Chime Communications board gives thumbs up to £374m WPP and Providence takeover bid

Chime Communications' directors have unanimously recommended a £374m takeover from Providence Equity Partners and WPP to shareholders

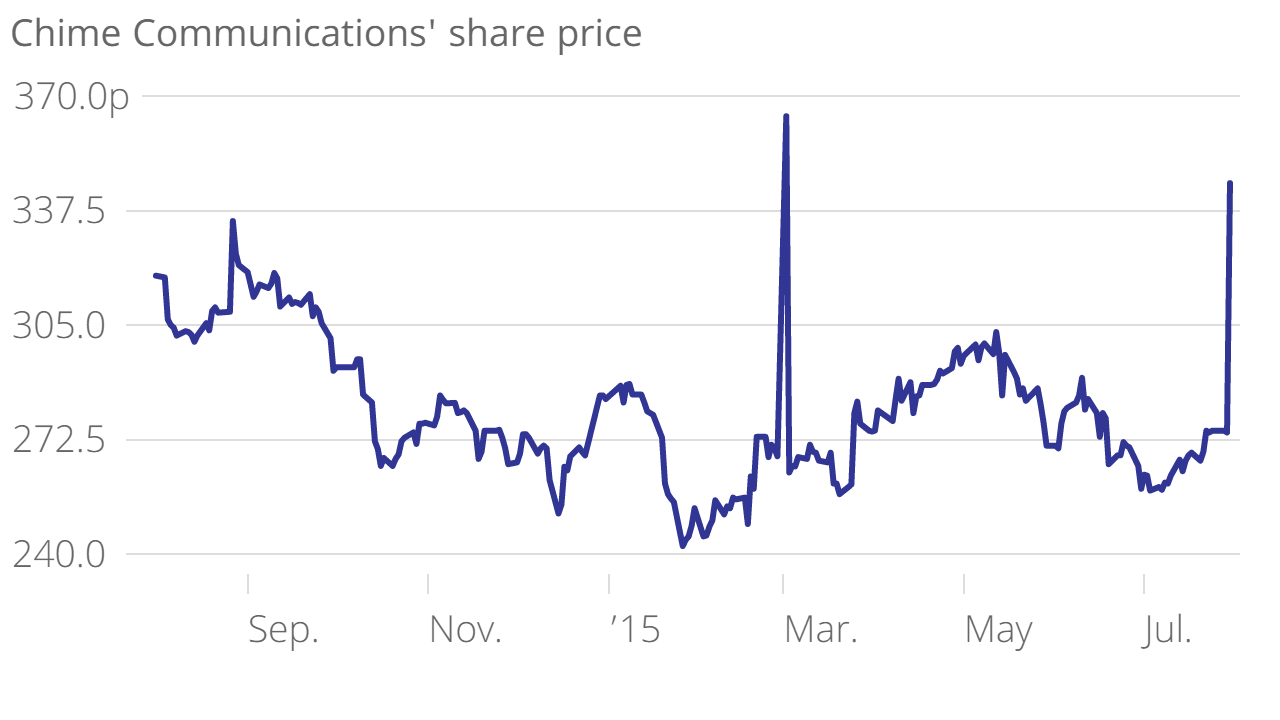

Read more: Chime shares soar on £350m WPP takeover talk

The takeover offer entitles shareholders to 365p per Chime share and an interim dividend for the current year of 2.53p per share.

Chime's specialist sports marketing businesses appear to have attracted marketing powerhouse WPP and private equity firm Providence, which have both expanded into the sector in the past year.

Lord Davies of Abersoch, chairman of Chime, said that the company needed the "significant new capital" from Providence in order to properly expand its global sports marketing business.

He commented:

Chime has achieved great success to date in building a leading position in the global sports marketing and communications industry, which is reflected in the attractive premium being offered to shareholders. However, to fulfil Chime's considerable growth potential, significant new capital is required.

Providence and WPP offer Chime both the capital and the industry expertise to fast-track our ambitions to build a full-scale, global sports marketing and communications business.