Capital Economics: Consumers to be ‘key driver’ of growth for UK economy

Households will dip into their savings, analysts at Capital Economics predict, which would help the UK economy to accelerate in the coming years.

The economic consultancy predicts that consumer spending will rise by 1.4 per cent in 2025 and 2.0 per cent in 2026, helping growth pick up on its relatively sluggish performance in 2024.

“Consumer spending will be a key driver of GDP growth in 2025 and 2026,” Ashley Webb, UK economist at the firm said.

GDP will expand 1.3 per cent and 1.6 per cent this year and next on their estimates.

The firm’s forecasts are based on the assumption that the household savings rate will fall in the coming years, meaning there are downside risks to the forecasts if the savings rate remains high.

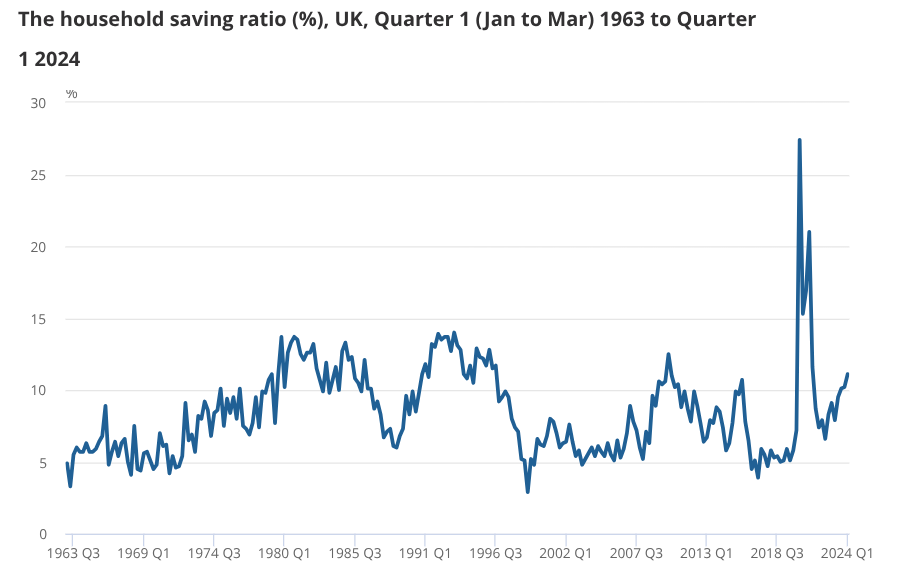

According to the ONS, the UK’s savings rate was 10.1 per cent in the third quarter of 2024, up from 8.9 per cent at the start of the year and around five per cent in the years before the pandemic.

Determining whether savings have increased due to cyclical or structural factors was a key factor for forecasting the UK economy, Webb said.

“It’s crucial for the outlook for consumer spending how much of this rise is due to a lasting increase in precautionary saving in response to the series of shocks that have hit the economy in recent years and how much is due to temporary factors that may be reversed.”

Capital Economics argues that most of the increase has been temporary, meaning it is likely to reverse.

Webb argued that higher savings rate was likely due to the Bank of England’s interest rate hikes, which strengthened the incentive to save. As these are unwound, consumers should save less.

He also pointed out that households tend to keep their spending relatively consistent over time whether or not real incomes rise or fall. In other words, they ‘smooth’ their consumption.

“History shows that households tend to save less when their incomes fall and save more when their incomes rise, in order to maintain a consistent standard of living,” he said.

Most forecasters expect growth in disposable income to slow as wage growth eases, which might prompt households to start saving less.

Finally, Webb argued that the higher savings rate was not a result of lower job security – known as precautionary saving – since unemployment has remained relatively low.

“This is in contrast to the early 1990s recession and the GFC, when lower job security appeared to be a key driver of the higher saving rate,” he noted.