China: what zero tolerance, supply chain disruption and floods mean for economic growth

Ongoing disruptions mean that we have lowered our forecast for growth in China this year. Activity lost due to outbreaks of Covid and supply chain bottlenecks will be largely recouped, but the lagged effects of past policy tightening are only just starting to take effect. As a result we continue to expect growth to slow into mid-2022.

A large package of policy support seems unlikely in the absence of much sharper slowdown than we anticipate. Instead the government is likely to continue to grease the wheels with relatively small monetary and fiscal measures. But there does seem to be a greater chance of more regulatory measures as the government turns its attention to longer term growth dynamics.

The confluence of factors weighing on economic activity

We have cut our forecast for GDP growth in China this year to 8.5%, from 9.2% previously, as a confluence of factors look set to weigh on activity in the near term. Parts of the country have suffered from floods, bottlenecks in global supply chains are crimping manufacturing output, while the authorities in Beijing have announced a broad range of regulatory changes and re-imposed some activity restrictions following an outbreak of the Delta variant of Covid-19.

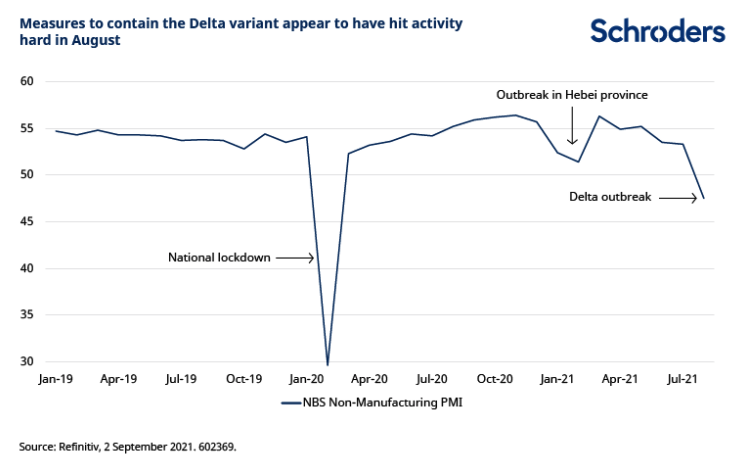

Economic activity data undershot expectations across the board in July, and the latest PMIs indicate that it remained subdued in August. After all, partial lockdown measures to contain Covid were tightened further last month. The NBS non-manufacturing PMI fell by more than it did earlier this year following an outbreak while manufacturing was also disrupted including curbs on operations at the world’s third busiest seaport in Ningbo.

Now that new Covid cases are back down to low levels, restrictions are beginning to be eased, and the macroeconomic consequences should reverse. This should give some lift to activity in the fourth quarter. Moreover, there is likely to be some boost to activity in the aftermath of flooding as reconstruction work begins, while the government signalled at the recent Politburo meeting that it will bring forward some infrastructure projects. That said, despite the rapid roll-out of vaccines, the government’s zero-tolerance approach to Covid means that disruption to activity following local outbreaks is likely to be seen again in the future.

Discover more at Schroders insights or click the links below:

– Read: Five thought-provoking books we’ve read in 2021

– Listen: What does China’s stock market meltdown mean for investors?

– Read: Which emerging markets will be the winners and losers from energy transition?

Why we expect a cyclical slowdown to follow

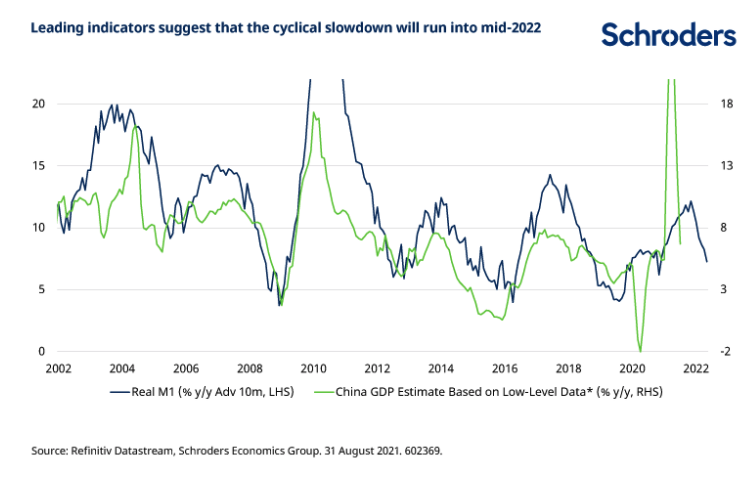

Even so, the bigger picture is that these disruptions are all noise around broader macroeconomic trends that are likely to drive a cyclical slowdown in growth in the months ahead. As we highlighted back in the spring, cyclical leading indicators such as the credit impulse and real M1 peaked in the autumn of last year after the authorities tightened policy, notably with regards to the supply of credit to the economy and the real estate sector.

