Clean technologies and climate policy: the global financial crisis and Covid-19

A lot has changed for clean technologies since the global crisis in 2008. As investors in climate change, this is hugely encouraging.

It is striking just how much has changed for clean technologies and climate policy between the financial crisis in 2008 and the one we face today. As climate change investors, this gives us cause to believe that this time is different. This is not to downplay how disruptive the coronavirus crisis is in its own right, rather to understand that the crucial trends for climate change investors are on a much firmer footing than they were in 2008.

Here we take a look at renewable energy, electric vehicles and climate policy.

Battery electric vehicles: no longer a niche industry

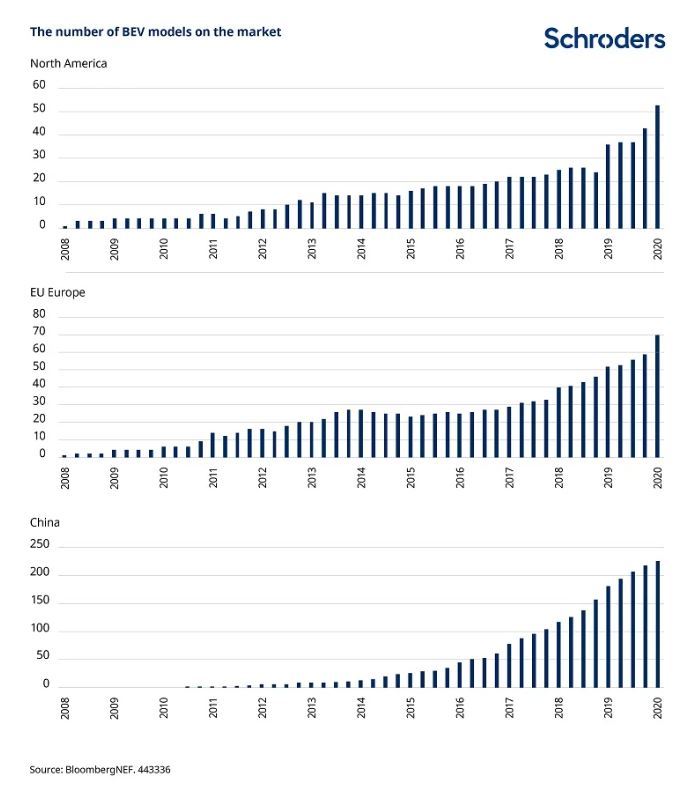

The original Tesla Roadster, launched in 2008, cost in the region of $100,000. In that year, there were just three battery electric vehicle (BEV) models on the market in the US, two in the EU and none in China. The best-selling BEV was the TH!NK City, clocking up sales of about 330 units.

Fast forward to 2020 and there are 53 BEV models on the market in the US, 70 in Europe and an astonishing 226 in China. The price of a lithium-ion battery pack has fallen by 85% over the last 10 years and, as batteries are the largest input costs for BEVs, this has allowed today’s product offerings to have a truly mass-market appeal.

Tesla’s Model 3 was the best-selling EV last year, with more than 300,000 units sold in 2019. This is not a niche industry anymore.

