What’s driving capital market developments in South Africa and Namibia?

CFA Institute has examined Africa’s 10 largest capital markets in a major report compiled by Heidi Raubenheimer, CFA, our senior director for journal publications. Here we highlight key developments in different countries, starting with neighbours South Africa and Namibia.

South Africa: Johannesburg Stock Exchange facing competition

South Africa – the second-largest economy in Africa after Nigeria – has considerably higher GDP than its sub-Saharan neighbours.

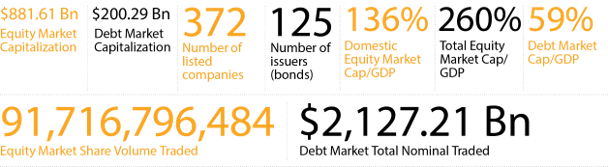

The country is home to the largest stock market in Africa, the Johannesburg Stock Exchange (JSE), which is 132 years old and has a capitalisation of more than USD1 trillion.

The JSE is a sophisticated and modern exchange, providing full electronic trading, clearing and settlement in equities, bonds and interest-rate products, as well as financial, commodity and currency derivatives.

There are about 350 companies listed on the JSE, of which the largest grouping is industrials, followed by resources companies such as mining and oil companies.

But the JSE faces significant headwinds. Having faced no competition for decades, the JSE is now challenged by smaller rivals such as ZAR X, a low-cost model created in 2016 to provide lower-income individuals with access to stocks.

Since then, other competitors have joined the fray, including A2X, 4AX, and the black economic empowerment-focused Equity Express Securities Exchange.

Market focus is currently on the recently introduced ‘twin peaks’ model of regulation, which responds to poor practices in the financial sector and inadequate regulatory oversight.

As in Australia, where the model debuted, it is designed to foster trust among investors and spur capital formation.

Namibia: finance, banking and mining dominate the exchange

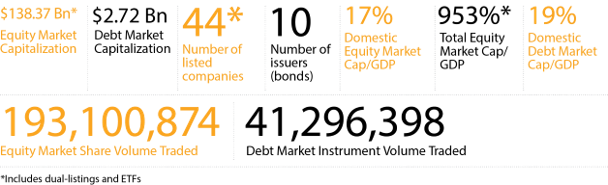

The Namibian Stock Exchange (NSX) has 424 listed companies – a fair achievement considering Namibia has the second-lowest population density of any sovereign country and counts just 2.6 million citizens.

The NSX was created in 1904 to fund the country’s diamond rush. By 1910, the rush was over and the exchange abruptly closed. It wasn’t until 1992, some 82 years later, that the NSX reopened with start-up capital from 36 Namibian businesses.

Although agriculture and tourism are important elements of the economy, the biggest stock market listings are dominated by other sectors. In fact, three sectors make up half the listings on the NSX: banking (four companies), mining (seven companies), and finance (11 companies).

The issuance and listing of debt is a more recent development. Until 2011, Namibia had almost no public debt. In fact, at just 16% of GDP, the country had one of the lowest debt-to-GDP ratios in the world. By 2017, however, the rapid rise in public debt led the country to be downgraded to a sub-investment rating by international ratings agencies.

The NSX has attracted interest from Namibian state-owned enterprises and private companies that have floated bonds worth more than NAD33 billion (about £1.73bn).

In the near future, more Namibian companies are expected to issue bonds as conventional funding dries up. Banks’ balance sheets and loan-to-deposit ratios have become stretched because of the economic downturn, and they are less willing to lend to corporates.

For local companies, the withdrawal of conventional funding represents an opportunity to source capital through balance sheets, collateralised or government-guaranteed debt instruments, or through equity raising on the local exchange.

In future postings we will take a look at capital market developments in Botswana & Zimbabwe; East Africa & Mauritius; Nigeria & Ghana; and Egypt & Morocco.

To access the full African Markets: Challenges and Opportunities report, and find more detailed assessment of South Africa and Namibia, click here.

About the report

Our tales of African capital markets’ history and future reflect the journey of CFA Institute: from a lunch group in New York City in 1937 to a diverse collection of 170,000 members and 157 societies worldwide in 2019, united with the purpose of leading the investment profession globally for the ultimate benefit of society.

Some of Africa’s exchanges were established in early colonial times. South Africa led the way on the heels of the diamond and gold rush, followed by Zimbabwe, Egypt, and Namibia (a German colony at the time) – all before 1905. Some didn’t outlive the commodities rush but others are still thriving – substantially diversified and modernised.

Some capital markets were established more recently, and their development tells of independence and nation-building: Nigeria in the 1960s; Botswana, Mauritius, and Ghana in 1989; Namibia post-independence from South Africa in the 1990s. Others, particularly the East African exchanges, are new and leapfrogging toward greater participation.

All tell of how regulation, trading technology and fintech are enabling fairer, faster and lower-cost participation in finance and investment for more market participants.

The CFA Institute Research Foundation brief was developed in conjunction with the African Securities Exchanges Association (ASEA).

Authors:

Adrian Saville (South Africa)

Chief Executive, Cannon Asset Managers and Professor of Economics & Finance, Gordon Institute of Business Science (South Africa)

Ronak Gopaldas (Namibia)

Director, Signal Risk

Image Credits: CFA Institute Archive