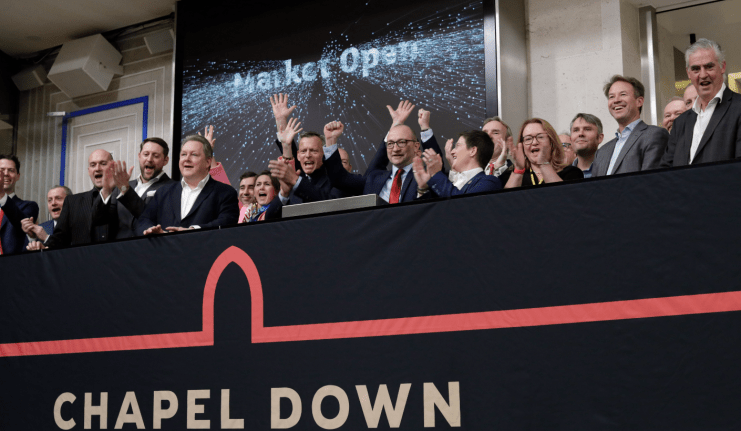

Chapel Down makes a splash on AIM as it pushes ahead with growth plans

Britain’s biggest winemaker Chapel Down Group has made its debut on the Alternative Investment Market (AIM), as it pushes ahead with plans to double the size of its business by 2026.

Admission on the AIM, which is a sub market of the London Stock Exchange, took place at 8am this morning. The chardonnay producer was previously listed on the Aquis Stock Exchange.

The British firm saw a positive open with its share price up 3.98 per cent.

Chapel Down reported net sales growth of 21 per cent to £8.37m in the first half of the year, as the group was bolstered by duty-free airport sales.

The company owns, leases and sources from 1,023 acres of vineyards in South East England, of which 750 acres are fully productive, making it the largest wine producer in the UK.

Last year, the company sold 1.4 million bottles of wine and has grown in popularity thanks to partnerships with England and Wales Cricket Board and Ascot Racecourse.

Andrew Carter, chief executive of Chapel Down, said that the move to the AIM will attract a wider pool of investors to participate in the company’s growth.

He said: “In November we confirmed a record 2023 harvest, with tonnage 86 per cent higher than 2022 and 75 per cent higher than the previous record posted in 2018.

“Which is creating great excitement within our business, and will underpin our strategic ambition to double the size of the business by 2026 as we continue to build Chapel Down’s position as England’s number one and most celebrated winemaker.”