Can companies really balance the needs of all stakeholders?

The question of whether companies can combine profits with purpose continues to be a thorny one.

In March, management change at French food producer Danone underlined the difficulties some companies face in trying to become more sustainable businesses. The CEO-chairman, who had made a powerful statement of intent by formally turning Danone into a “purpose-driven company”, was ousted by activist investors.

Many companies are taking a broader view of their purpose so that they serve the interests of all their stakeholders, rather than focusing primarily on rewarding shareholders. This is a concept known as stakeholder capitalism.

But how does this work in practice, and can investing this way really achieve above-benchmark returns for investors? Three investment experts give their views, and offer a real-life example of how investors can influence a company’s treatment of its stakeholders.

How should sustainable companies prioritise their stakeholders?

Nicholette MacDonald-Brown, fund manager and Head of European Blend, said: “As a sustainable investor, what I’m looking for is companies that consider the needs of all their stakeholders. These are employees, suppliers, customers, regulators, shareholders, local communities, and the environment.

“These stakeholders aren’t all equally important to every company; regulators are more important to some industries than others, like banking, for example. And at different times a company may need to prioritise one set of stakeholders over another. But what is important that this isn’t to the detriment of other stakeholders.

Scott MacLennan, fund manager, said: “Sustainable investing or ESG investing largely grew up out of concerns around governance. News events or public opinion have at times shifted the pendulum more towards the environment, or towards social issues. But as long-term investors, we have to maintain our focus on how companies are treating all of their stakeholders.”

Discover more from Schroders:

– Learn: How do you measure impact?

– Read: What does a €50 carbon price mean for European companies?

– Watch: The telecoms business which pioneered a payment system lifting thousands out of poverty

What role do investors play in ensuring companies consider all their stakeholders?

Nicholette said: “This really comes down to active fund management. Stockpickers like ourselves choose which companies we allocate clients’ capital to, in contrast to a passive fund that simply buys holdings to reflect a particular index.

“As investors who can choose whether or not to invest in a company, we can play a powerful role in engaging with companies on behalf of all stakeholders.”

Scott said: “Ultimately, a sustainable business is one that is managed for the long term. If a business considers the impact it has on all its stakeholders then it should be better placed to grow, deliver returns for shareholders, provide secure jobs for employees, and be a reliable partner for suppliers.

“A business that doesn’t consider its stakeholders leaves itself open to all kinds of risks. These could be reputational, or financial (in the form of fines from regulators, for example) or the operational risk posed by a demotivated workforce.”

Where do priorities lie?

Every company has its own complexities and challenges, meaning there is no “one size fits all” approach for management to take with regard to considering the needs of stakeholders. Investors too need to consider the challenges facing a business, and weigh up when to press for change.

“An example of a company prioritising certain stakeholders without harming others is French supermarket group Carrefour,” said Nicholette. “We recently engaged with the company on behalf of shareholders.”

Michael Docherty, Equity Analyst, said: “Going back a few years, Carrefour had been experiencing a difficult period for sales amid new pricing laws in France and tough competition from rival chains. As a food retailer, clearly a focus on customers is paramount and so the priority task for management was to put that right.”

But once the customer focus issues have been addressed, what comes next?

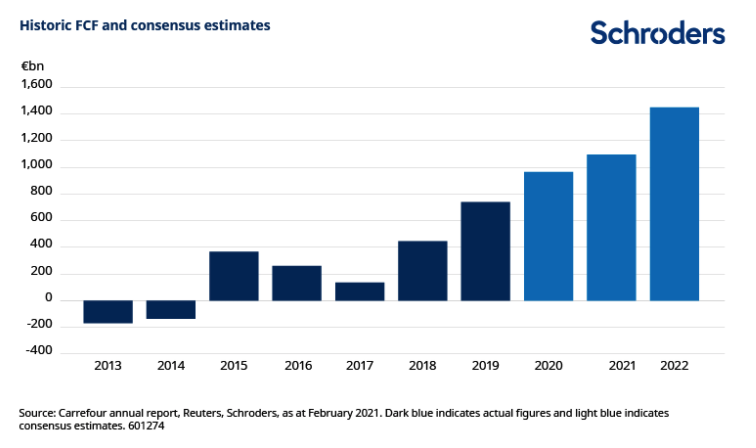

“Carrefour improved its price positioning and customer focus,” Michael said. “It also took other steps to improve its operational performance. The result was that free cash flow (FCF) generation began to improve substantially.”

FCF represents the cash that a company is able to generate after accounting for the money required to maintain or expand its asset base. FCF is important because it allows a company to pursue opportunities that enhance shareholder value: invest in new products, make acquisitions, pay dividends, buy back shares, and reduce debt.

