Chinese-owned Nexperia withheld cash from Newport Wafer Fab to snap up on the cheap

The Chinese-backed owner of the UK’s largest chipmaker Newport Wafer Fab pushed it into financial difficulties and stalled a private equity takeover so it could buy the firm cheaply, according to reports.

Dutch chip making group Nexperia, which is owned by Chinese firm Wingtech, took a 14 per cent stake in Newport Wafer Fab in 2019 which gave it a board seat and a veto over company decisions.

According to sources cited by the Times, Nexperia withheld cash from the firm and reportedly stalled a £50m offer from a private equity bidder, allowing it to then snap up the remaining 86 per cent of the firm for £67m.

Newport Wafer Fab went through “a period of financial distress” in 2021 as it said it was unable to raise funds elsewhere, according to its company accounts, before Nexperia agreed to buy the firm.

The sale is currently under investigation from the government under national security legislation after the Commons’ foreign affairs select committee flagged concerns over the Chinese.

In April, chair of the Committee Tom Tugenhadt said the takeover “left many wondering why we are handing over critical security infrastructure to overseas companies with well-documented links to the Chinese state”.

Nexperia has refuted the claims however and disputed that a private equity deal was near completion, the Times reports, stating “that there were no other viable and funded business options on the table for [Newport Wafer Fab] to continue operating”.

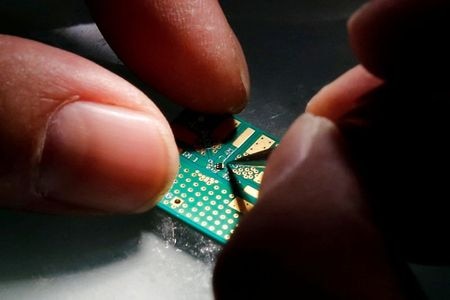

The sale comes amid a wider shortage of chips that are essential to the manufacturing of all modern electronics and found in everything from cars to mobile phones.

A Nexperia spokesperson said: “Nexperia strongly refutes these unsubstantiated allegations by unnamed sources. Until last year, Nexperia was an important customer and shareholder of Newport Wafer Fab.

“NWF’s previous owners consistently failed to meet their customers’ requirements, misrepresented the capacity available, exaggerated their future potential, were running out of cash, unable to meet loan repayments to the Welsh Government and appointed insolvency advisors.”