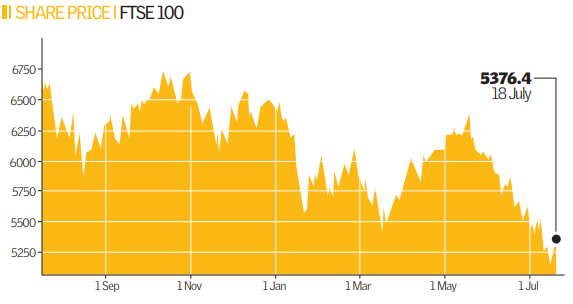

City: FTSE to bounce back

London’s benchmark equity market could stage a dramatic recovery by the end of this year, according to leading strategists who predict the FTSE 100 will end the year above 6,000.

Analysts at brokerages Charles Stanley and Brewin Dolphin expect the FTSE 100 to end the year at 6,800 and 6,200 respectively.

The more optimistic forecasts come at the end of the best performance for the leading blue chip benchmark index in nine weeks as it closed last week with a 1.9 per cent gain, bringing to a halt its longest losing stretch since May 2002.

Although the index remains in official ‘bear’ market territory, defined as a 20 per cent fall from peak to trough, hopes are now building that the worst could be over.

“We have got used to rallies failing recently and it is still early days for the latest recovery, but there is a feeling amongst some traders that for now at least, the worst may be over,” said David Jones, chief market strategist at spread better IG Index.

Analysts at US bank Citigroup are also cautiously saying relief may be close at hand.

“The near-term risk reward balance has improved for European equities. Valuations, rock-bottom sentiment and historical performance patterns in bear markets support this thesis,” says strategist Adrian Cattley.

But not everyone in the City of London is in agreement that the outlook has suddenly become positive. Strategist Albert Edwards at Société Générale, renowned for his dramatic and pessimistic outlook, continues to anticipate the FTSE reaching a low of 3,000 before recovering

He said: “I expect a deep recession in both the UK and US resulting in a profits slump. I think equities are still very expensive. The fundamentals are similar to what happened to Japan in the post-bubble debacle from 1990 onwards.”

Analyst Views: Where will the FTSE end this turbulent year?

Mike Lenhoff (Brewin Dolphin): “6,200, which gives us something to go for. It wouldn’t take a great deal to turn these markets around. After the Fed rescued Bear Stearns, the market added 1,000 points in six weeks, showing how rapidly sentiment can change. If oil fell below $120 a barrel, it would transform expectations.”

Albert Edwards (Société Générale): “I don’t have a year end prediction, but expect the FTSE to trough just below 3,000. I expect a deep recession in both the UK and US resulting in a profits slump. Equities are still very expensive. The fundamentals are similar to what happened to Japan in the post-bubble debacle from 1990 onwards.”

Jeremy Bastone-Carr (Charles Stanley): “6,800, a courageous call I made at the start of this year. Shares have been oversold and there is valuation support. If oil prices keep falling that could spark a turn around. A substantial amount of money has been taken out of equities and put into cash but it wouldn’t take much to start a rally.”