China’s role in UK nuclear sector poses challenges for net zero push, say think tanks

China’s continued foothold in the UK’s nuclear energy sector poses headaches for the UK government as it looks to attract overseas investment to meet its ambitious green energy goals, several think tanks have warned.

Sophia Gaston, head of foreign policy and UK resilience at Policy Exchange told City A.M. the so-called golden era of Chinese investment in critical infrastructure is “well and truly over.”

This was reflected, she said, in the government’s decision late last year to buy out state-backed China General Nuclear Power Group’s (CGN) 20 per cent stake in Sizewell C.

…the prospect of Chinese state companies being subject to future Western sanctions renders their investments in long-term projects inherently unstable.

Sophia Gaston, head of foreign policy and UK resilience at Policy Exchange

The policy expert now called on the government to remove Chinese investments from both Hinkley Point C – where CGN still has a one-third stake – and for a potential new power plant at the defunct Bradwell B site, which is two-thirds owned by CGN.

“Securing alternative investors for the Hinkley and Bradwell nuclear sites must be seen as critical priorities for the government and a key opportunity for British diplomacy,” she said.

Gaston argued the UK needed a “diversification of funders,” rather than relying on China to meet its nuclear ambitions, and that this would be “essential for the nation’s resilience in the long run.”

“Even beyond the geopolitical and security considerations, the prospect of Chinese state companies being subject to future Western sanctions renders their investments in long-term projects inherently unstable,” she added.

China balancing act dependent on risk

Antony Froggatt, deputy director and senior research fellow at Chatham House, offered a more cautious perspective, however.

He did not believe domestic funding alone would be sufficient for the country to meet its net zero goals over the next three decades and shift its reliance on fossil fuels to a fully decarbonised power sector by 2035.

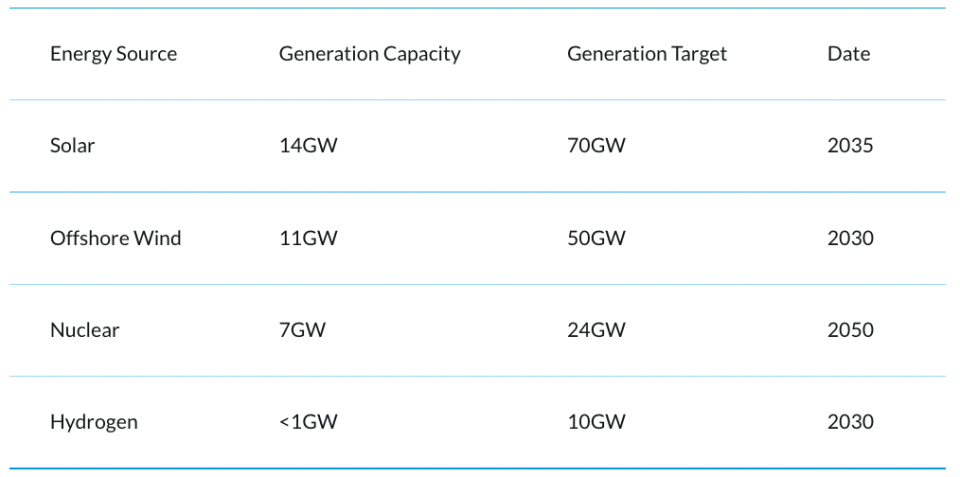

The government is currently targeting a ramp up of nuclear energy generation from 7GW to 24GW in its supply security strategy as part of its climate and energy independence goals.

In his view, minority stakes in UK nuclear plants, like CGN’s stake in Hinkley Point C, were not a strategic issue, and that the UK’s focus needed to be on boosting low carbon technology, which required investment from overseas.

Froggatt said: “If we’re looking forward, what we know now is that we need to very rapidly decrease our dependence on gas in order to have greater energy independence and have greater security.”

Nevertheless, he recognised CGN’s proposals to design and build Bradwell B power station were potentially concerning because, if approved, it could create a precedent of licensing Chinese-designed nuclear power stations in Western markets.

“Having overseas investment isn’t necessarily wrong, but it needs to be done in a very clear, transparent way and so we have a certain amount of security from a supply perspective, but I think overseas investors are not going to undermine medium term or longer term operational facilities,” he said.

Froggatt also highlighted that China had a dominant position in the manufacturing of wind turbines and solar panels, as well as investments in offshore wind farms in the UK, meaning questions around its involvement were unlikely to fade any time soon.

“I think we need to have a system wide strategic approach – but decarbonisation is probably the priority,” he said.

Dr. Peter Bird, managing director at consultancy firm Berkeley Research Group, also believed managing overseas investment was a balancing act, and that it was incumbent upon the government to determine how much risk it would allow when reviewing investments from foreign companies.

He said: “In the UK there are substantial sources of capital keen to invest in large projects, provided the risk profile is acceptable. Foreign investment is not essential for their financing, but opening the market to foreign investors creates more demand. The resulting competition for projects to invest in can lower the cost of funds, to the benefit of UK consumers.”

Concerns over the role of China in the UK’s energy sector intensified this week, after senior MPs on leading Westminster bodies called on the Government to reduce China’s influence in the North Sea.

CGN and the government were approached for comment.