Cash in on volatile financial markets

More tips on how to succeed in financial betting

At the core of speculation on the financial markets is a single premise – your opinion that the market will ‘do something’.

The simple, fixed risk nature of fixed odds financial betting is such that you can never lose more than your stake, but has the potential to make many times more if the market goes your way.

Today we will explore the differences between two of the most popular types of financial bets – the One Touch Bet and the Binary Bet. I will guide you through BetsForTraders.com pay-off profiles, why some traders prefer one over the other and when you might consider using each bet.

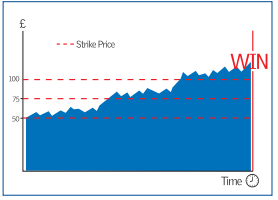

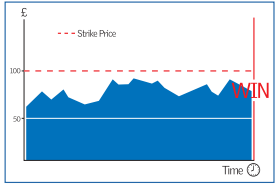

Firstly lets look at the Binary Bet. A Binary Bet is very simple. You pick a level, known as the ‘strike price’, above or below which the market will be, and then you decide when it will be above or below that level. Finally you select the pay out that you will win if you are right.

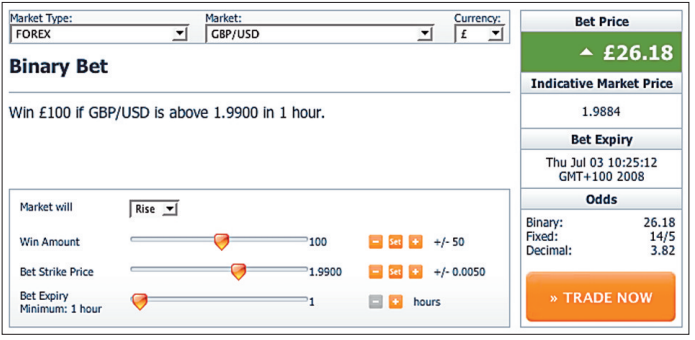

Let’s work with an example of a recent bet I made. The Sterling/US Dollar exchange rate (GBP/USD) had broken out of its range on the upside 10 minutes earlier, having fallen back a bit over the previous few hours. ‘Spot Price’ being 1.9884.

I was confident the rally would last so I moved the ‘Strike Price’ bar along to 1.9900. I didn’t want to push my luck and go so far as 1.9910 (though I should have as the market then shot up to 1.9912 and I could have got better odds).

I moved the ‘Win Amount’ bar to £100 and the ‘Expiry Time’ bar to one hour. Note that the bet contract, displayed above the slide bars, updates as you move them. The full terms of my bet were: Win £100 if GBP/USD is above 1.9900 in one hour.

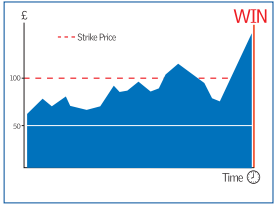

The ‘Bet Price’ box, to the right, in green, quotes a real-time price for the bet. I placed the bet at £26.18 for a profit of £73.82 (the £100 pay out less the stake) and made approximately 300 per cent profit when it came in. Moving on to the One Touch bet. A One Touch bet is effectively the same as a Binary Bet in every regard, but one. To win a Binary Bet, the market must surpass your strike price at expiry (be above for an ‘up’ bet or below for a ‘down’ bet). A One Touch, however, pays out the win as soon as the market hits the strike price.

Taking the example of the case above, the bet would pay out as soon as the market touched 1.9900, rather than paying out if it was above the strike at the time of expiry.

This has the clear advantage of considerably increasing your odds of winning each bet. You are far more likely to accurately predict a market level that will be touched at some point than to predict whether the market will be above or below that level at a specific point in time.

With this in mind, many traders only trade longer-term, multi-day, One Touch bets to increase the probability of it ever touching their strike.

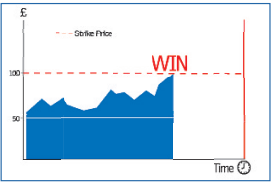

So, where’s the catch? While many traders make a killing, there is no free lunch in the markets. A One Touch bet will cost more than a Binary Bet with the same strike price and expiry time – usually about twice as much.

For example, a five-day Binary Bet might have odds of 9/1, costing £10 to win £100, while a five-day One Touch with the same strike price would likely have odds in the region of 5/1, costing £20 to win £100.

Application of each

Binary Bets are offered with very short-term minimum expiry times. This makes them very attractive to some high volume traders who are confident of their market view. When you are very confident you may want to take the slightly higher risk in exchange for about double the potential reward.

Some more conservative traders, on the other hand, feel more comfortable in the knowledge that they have several days until the bet expires and only need to be right once, at any time, to win. To them this is worth a premium in the form of shorter odds.

My personal opinion is that neither is objectively better, rather each has its uses within the context of your market view.

In considering which is appropriate each time, I always consider:

1) How strong is the trend? I tend to use a Binary Bet in a very strongly trending market and a One Touch in a weaker one.

2) How long term is my view? If it is just a few minutes, a Binary is the clear choice; if it is several days, I am more likely to go for a One Touch.

3) What are the Odds?

What now

Anyone can go to BetsForTraders.com and start pricing up some bets on the dealing interface; you don’t even need to log in.

If you are new to fixed odds financial betting, go to the site and have a look. There are some other, more complex, bets available as well.

Once you have grasped the basics consider taking a look at these. In these volatile financial markets everyone can cash in, go to BetsForTraders.com and start winning now!

Know your bet types

Binary Bet: Win a multiple of your stake if the market price is above the strike price at the time the bet expires. If the market price is below the strike price when the bet expires, you win nothing but only lose the stake. Set a strike price, the amount you want to win and the expiry time of the bet, and place your bet.

One Touch Bet: Win a multiple of your stake if at any time before the bet expires the market price touches – or goes past – the strike price. If the market price never touches the strike price you win nothing and lose your stake.

No Touch Bet: Win a multiple of your stake if at the time the bet expires the market price has never touched or gone past the strike price. If the market price touches or goes past the strike price you’ll win nothing and lose your stake.

Trend Multiplier Bet: Win a multiple of your stake if the market is higher at the end of each of a number of time intervals than it was at the last interval. Select the number of time intervals and the length of each interval, set how much you want to win and place your bet.