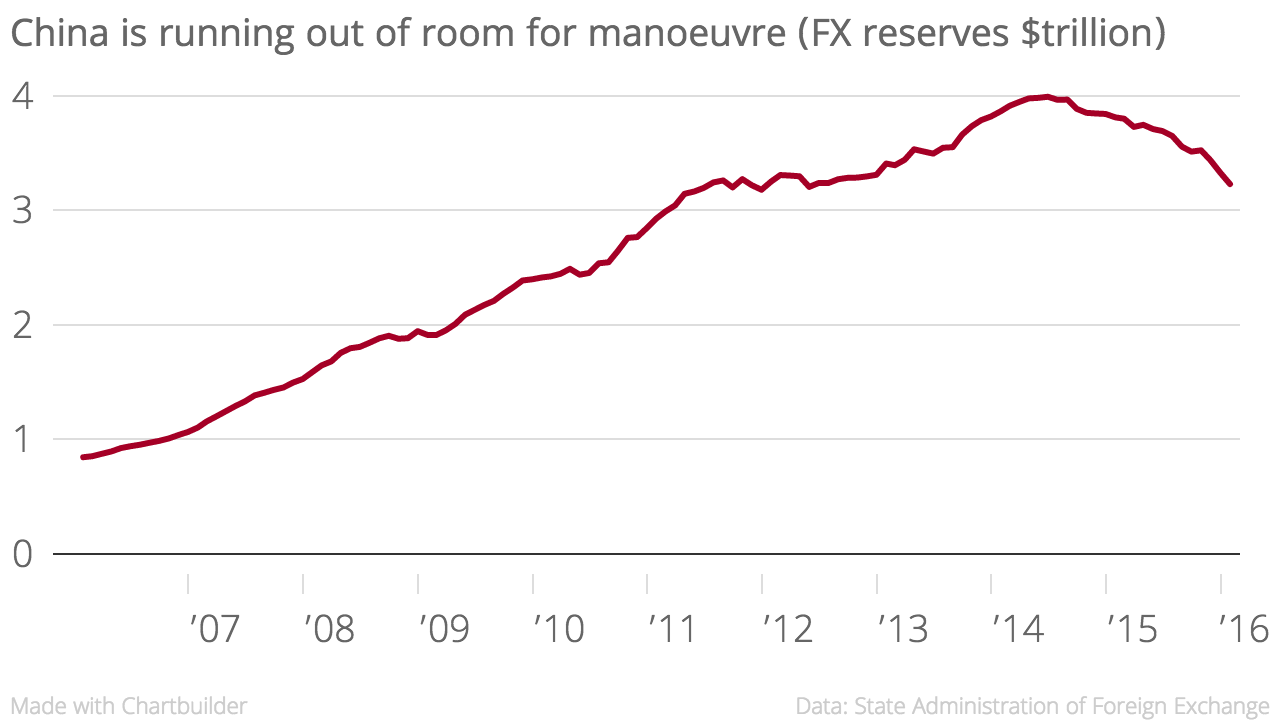

China’s foreign exchange reserves hit lowest level since 2011

China’s foreign exchange reserves tumbled in January, according to figures released today.

The country’s holding of US dollars fell by $99.5bn (£68.6bn) in January to $3.23 trillion, the lowest it's been since 2011, the data from the Chinese State Administration of Foreign Exchange shows.

The Chinese authorities are attempting to maintain a value of the yuan against the US dollar. If the yuan weakens against the dollar, China sells off some of its enormous stash of US dollars in order to buy yuan. This, at the same time, puts downward pressure on the dollar and upward pressure on the yuan.

“While the remaining $3.23 trillion of China’s FX reserves still represents a substantial war chest, the mathematics around this rapid pace of depletion of FX reserves in recent months is simply unsustainable for any length of time,” said economist Rajiv Biswas from IHS Global Insight.

“As the PBOC desperately tries to stabilise the yuan, domestic private investors as well as global currency traders and hedge funds continue to see a one-way bet against the yuan. This has resulted in large-scale private capital outflows out of the yuan since early 2015, as expectations mount that eventually the PBOC will be forced to capitulate once its FX reserves are sufficiently depleted.”

“The PBOC is caught between the devil and the deep blue sea, facing a choice of either continued slow erosion of FX reserves, or a rapid currency adjustment that could be destabilising for China and plunge global currency markets into turmoil.”