Candy Crush maker King’s $500m IPO on its way

The developer of addictive puzzle solving games, King, has confirmed that it's going to market.

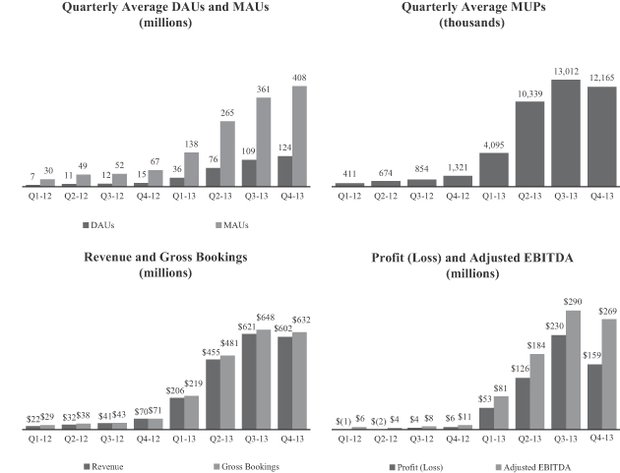

The company has filed for a $500m initial public offering. It boats 324m monthly unique users, and offers a portfolio of over 180 games.

King hopes to list ordinary shares on the New York Stock Exchange with the ticket symbol "KING". The number of shares to be offered and the price range have not yet been set.

They've been translated into 14 languages, but its Candy Crush offering is by far and away the most recognisable. And King say it accounts for a staggering 78 per cent of its total gross bookings.

User growth has been phenomenal. See the daily active user (DAU) and monthly active user (MAU) numbers below.

(King Digital Entertainment)

JP Morgan, Credit Suisse and Bank of America Merrill Lynch are acting as joint lead book-running managers and as representatives of the underwriters for the proposed offering. Barclays, Deutsche Bank, and RBC Capital Marketsare also acting as joint book-running managers for the proposed offering.

Back of envelope calculation. Flappy Bird makes $50,000 a day. Candy Crush made $5.2m/day in Q4

— James Titcomb (@jamestitcomb) February 18, 2014