City of London has ‘record’ office leasing deals allaying hybrid work fears

The City of London had a record 331 office leasing deals in 2023, allaying concerns the Square Mile experienced a dip due to hybrid working patterns.

London’s business and finance district recorded its joint highest number of office leasing deals in a calendar year in 2023 with 331 transactions over 5,000 sq ft, according to a report by estate agent Cushman and Wakefield.

This equals the totals recorded in 2015 and 2018, the highest in the last decade.

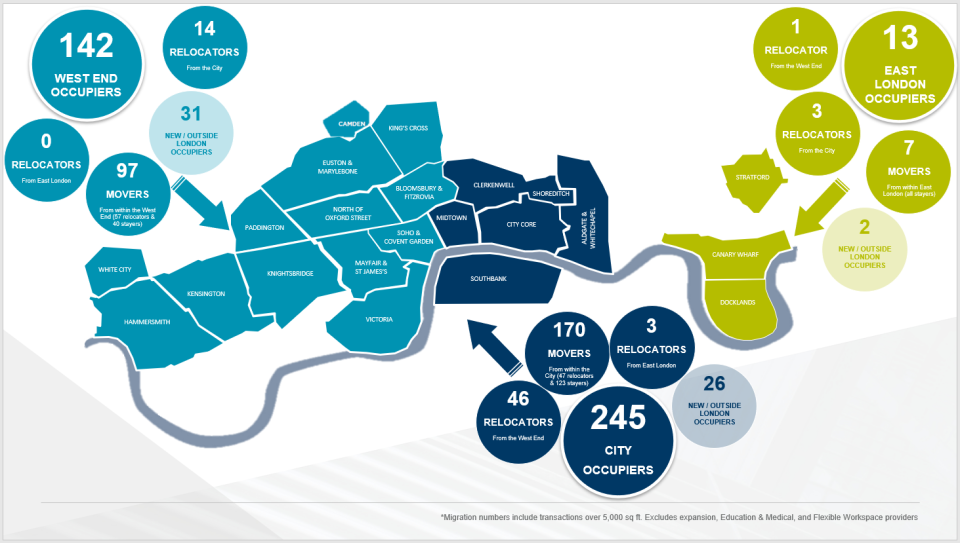

Of the 331 deals in the City, 245 transactions were signed either by new market entrants or existing firms relocating within Central London. The comparable figure for the West End was 142 deals.

Last July, it was announced that HSBC would leave its historic headquarters in Canary Wharf for a smaller office in the City.

The bank, which aims to reduce its global office space by around 40 per cent, will move into the former office of BT.

Ben Cullen, head of UK Offices at Cushman and Wakefield, said: “The City of London’s office leasing market is characterised by high volume and high resilience, despite some of the major occupiers relocating.

“The City’s record leasing activity reflects its enduring status as a globally competitive business hub and destination of choice for many occupiers.

Cullen said he expects some large-scale occupiers to downsize or consolidate their offices over the next year but Central London remains a desirable location for businesses.

He added: “Whilst we expect some large-scale occupiers to downsize or consolidate their offices, the volume of expanding occupiers demonstrates Central London’s desirability as an office centre for both small and larger businesses, countering the narrative that all occupiers are downsizing amid challenging economic conditions.”

“The volume of expanding occupiers demonstrates Central London’s desirability as an office centre for both small and larger businesses, countering the narrative that all occupiers are downsizing amid challenging economic conditions.”

The London office market has become more competitive due to a shortfall in office space because so many older buildings do not meet carbon neutral targets.

Tenants are also becoming increasingly picky and tend to favour buildings which are best in class, and with less space due to work from home practices.

This trend has led to a number of businesses ditching the West-End for a space in the City.

Last year 46 occupiers specifically relocated out of the West End into the City, also the highest figure since 2015, while 14 moved the other way.

Cullen said: “It is no longer just cost that is the primary driver for moves, as was the case pre-pandemic.

“Supply has taken precedence, most acutely in relation to grade A space, which is a scarcity in many of the West End submarkets, forcing occupiers to widen their search radius.”

He added: “Some are taking the approach of regearing or renewing existing leases for the short-term, awaiting a period when appropriate space may become available.”