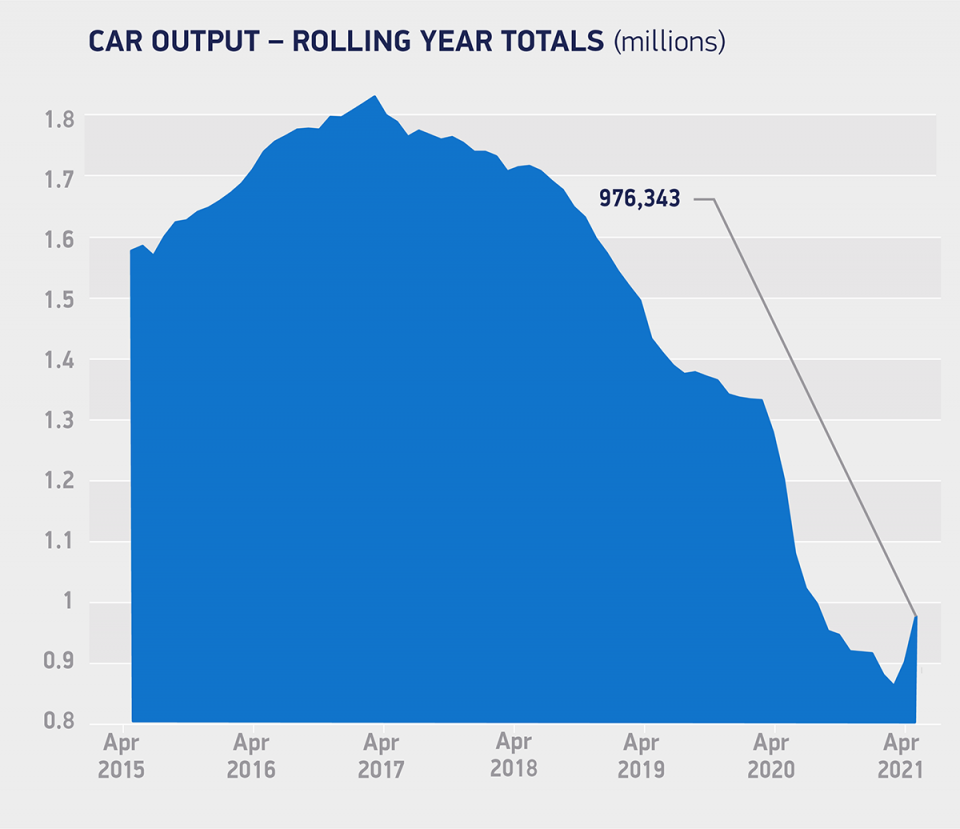

Car production bounces back on 12-month anniversary of factory shutdowns

UK car production returned to near normality in April compared to the same month a year before as automakers continued to struggle with the shortage of semiconductor chips.

Britain made 68,306 cars last month, up from 197 a year ago when factories were shuttered due to the initial Covid-19 lockdown.

Compared to April 2019, the number of cars rolling off production lines was down 3.8 per cent, the Society of Motor Manufacturers and Traders (SMMT) said.

For the year to date Britain’s carmakers have turned out 374,864 cars, down 15 per cent on the same four months in 2019.

However, the trend towards electric cars continued, with more than a fifth of all vehicles made last month either battery or hybrid powered.

In total, 22.8 per cent of all production was of such models, a third higher than in 2019.

SMMT chief executive Mike Hawes warned that the situation would remain “challenging” for UK carmakers through the year.

Before the Open: Get the jump on the markets with our early morning newsletter

“April’s figures were always going to be exceptional as factories were closed at this time last year amid the first wave of the pandemic”, he said.

“However, the situation for UK car manufacturers remains challenging, particularly with the worldwide shortage of semiconductors affecting output.

“While it’s good news that the UK is on track with its Covid roadmap back to normality, we still need strong domestic demand and given we’re export-led, confident overseas markets to drive a recovery, both for the automotive sector and for the wider economy.”

Electric vehicles need about 3,500 semiconductor chips, about three times as many as traditional internal combustion engine powered cars.

Jim Holder, editorial director of What Car?, said: “A source of concern for the industry is the continuing microchip shortage, which is affecting both lead times and vehicle specification levels.

“Our latest research of 1920 in-market buyers has found 38 per cent of new car buyers are not willing to wait more than two months for their car. If waiting times cannot be met, 35 per cent of buyers tell us they will look at existing stock or used models instead, which will add pressure to the already inflated used car market.”