Some car firms losing 30 per cent of staff due to ‘pingdemic’

Some UK car makers are seeing up to 30 per cent of their staff having to isolate due to the ‘pingdemic’, trade body the Society of Motor Manufacturers and Traders (SMMT) has warned.

Speaking at the association’s half-year production briefing, SMMT boss Mike Hawes said that the problem, which has affected many industries, was threatening the car industry’s recovery.

“We’ve got some companies that have lost up to 30 per cent of their staff due to isolation. The impact varies: the larger companies have greater flexibility to cater for these sort of absences compared to smaller companies, but you need to be operating at full production to make vehicles.

“You can’t make cars at 99 per cent of the parts”, he added.

Hawes called on the government to move the 16 August deadline for ending mandatory isolation for fully vaccinated people forward.

His words came as the SMMT revealed that UK car manufacturers could produce up to 100,000 cars fewer than predicted this year as a result of the global shortage of semiconductors.

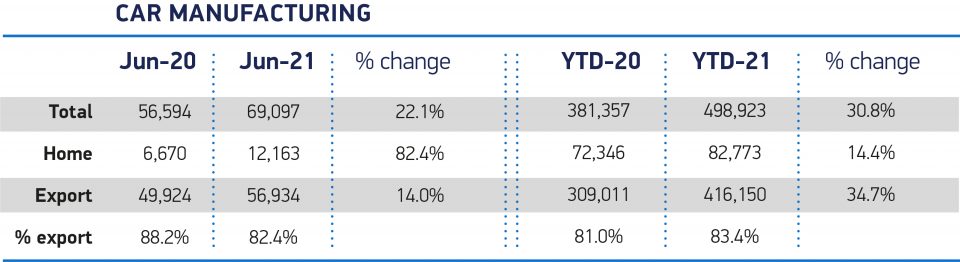

At the half year, car firms have produced fewer than 500,000 vehicles, down 38.4 per cent on the five-year average, the SMMT revealed.

Although that is up around 31 per cent on last year, which saw production flatline for several months due to the spread of the coronavirus pandemic, the supply chain crisis has slowed production lines and limited the sector’s recovery.

In June alone, just 69,097 units were produced, the lowest total for the month – barring last year – since 1953.

Speaking to reporters, Hawes confirmed the shortfall could see total production for the year drop below 1m.

At the beginning of 2021, the body estimated annual production would come out at 1.052m models.

“It’s difficult to forecast because for every manufacturer that you talk to about the semiconductor issues, one of the biggest problem they have is forecasting its impact. But we could be again below a million units”, he said.

The shortage will last until the end of the year, he added, although it would become less pressing over the next two quarters.

Investment boom brings hope

Despite the gloom surrounding recent events, Hawes insisted that the fundamentals of the UK car industry remained strong.

He pointed to the £606m worth of investment which went into the industry in the first half – up from £485m the year before – as proof of this.

That figure does not include recent announcements by Nissan and Stellantis over their respective plants in Sunderland and Ellesmere Port in Cheshire.

Hawes said that the investment was proof of how important the free trade agreement struck with the EU in December had been for the sector.

But if the sector is going to achieve its goal of ending the sale of all new petrol and diesel cars by 2030, Hawes said that the government would need to add to the £500m it has set aside for the automotive recovery fund.

“Operating conditions are still challenging, however, highlighting the need for specific actions to help competitiveness, such as creating a Build Back Better Fund and the alleviation of high energy costs, to get the sector back on track and towards the volumes that make UK facilities viable”, Hawes finished.