Given that declines in these leading indicators, which continued in July, typically feed through to activity with a lag of around nine months, the slowdown in Chinese growth is only just beginning and will run into mid-2022. As a result, we continue to expect the official rate of GDP growth to slow to around 5.5% next year.

More meaningful policy support would cause us to upgrade our expectations for growth next year, but so far there is little sign of major stimulus measures. We think that additional reductions in reserve requirements for banks are likely in the months ahead, along with some loosening of the public purse strings.

But so long as the government continues to clamp down on the real estate sector, these loosening measures are only likely to cushion the downside rather than drive a change in direction. While not in our central scenario, outright interest rate cuts clearly cannot be ruled out, but will probably be a last resort since these would work against efforts to contain leverage.

Regulatory action has increased – but what does it mean for long term growth?

One area where the government has been far more active is on the regulatory front. The authorities have continued to add to their long laundry list of sectors that will face greater scrutiny in the future. These range from the provision of private education, to the reach of internet tech companies and operations in parts of the gig economy such as ride-hailing firms. A lot of very good analysis has already been published on the regulatory crackdown that we will not go over again.

From a macroeconomic point of view, the motivation for at least some of the measures seems to be an effort to deal with the long term structural slowdown in China’s economy as the old drivers of growth fizzle out. As we noted earlier this year, it is inevitable that growth will slow from the high single digits rates of expansion seen in the recent past, now that rapid industrialisation and urbanisation has largely run its course and demographics are becoming less supportive. Nonetheless, the government can influence the severity of the slowdown by taking steps to support productivity and income growth, which are effectively the aims of the “dual circulation” policy.

A desire to become self-sufficient in high-tech sectors, emboldened by the so-called trade war with the US, has seen China ramp-up spending on research and development (R&D) in recent years. But there is a long way to go, particularly in sectors such as semiconductors, and the crackdown on internet services companies may be a sign that the authorities want to redirect resources towards more strategically important, and productive sectors.

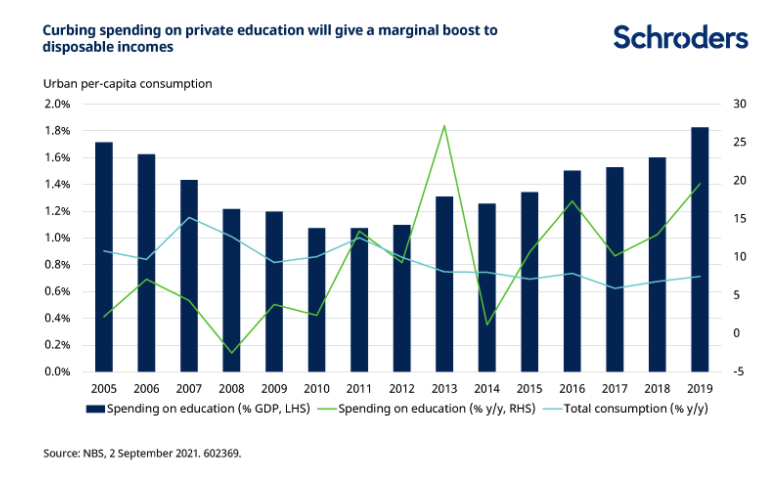

Meanwhile, the government has long targeted a rebalancing of the economy towards greater consumption and a notable feature of the recovery from the Covid recession has been tepid consumer activity. Moving up the value-added chain in industry through R&D would be supportive of higher incomes. This will clearly take time and recent measures to clamp down on private education and limit the deductions that companies can make from workers in the gig economy all point to an effort to support household disposable incomes, albeit the impact is likely to be marginal.

In light of all of this, there is a high chance that the government will go even further with these reforms and there is clearly a risk that the crackdown will deter private sector activity. Time will tell if they are successful in propping up long term growth.

– For more visit Schroders insights and follow Schroders on twitter.

Topics:

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.