Cash and bonds will help protect your investments from stagflation

It’s time to re-balance your portfolio to cushion the blow of the bear market, says Bill Jamieson

Investors have arrived at a critical inflection point on portfolio planning. Many believe that key sectors of the equity market such as banks and house builders are now undervalued, yet they choose to remain markedly underweight in these areas. They fear worse is to come and that it is too early to make investment commitments.

Similarly, many have been scrambling to achieve inflation protection to prevent the corrosion of the purchasing power of their savings.

To secure returns that offer best protection against an inflation rate of 4 per cent or more often requires a commitment to accounts locking in the investor for a year or more. But in recent weeks expectations that inflation will persist at today’s elevated levels for a year or more have fallen.

Portfolio planning thus has to balance two acute concerns over a period in which threats to the value of long term savings are set to shift.

Corrosion by inflation is likely to moderate while the likelihood of a downturn in corporate earnings, share ratings and dividends is set to intensify. How best to balance and to contain these stagflation risks?

Compelling Evidence

Only a portfolio invested fully in cash and short term fixed interest bonds would have avoided damage in the past year from the combination of rising commodity prices and the spreading effects of the credit crunch. But few portfolios are actively managed in such a way. In reality, most investor portfolios structured for the longer term (five years or more), are only intermittently changed, and continue to be diversified across different asset classes and different sectors within these classes.

This tendency to maintain a spread of investments in the face of sharp falls in markets and the deteriorating outlook for corporate earnings draws from a combination of compelling evidence. It all points to superior performance of equities over cash and fixed interest as an inflation hedge over the longer term, uncertainty over the length of the downturn and experience of previous downturns when prices have broadly recovered after a period of weakness.

Over-active switching, which triggers dealing costs and capital gains tax liabilities, can cut into the superior returns offered by more intensive portfolio management that seeks to take advantage of market turning points, even assuming these can be accurately predicted.

Bear Market

In addition, despite sharp falls in major equity sectors such as financials, property, retail, media, house building and construction, there is as yet no confidence among professional fund managers that the bear market in these areas is over.

According to the latest Merrill Lynch European fund manager survey, pessimism over the UK market is especially marked, with a net 92 per cent expecting weaker growth and a net balance of 77 per cent expecting earnings to deteriorate over the next 12 months.

Thus, while short term traders have exploited the “bar bell” movement between natural resource shares and financials – switching from oil-related shares when the oil price is falling into banks and financials and vice versa – many have been hesitant to embrace a full-on leadership switch from commodity sectors to financials.

The ML survey shows that while the net balance overweight cash fell from 37 per cent in July to 15 per cent in August, cash levels remain well above the averages seen in 2005-06.

The overall result – encouraging for some – is that a record net 50 per cent of fund managers are overweight in cash, with 62 per cent viewing the UK as “undervalued” – a figure close to the lows recorded in early 2003, just before the market embarked on a sustained upturn. However, the financial and economic environment is markedly different – and for the worse.

Cash Increase

Little wonder that the biggest change in investment thinking over the past twelve months is that cash and near cash (bank and building society deposits) have increased and have moved from the periphery of portfolio planning to centre stage.

Holdings of cash and fixed interest stock have risen sharply. They have helped to cushion the falls in the equity markets while keeping open opportunities open for bargain buying as and when conditions improve.

But this brings problems of its own. With inflation heading to five per cent and over, returns on fixed interest and cash investment are being eroded in real terms while the capital is also depreciating in real terms.

Twin Threats

Faced with these twin threats of elevated, if temporary, inflation and a bleak longer term outlook for UK corporate earnings, how might a contemporary portfolio look? And how should a portfolio builder proceed?

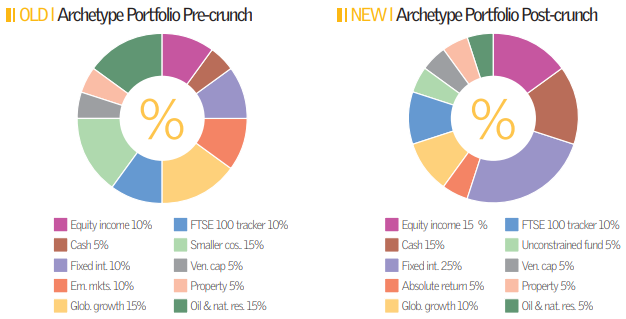

An archetype established long-term private investor portfolio will have a markedly higher percentage in cash and fixed interest compared with the long term average, but still have an exposure to equities of more than 50 per cent of the total.

Liquidity will have moved from a low level (five per cent or less) towards 15 per cent. Holdings of government gilt edged stock (including index-linked gilts) and fixed interest holdings (including corporate bonds) will have moved from 15 per cent to 25 per cent. For those nearing retirement, these percentages will be significantly higher.

The increase in cash and fixed interest can be achieved by re-direction of investment income and by top slicing of exposure to oil and natural resource shares, smaller companies and emerging markets.

The changes, summarised in the pie charts below, take the cash and fixed interest components from 15 per cent to 40 per cent. Additional low risk can be provided through holdings in absolute return funds. Standard Life Investments’ £600 million plus Global Absolute Return Strategies Fund, which has recently been made available to retail investors, has delivered annualised returns of 7.3 per cent since June 2006 with very low levels of volatility.

Defensive Spread

The fund takes advantage of small anomalies in market pricing and invests in bonds, currencies and equities using credit protection and volatility strategies. It is now ranked among the top 50 selling funds on both Co-Funds and Funds Network platforms.

Overall, the changes mark a big step-up in cash and fixed interest holdings and a shift towards capital protection and more assured income. Diversified equity exposure is still maintained, but with a greater emphasis on large cap stocks and big UK companies likely to benefit from more competitive export pricing as sterling has weakened.

Broad based equity income unit and investment trusts are retained, together with actively managed global growth funds – for example, Monks Investment Trust or Scottish Mortgage Trust.

What of those building a portfolio? A similar shift can be applied to construct a more defensive spread of holdings while still taking advantage of lower prices for equity income funds to build up holdings which should show good growth on a five to seven year view.

An 11-way, £1,000 a month regular savings commitment is shown by way of illustration.

The benefit of portfolio building in this way is that it substantially mitigates the problem of investment timing while retaining flexibility for future change, helping investors ride those deadly inflection points – both in the past and in the future.