Cardano hard fork ‘Mary’ proudly announced while the Saylor Musk saga keeps on turning

Crypto at a Glance

It all seems to have calmed down a bit after the volatility earlier this week.

The price has now stabilised at around the $50,000 level for the time being, MicroStrategy has bought yet more Bitcoin to bring its total haul up to over 90,000 BTC, and Elon Musk is tweeting about Doge again. It’s just a normal sunny day in the cryptosphere.

There’s a lot to watch out for on the horizon, though. US stimulus checks are coming up and, according to Deutsche Bank strategists, they could unleash a $170 billion wave of fresh retail inflows to the stock market.

Their survey found that 37% of retail investors planned to put their stimulus cash directly into equities. What does it mean for Bitcoin?

There was also big news from Cardano. IOHK, the company developing the Cardano (ADA) protocol, announced that the “Mary” protocol update (which will require a hard fork) will be applied to the mainnet on March 1, noting that it’s another key milestone in the #Goguen rollout. In a tweet, they explained that “the update introduces native tokens and multi-asset support, bringing exciting new use cases for #Cardano”. Could the update see the token’s remarkable recent price drive continue even further?

Catching our eye in the DeFi market is CyberFi (Token: CFI) who appeared in the Spotlight in Crypto AM last November (Read more here). The price shot up yesterday by more than 130% and at the time of writing is $23.03. CyberFi CMO Darius Greicius explained that the v2 platform is going live today and that, together with their not-so-secret project called ‘Samurai’ later this week, demonstrates CyberFi’s real life user case has caught the imagination of the market. We say great effort!

Start your investment journey into crypto with Luno with £10 on us!

If you’ve not started your crypto journey yet, we’ve joined forces with Luno to offer you £10 absolutely free. Click on the graphic below and simply use the code CITYAM10 when you sign up.

In the Markets

| Name | Price | Price Change (24h) | Price Change (7 days) | |

| Bitcoin (BTC) | $49,998.50 | +0.25% | -2.84% | |

| Ethereum (ETH) | $1,617.33 | -1.23% | -13.79% | |

| XRP (Ripple) | $0.4725 | -2.11% | -14.29% | |

| Monero (XMR) | $206.33 | -3.45% | -22.33% | |

| Polkadot (DOT) | $33.17 | -4.82% | +6.02% | |

| Algorand (ALGO) | $1.09 | -1.14% | -22.84% | |

| Cardano (ADA) | $1.04 | +5.25% | +10.99% | |

| Chainlink (LINK) | $26.98 | -2.54% | -16.53% | |

| Aave (AAVE) | $368.59 | -6.25% | -16.96% | |

| UniSwap (UNI) | $24.75 | -4.49% | +17.37% | |

| Celsius (CEL) | $5.14 | -1.35% | -9.82% | |

| Binance Coin (BNB) | $243.98 | -0.53% | +40.43% | |

| Crypto market cap | $1,514,933,279,959 | |||

| MVIS CryptoCompare Digital Assets 100 Large-Cap Index | +0.46 | |||

| MVIS CryptoCompare Digital Assets 100 Small-Cap Index | +1.17 | |||

| MVIS CryptoCompare Ethereum VWAP Close Index | -1.50 | |||

| Prices and data as of [08:30, 25/02/2021] | Source: CryptoCompare.com, MVIS |

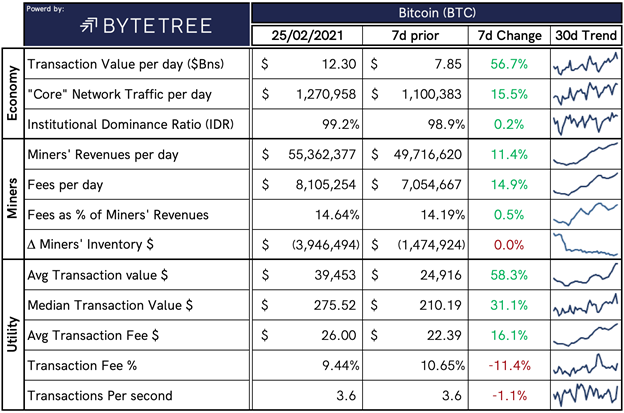

The Bitcoin Economy

*Definitions and insights can be found at https://bytetree.com/insights/

What Bitcoin did yesterday

We closed yesterday, February 24 2021, at a price of $49,705.33 – up from $48,824.43 the day before.

The daily high yesterday was $51,290.14 and the daily low was $47,213.50.

This time last year, the price of bitcoin closed the day at $9,924.52. In 2019, it was $4,142.53.

As of today, buying bitcoin has been profitable for…

99.9% of all days since 2013-04-28.

Bitcoin market capitalisation

Bitcoin’s market capitalisation is currently $939,867,830,278, down from $944,091,976,749 yesterday. That means it is still the eighth largest asset in the world by market cap. Gold has a market cap of $11.372 billion.

Bitcoin volume

The volume traded over the last 24 hours was $56,846,777,902, down from $100,328,317,079 yesterday. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 82.74%.

Fear and Greed Index

Market sentiment remains high at 79 today. We’ve spent fewer than seven days outside of Extreme Greed since November 2020.

Bitcoin’s market dominance

Bitcoin’s market dominance is currently 62.52. Its lowest ever recorded dominance was 37.09 on January 8 2018.

Relative Strength Index (RSI)

The daily RSI is currently 57.39. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

Peter Lynch, legendary investor (via Michael Saylor)

What they said yesterday…

At what point does this become a concern?

Balancing act…

Nope?

Wow, diamond hands indeed…

Crypto AM Editor Writes

Markets respond after Bitcoin pierces $50,000 to reach new all-time-high

Citadel billionaire questions economic value of Bitcoin

Crypto AM: Longer Reads

City AM Markets: What is Decentralised Finance (DeFi) by Aave

Crypto AM: Conversation with James Bowater

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with with Zumo

Crypto AM: Talking Legal

Crypto AM: Spotlight

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: A Trader’s View with TMG

Crypto AM: Tiptoe through the Crypto with Monty Munford…

Crypto AM: Definitively DeFi

Crypto AM: Recommended Events

What’s Next for Crypto Webinar

Baker Botts & Team Blockchain

March 3 2021, 17:00 GMT

https://event.on24.com/wcc/r/3025235/72862B4A2DA17F4097395FBA84B845BF

CC Forum

Global Investment in Sustainable Development

March 31 to April 1 2021 – Dubai

Global Technology Governance Summit

April 6 to 7, 2021 – Tokyo

https://www.weforum.org/events/global-technology-governance-summit-2021

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.