Climate investors will flock to the EU if we keep dulling our green ambitions

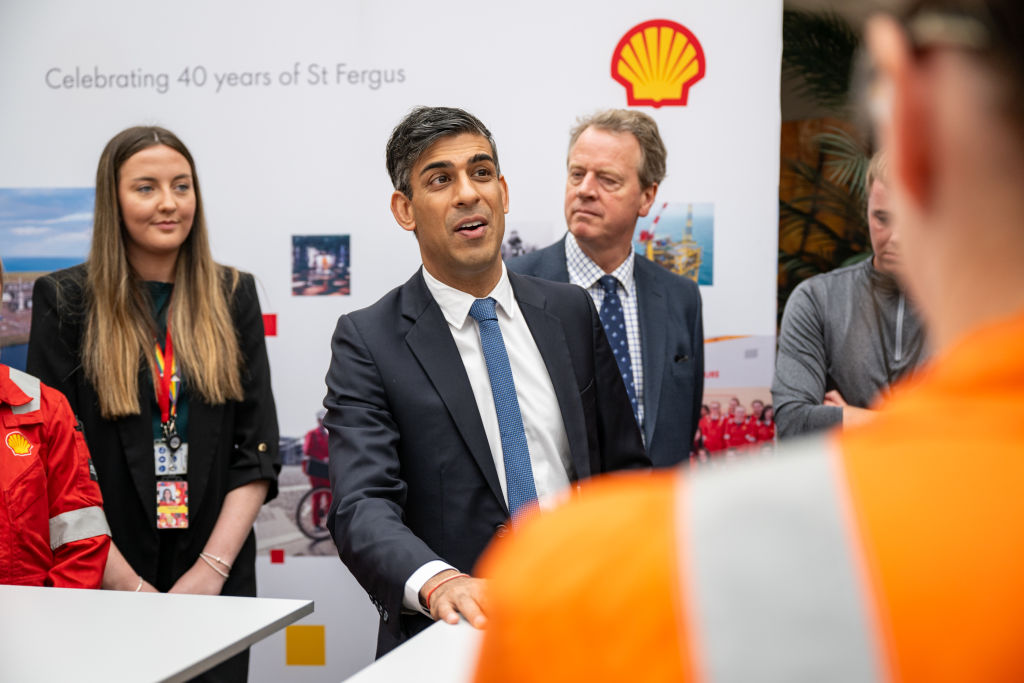

As Rishi Sunak quietly dampens green policies, Britain’s business community will lose faith in our tepid climate ambitions and flee to other countries, writes Ted Christie-Miller.

Last year, financial services giant BNP Paribas made a major pivot towards financing low-carbon energies, with €28.2bn of investment. This year in its climate strategy, Natwest quoted Chris Skidmore, the Conservative MP who led the government’s net zero review, when they said the green agenda represents “the growth opportunity of the 21st century.” The desire from major financial institutions to finance and enable net zero is there, and it exists across the private sector, as shown by 100 of the biggest businesses who penned a letter to the government calling for greater climate clarity and action.

But over the last week, the UK government has quietly started shelving green policies, and has now made it cheaper to pollute through the UK Emissions Trading Scheme. This is an unnerving indicator that there is no clear strategy on emissions reductions or a desire to encourage them. This is, of course, a blow to the UK’s ambitions to reach net zero, but what is equally concerning is the damage this could do to the UK’s prospects as a global innovator for rapidly growing green technologies. The government is sending mixed signals which will damage investor confidence in a potential multi-billion-pound green technology market.

To address first the impact on our pathway to net zero, cutting the price of carbon shows that government ambition on climate is simply too low. Carbon pricing is a hugely effective mechanism to channel capital into impactful climate solutions – and the widening gap in carbon pricing between the UK and the EU risks us losing our lead in decarbonisation.

Businesses cannot allow the lack of government strategy to draw focus away from their own net zero ambitions. Instead, they must turn their heads towards further investment in voluntary reductions. The voluntary carbon market – where investors can buy, sell and trade carbon credits – is the mechanism to do this, and it’s rapidly scaling into an effective force for global change. It means businesses can still invest in projects which will help reduce carbon on a global scale, and ratings agencies help scale the market by providing analysis on carbon credit quality.

Although the voluntary carbon market can go a significant way to supporting climate action from the private sector, there remain broader consequences from the cuts to carbon pricing which will impact green technologies. Take, for example, the technological carbon removal sector. Put simply, carbon removal technology sucks carbon out of the air to store it in the ground. Imagine, if you will, a big mechanical tree.

The government risks handing the EU the first-mover advantage to grow and develop this lucrative sector on a silver platter

At present, the market for technological carbon removal is small – totalling just $2.5bn to date. But the government has committed to integrating carbon removal technology into the UK Emissions Trading Scheme – and it’s a matter of if, not when, the EU follows suit. Together, the markets have a combined size of $800bn. According to the UN, carbon removal methods need to be worth trillions of dollars by 2050 to meet our climate targets.

By making it cheaper to emit carbon emissions under the UK trading scheme, the government risks handing the EU the first-mover advantage to grow and develop this lucrative sector on a silver platter. With the equivalent EU prices rising past $100/tonne while the price of carbon removal technology is starting to come down, technology-based carbon removal credits could soon reach price parity and be ready to trade. Immediate investment in this technology could allow investors in the EU to reap huge rewards. With UK carbon prices now 40 per cent lower than in the EU, it will take us much longer to reach price parity, with less capital generated from the UK scheme to finance these ground-breaking carbon removal technology projects.

By slashing carbon pricing, the government is wielding a double-edged sword. It risks giving emitters more of a licence to pollute, hurting its own ambitions to become a global hub of green growth, and increasing instability in a sector with huge potential for investment. It also tells business that Britain won’t prioritise green technology, and encourage them to move to markets which do.