City banks and insurers will book £330bn climate change loss without action to control impact

The City could lose as much as £330bn over the next three decades if the UK fails to tackle climate change, the Bank of England said today.

Firms will struggle to pay back loans due to costs swelling as a result of higher carbon prices, according to conclusions drawn by the Bank from its first climate stress test.

Higher mortgage defaults triggered by an uptick in joblessness caused by climate change dragging down the UK economy will sour Britain’s biggest high street lenders’ balance sheets, the Bank said.

These projections were based on a worse case scenario constructed by Threadneedle Street where the UK develops no strategy to cope with climate change and families are unable to remortgage or insure their homes due to property prices plummeting as a result of climate risk exposure such as flooding.

Key factors driving bank losses are “large increase[s] in carbon prices… which leads to large corporate loan losses across energy users and energy producers, and the economy-wide recession, including a rise in unemployment and fall in house prices caused by the sharp adjustment process, leading to significant mortgage impairments,” the Bank added.

Corporate defaults are expected to be highest among mining, manufacturing, transport and retail firms.

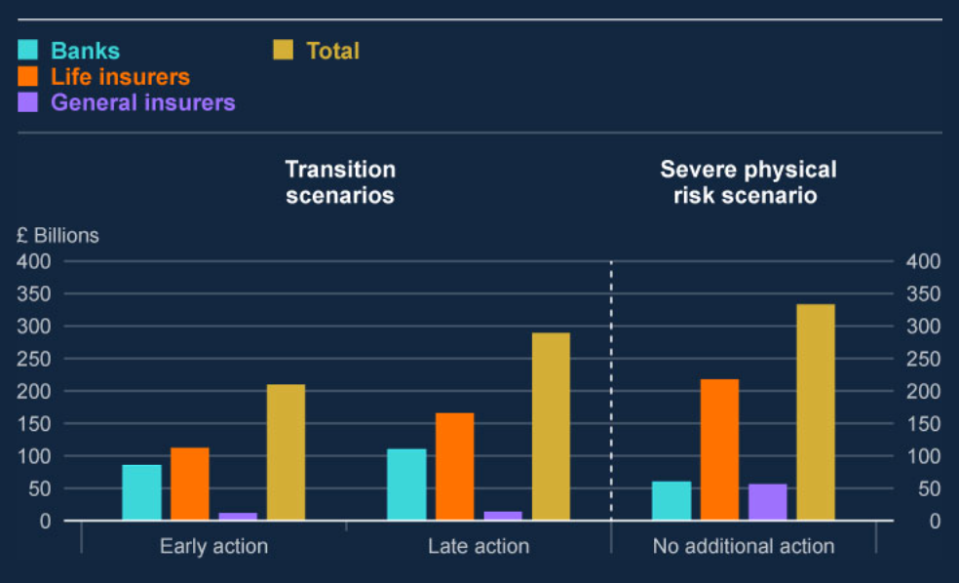

In a scenario where the UK takes early action to tackle climate change, losses are limited to just over £200bn over the next 30 years. Late action will result in around £290bn of losses.

The Bank praised City firms for progress made on capturing the impact of environmental damage on their financials.

The central bank surveyed the UK’s biggest banks and insurers, including HSBC, Barclays and Aviva.

The findings come after HSBC this week suspended Stuart Kirk, the bank’s responsible investing chief, for saying climate change is “not a financial risk we need to worry about”.