Renewable energy is now cost competitive

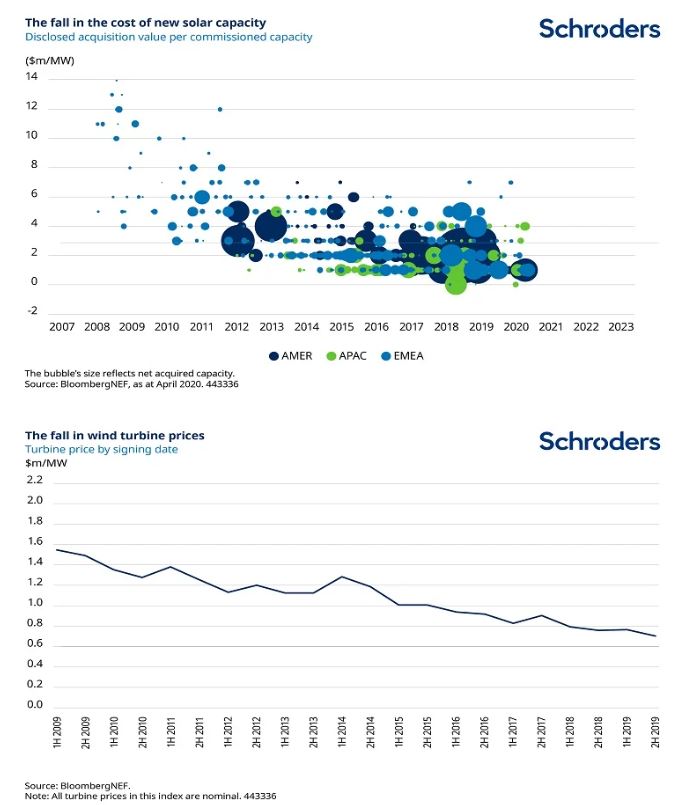

Back in 2008, solar industry demand was dominated by a handful of European countries and was heavily dependent on subsidies. As governments sought to shore up their finances following the global financial crisis, these generous subsidies were slashed, causing a major setback for the industry. Solar photovoltaic prices have fallen by 80% since 2008 and solar demand has become genuinely global.

Wind energy was a more mature industry than solar in 2008, but it has also seen a large drop in costs in the intervening years as the technology has improved and the industry has scaled up. As at the start of 2020, wind and solar were the cheapest forms of new bulk energy generation in two thirds of the world, up from as little as 1% of the world five years ago.

For more:

– The inescapable truths faced by investors

– Covid-19 poses temporary setback to the energy transition

– Why global cities can still thrive despite Covid-19’s impact

In short, the economic drivers for renewables are far stronger than they were following the last crisis.

Political and corporate will: a sea change

Climate change is part of the discussion in a way that it was not 10 years ago. This time, there is a good chance that policymakers and corporations will come through.

The policy backdrop is different now. A decade on, climate commitments are now much more firmly established in policy planning and corporate strategies. The Paris Accord, which was signed in 2015, saw global leaders make a collective agreement with respect to temperature rises, with more national policies then following suit. Leaders agreed to take collective action to limit long-run temperature increases to around two degrees Celsius over the pre-industrial levels of the late 1800s.

COP26 – the 2020 United Nations Climate Change Conference, originally scheduled for November this year – might be postponed but its profile reflects the continued importance policymakers attach to achieving climate progress. European leaders have stressed the importance of aligning recovery plans to climate commitments.

For the most part, the corporate world has recognised the risks and opportunities climate change poses. Global leaders at the World Economic Forum now see climate change as the biggest and most likely risk to business, whereas the issue did not feature in the top five threats a decade ago.

The post-Covid 19 business re-evaluation

We have seen dramatic changes already. People are working from home where they possibly can and meetings and conferences have become virtual ones. This crisis will make businesses re-evaluate the necessity of what they would previously have considered “business as usual” practices.

And this could just be the start. We think it is quite possible that we could see some more permanent changes in how we work, and that could be good for the climate.

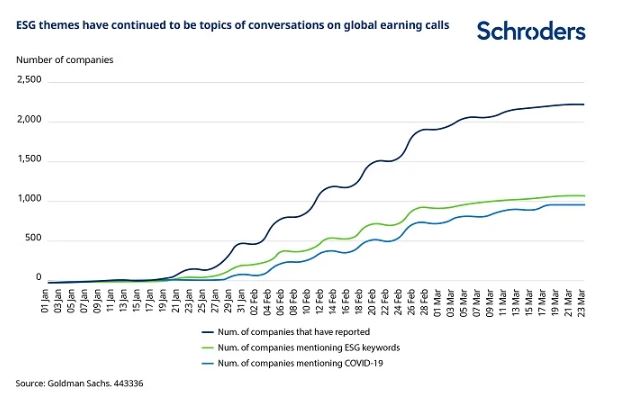

Sustainability remains firmly on corporate agendas; references to coronavirus and sustainability in conference calls have dramatically increased.

Climate-focused investments are no longer as dependent on policy support as was the case a decade ago. However, that support remains important in accelerating progress, particularly in areas such as heavy industry where the economics of decarbonisation technologies are not yet compelling without regulatory intervention.

The 2008 crisis was followed a year later by disappointment at the failure of global leaders to reach agreement on climate action in Copenhagen. Now that this is well behind us, we are hopeful that the current crisis could prove the springboard for the climate transition that scientific consensus tells us is becoming increasingly urgent.

Looking ahead – monitoring progress

Schroders has built a Climate Progress Dashboard to provide an objective gauge of how far and how quickly various things will need to change to get us to two degrees.

There are 12 different measures including political efforts, business strategies, technological change, and fossil fuel productions. So, for example, we look at how many more electric cars will need to be on the road. How much more renewable energy will need to be generated? And how quickly oil, gas or coal production would need to drop.

The dashboard is updated quarterly. The last update suggested we are heading for around a 3.9 degree long-run temperature rise. We have begun a journey but there are many more steps still to take.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.