Changes to UK mortgage market cushions blow to borrowers from interest rate hikes

Changes to the mortgage market have helped protect borrowers and smooth the economic impact of higher interest rates, new research suggests.

The Bank of England’s rate hikes have increased mortgage rates by over four percentage points in the last two years, raising the cost of repayments for those re-fixing.

According to the Bank’s researchers, a three percentage point rate increase on a £300,000 mortgage would set borrowers back by roughly £500 per month

However, despite rising costs, the housing market has not seen a major upturn in arrears, defaults and forced sales. Although mortgage arrears hit a six-year high in the three months to December, this was still relatively low historically.

The figures showed that 1.14 per cent of total loans were in arrears at the end of last year, compared to 3.64 per cent in the first quarter of 2009.

New research from the Bank of England suggests part of this comes from successfully ‘stressing’ customers when the mortgage was first taken out.

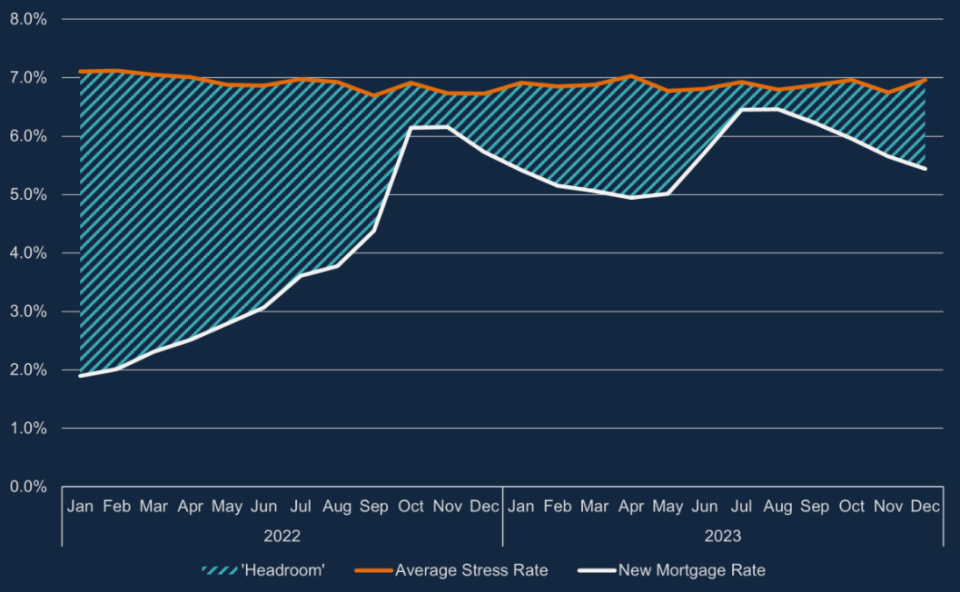

Stress tests were introduced in 2014 to make sure that borrowers did not take on more debt than they could afford to repay.

Researchers at the Bank found that the vast majority of borrowers who came to the end of a fixed term in 2023 faced new mortgage rates lower than the rate at which they were ‘stressed’.

Having no headroom against the stress rate does not imply that borrowers would default or would not be able to re-fix. However, the researchers noted there would be “less certainty about affordability”.

Stressing is likely to have supported the “resilience of individual borrowers and the overall market,” they noted.

Research from Barclays also showed that the changing nature of the mortgage market has helped to smooth the impact on the economy.

Around 85 per cent of mortgage debt is on fixed deals, mainly two years or five years. Back in 2012, as much as 70 per cent of mortgage debt was on variable rates, Barclays said.

If there were as many variable rate deals now as there were in 2012, the current hiking cycle would have led to a 3.5 per cent cumulative fall in disposable income over 2022 and 2023. This is more than four times the estimated impact on the current mortgage market, Barclays’ Abbas Khan said.

“The structure of the mortgage market has smoothed the impact on consumption from the rate cycle,” he concluded.