China is relaxing foreign ownership caps, and London must grasp the opportunity

I write today’s article in a tall building overlooking the so-called “Paris of the East”, better known as the city of Shanghai.

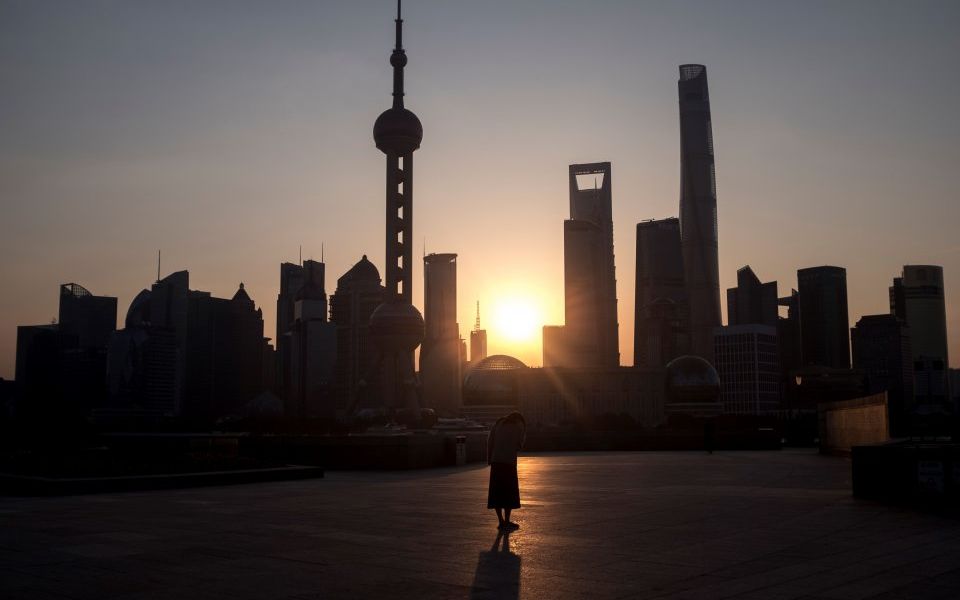

From here, you can see the old and new – the remnants of Shanghai’s old financial centre along the Bund, and the mind-boggling array of skyscrapers which have flown up on the other side of the river.

It’s hard to believe, but Pudong, and the Lujiazui financial centre that it is home to, was just farmland in the 1990s.

Since then, it has been transformed into one of the world’s most well-known modern skylines.

Indeed, much like Canary Wharf, and much of the Square Mile post World War II, the redevelopment is an economic marvel, and something that China is rightly proud of.

My visit to China comes at an exciting time. I travelled here to speak at the Lujiazui Forum – now an annual fixture on the international economic calendar, and one that has grown in importance over the years, as shown by the high-calibre array of speakers and attendees.

One of the star speakers at this year’s event was the governor of the People’s Bank of China (PBoC), Yi Gang, who took to the stage in the wake of his speech on economic reforms at the BOAO Forum for Asia earlier this year – one for which we are still feeling the repercussions.

In fact, the set of measures he outlined were some of the most audacious – and, I must say, welcome – economic reforms in China since the process of opening up began 40 years ago. Yes, we were expecting them, but what we didn’t anticipate was the accelerated timetable for their introduction.

By the end of this year, we can expect to see foreign ownership caps relaxed to 51 per cent in a whole host of sectors – including banking, insurance, futures, and asset management – and after three years this cap will be completely removed.

In addition, China has reaffirmed its commitment to introducing the London-Shanghai Stock Connect this year, which will give UK and Chinese investors unparalleled access to each other’s markets.

It’s certainly an interesting time for Sino-UK relations.

Before my arrival in Shanghai, I visited Beijing to pay a visit to some of our most important stakeholders, including the National Development and Reform Commission and PBoC, both of whom have crucial roles to play in China’s Belt and Road Initiative.

What was made clear to me in these meetings was the potential of a role for the UK in the Belt and Road, in providing some of the “soft infrastructure” required in its development. Think financing, legal services, and green finance expertise, to name but a few areas which the UK’s financial and related professional services sector can support.

There is clearly support on both sides to move to our next level of engagement in this area, and begin collaboration on initiatives in third countries where British and Chinese strengths are complementary.

I certainly hope so. After all, by some estimates the Belt and Road Initiative could add £1.8bn to our GDP every year. As they say in China, zhua jin shi ji, let’s grasp this opportunity.