City expects interest rates will be held

Interest rates are expected to remain on hold this week in spite of a slew of bad economic news that has left the UK teetering on the edge of official recession.

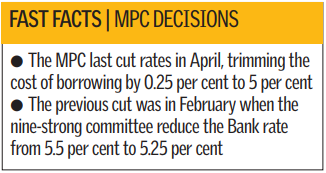

Consensus expectations suggest that once again rising inflation will trump dwindling growth for the Monetary Policy Committee (MPC) meaning interest rates will remain at five per cent for the fifth month running.

“We expect the MPC to keep rates on hold, but faced with the prospect of a recession, we believe the Bank of England will cut interest rates again later in the year, starting in November,” says Peter Newland, economist at Lehman Brothers.

Newland, who expects interest rates to sink to 3.5 per cent by the end of 2009, echoes the views of a growing number of economists who predict the next move by the central bank will be down.

“With inflation set to peak within the next few months and the economy heading rapidly towards recession, we still think that interest rates will be falling by the end of this year,” says Jonathan Loynes, economist at Capital Economics.

Data last week showed that house prices fell at their fastest pace since 1991, while UK retail sales plunged to their lowest level since 1991 in August. The grim figures follow on from revised statistics showing the economy ground to a halt in the second quarter, registering no growth for the first time since the recession of the early 1990s.

Last month, policymakers were split three ways, with Timothy Besley voting to raise rates, David Blanchflower to cut them and the remaining seven committee members choosing to leave them on hold. But economists say the fact that the committee even discussed arguments in favour of a rate cut is indicative of a loosening bias.

Howard Archer at Global Insight said: “We suspect that this Thursday will prove premature for the Bank of England to cut interest rates. While we would not totally rule out a 25 basis point reduction to 4.75 per cent, we believe that most MPC members will still be reluctant to cut interest rates at this stage given the fact that consumer price inflation (already at 4.4 per cent) could well reach 5.0 per cent around October.