicators spanning politics, business, technology and energy.

By focusing on longer-term indicators of progress and action, the Climate Progress Dashboard provides a relatively stable view of the long-run temperature rise we face.

On the face of it, the Covid-19 crisis appears to have sparked a turning point in global greenhouse gas emissions. The kind of turning point that scientists have warned will be needed to deliver the commitments global leaders made in Paris in 2015.

Unfortunately, the predicted 3.9°C long-run rise in global temperatures is unchanged from last quarter.

If current lockdown trajectories continue, global energy demand may fall by 6% and carbon emissions by 8%, according to data from the International Energy Agency.

However, there is also an unprecedented economic cost. The International Monetary Fund has predicted the global economy could shrink by as much as 5% this year.

It has revealed unemployment levels have already reached the highest levels seen in at least half a century.

We believe that as economies recover from the Covid-19 crisis, falls in emissions are likely to be reversed, if recoveries from past crises provide any guide.

Tougher structural changes are needed if we are going to avert the equally devastating long-term impacts of the climate crisis.

Bold climate policy needed

There are indications that some policymakers are gearing up for the tougher structural changes required.

In particular, the EU has announced that up to three-quarters of the region’s Covid-19 stimulus plan will be tied to the delivery of climate targets.

But the impact has not yet been felt and a shift from statements of intent to tangible action will be vital.

Tracking policymakers’ intentions is challenging at any time. We have turned to the political press to gauge the extent to which their collective attention remains on climate change.

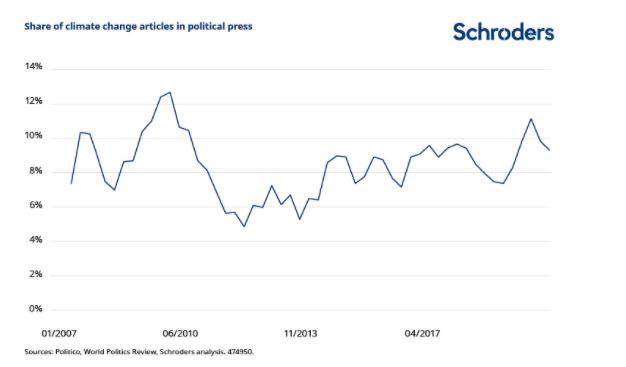

We have tracked the numbers of articles in major political publications focused on climate change every quarter since before the global financial crisis.

The chart below shows that while attention has turned elsewhere recently, it remains robust – particularly compared to the sharp fall of 2008/09.

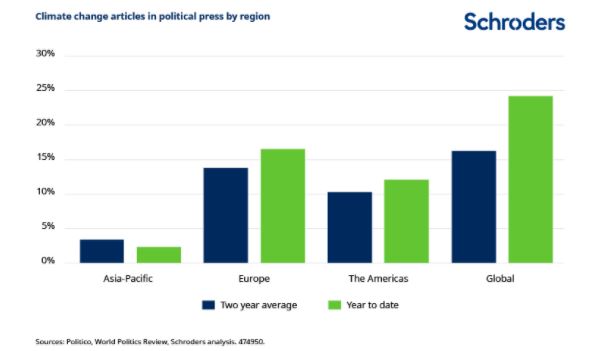

And the following chart underlines the stronger focus on climate change this year compared to the last two years.

Weighing up the positives and negatives

Turning to the Climate Progress Dashboard in more detail, there’s been a tension between the positives and the negatives over the last quarter.

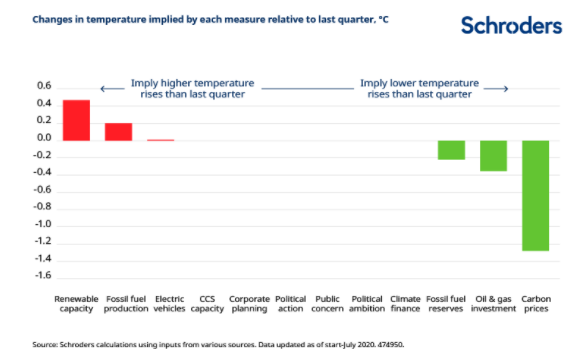

Positive: carbon price rises and weaker fossil fuel capital investment

A major boost was driven by the sharp rise in carbon prices, particularly in the EU Emissions Trading Scheme, where they touched decade-long highs in July.

That rise – despite still-subdued industrial output – points to optimism for tougher climate action going forward.

Further weakness in fossil fuel capital investment in the last quarter also helped, signalling lower growth intentions for that industry.

Negative: growth in fossil fuel production, weak renewable energy growth

The latest BP Statistical Review of World Energy 2020 underlined the challenge of continued growth in fossil fuel production. It showed relatively weaker growth in renewable energy capacity than the IEA has determined will be needed to meet the commitments global leaders made in Paris.

Vehicle tensions: electric car sales down vs commitments on combustion engines

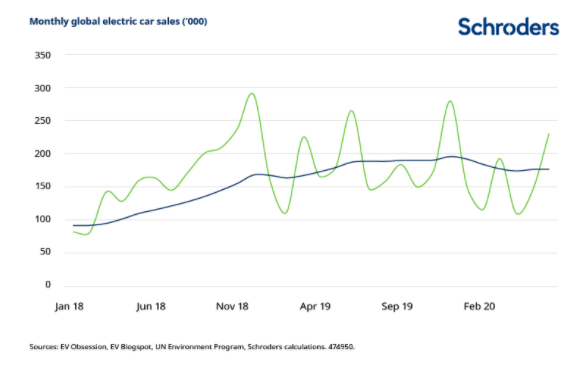

The headline temperature rise of 3.1°C implied by the growth of electric car sales is unchanged compared to last quarter. The tensions in that indicator are a microcosm of the wider pressures on the climate trajectory.

This year electric car sales have fallen sharply. This is undermining the pace of turnover in the global car pool, though it is only around half the level of the wider car industry’s contraction.

Looking forward, an increasing number of governments have committed to removing combustion engines from their roads, implying a platform for faster growth in the future.

The tension between current headwinds and future opportunities is common to many of the indicators across the Climate Progress Dashboard.

How those tensions will ultimately be resolved remains uncertain, but the Covid-19 crisis has underlined the importance of political leadership to driving changes across society.

The early indications give grounds for optimism.

Summary of changes

The chart below plots the changes in each indicator relative to the last update (Q1 2020).

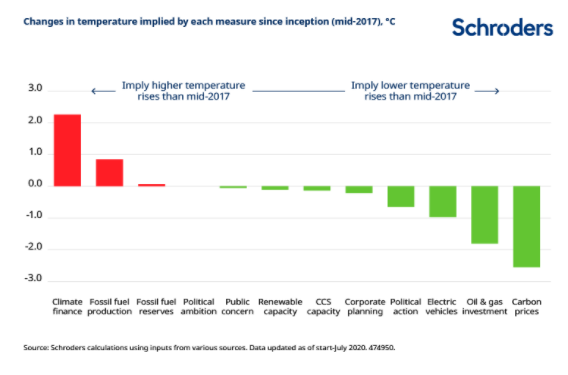

The chart below plots changes in each indicator since we launched the Climate Progress Dashboard in mid-2017.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.