City eyes economic data dump for clues on BoE rate hike path

City traders will be looking for clues shedding light on how far the Bank of England will need to hike interest rates in this week’s economic data dump.

The capital’s premier FTSE 100 index posted a decent performance last week, adding nearly one per cent to close at 7,351.07 points.

Its mid-cap domestically-focused counterpart, the FTSE 250, notched a better week, gaining 1.78 per cent to close at 19,188.03 points.

Fresh GDP figures for July published tomorrow could boost investors if they come in stronger than expected.

The economy has performed better than the Bank of England projected at its meeting last month. However, experts have warned the UK is still on course for a recession beginning this winter.

New prime minister Liz Truss’s cost of living support package launched last week, in which she said energy bills will be frozen at £2,500 for two years at a cost of around £150bn, will both support the economy by shielding household incomes and curb inflation by pegging energy prices.

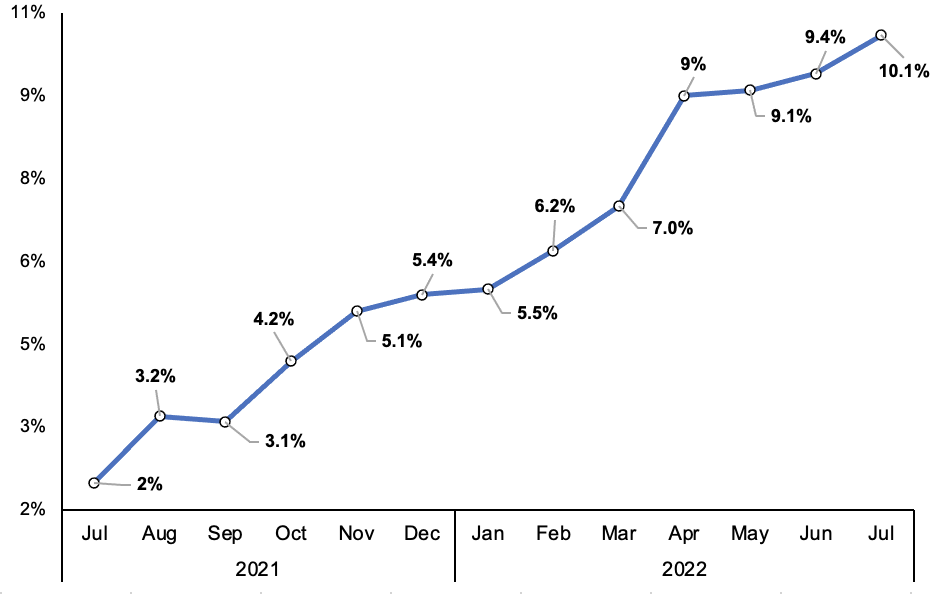

City investors are also bracing for fresh inflation figures out on Wednesday, which will not take account of Truss’s measures and may nudge slightly higher than July’s 40-year high number of 10.1 per cent.

Annual UK CPI inflation

Inflation is “now projected to peak nearer to 10.5 per cent year on year than the 13 per cent year on year peak forecasted” by the Bank in August, Sanjay Raja, senior economist at Deutsche Bank, said.

Raja added a cooling in headline inflation will tame price expectations, reducing the risk of price pressures embedding in the economy over the long run.

However, “strengthening wages (nominal) should also start to feed through into prices more fully over the coming quarters, resulting in a more protracted period of above-target inflation,” he added.

Those dynamics could force the Bank to hike rates 50 basis points at its next three meetings and eventually lift them to four per cent.

Truss’s support package is also likely to keep inflation high over the medium term by supporting household spending.

As a result, “the Bank’s credibility is now of paramount importance – especially with government policy pushing nearly 10 per cent of GDP in fiscal loosening in the near-term. This should give the MPC a longer runway for rate hikes,” he said.

Jobs data out on Tuesday are anticipated to show demand for workers is rubbing up against weak labour supply. Retail sales numbers are out on Friday.