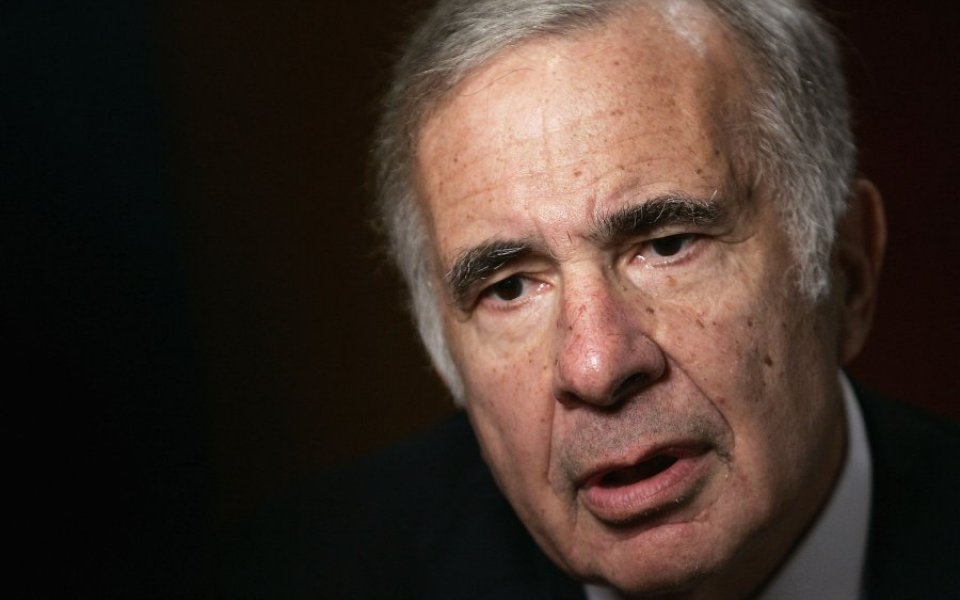

Carl Icahn just called a shareholder meeting for AIG investors to discuss ousting chief executive Peter Hancock and ramp up plans to split the insurance giant in three

Billionaire activist investor Carl Icahn is calling a shareholder meeting for AIG to discuss ousting current chief executive Peter Hancock, claiming the company is not reacting quickly enough to fears that it's grown "too big to succeed".

Last month Icahn – who is one of AIG's largest shareholders, owning more than 42m shares – published a statement calling for the insurance giant to split into three firms "to shrink below the threshold for systemically important financial institutions".

Icahn received the support of "many large institutional shareholders and analysts", and has held meetings with Hancock to discuss his proposals. But there has been no movement, Icahn claims, and he is getting itchy feet over changes that he describes as "long overdue".

"We believe the current situation is too time-sensitive to even wait until the company’s annual meeting next spring, especially when all of the stakeholders who have reached out to us believe management’s current plan (or lack thereof) is insufficient," Icahn said today.

"Therefore, while we plan to accept Mr Hancock’s offer to continue having discussions and meetings with AIG, we do not believe that he will ever sincerely consider what we, and so many others, have proposed. Nor do we believe that the AIG board of directors will respond to the demands of AIG shareholders absent a clear mandate.

"As a result, we intend to commence shortly a consent solicitation that will enable shareholders to express their views directly to the board, which may include a proposal to add a new director who would agree in advance to succeed Hancock as chief executive if asked by the board to do so."