The chart below shows how Carrefour’s FCF began to improve in 2018, with consensus estimates anticipating further improvements in 2020 and beyond.

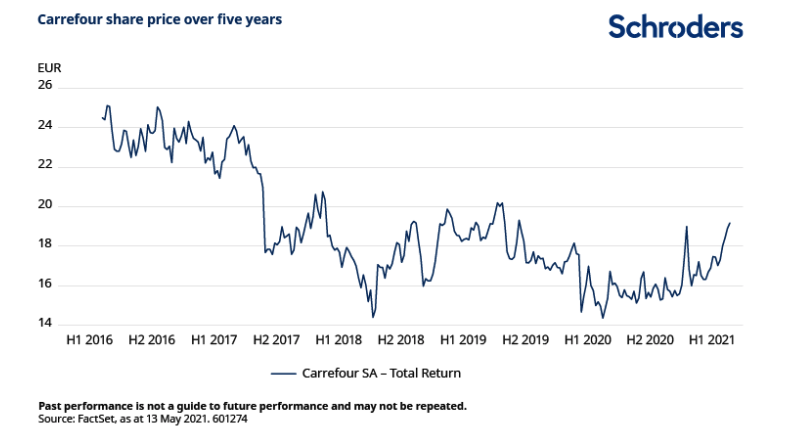

However, as the second chart shows, this did not translate into significant improvements in Carrefour’s share price in 2018.

But while Carrefour’s expected operational improvements went unrewarded by the stock market, they were certainly noticed by others. The January 2021 share price spike evident in the chart above marks news of a takeover bid from a Canadian food retailer. The bid came to nothing, but it shows how companies that neglect shareholders can become vulnerable to takeovers by rivals or other investors.

Engagement on behalf of shareholders

Nicholette said: “It seemed clear to us that the stock market wasn’t giving Carrefour any credit for the improvements it had made. Our view therefore was that Carrefour should combine its ongoing operational improvements with cash returns to shareholders. We wrote to Carrefour to communicate this view.”

“Shareholders are an important stakeholder for companies,” Scott said. “A business needs to be able to fund its future and shareholders are essential to this.

“We felt Carrefour could afford to increase shareholder returns without jeopardising its commitments to other stakeholders.

“For example, Carrefour has said it will recruit 15,000 young people this year given labour market pressures. It might also expand via bolt-on acquisitions. But the strong improvements in the business gave us confidence it could do all three.”

Importance of in-depth knowledge

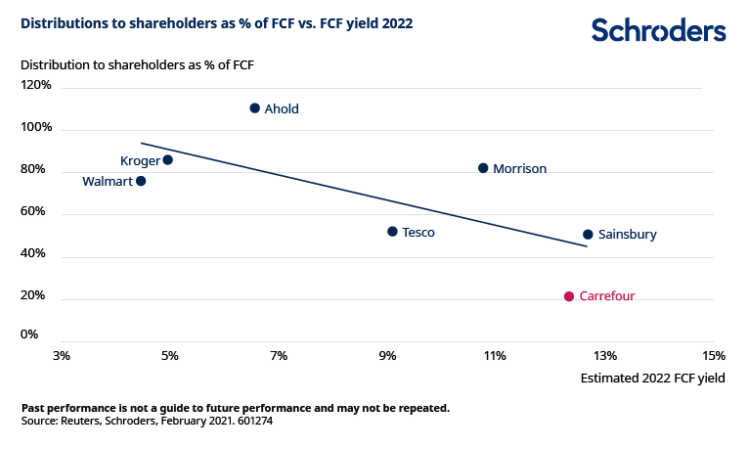

Michael sid:“ I had compared Carrefour to its peer group in terms of returns to shareholders. As the chart below shows, Carrefour was expected to have one of the higher FCF yields in the supermarket industry, but was paying a smaller proportion of that cash out to shareholders.”

“Given the ongoing global pandemic, the present moment isn’t optimal for many companies to improve their shareholder returns,” Nicholette said. “But supermarkets have been among the ‘pandemic winners’ and we felt that asking for a plan around future returns was appropriate.”

Subsequently, in March this year, Carrefour announced that it would start paying its dividend in cash rather than in shares, and aims to increase the dividend regularly. The dividend had been paid in shares (known as a “scrip dividend”) for almost ten years. Then, in April, Carrefour announced it would buy back €500 million of its own shares.

Of course, it remains to be seen how this renewed focus on shareholder returns will affect Carrefour’s share price in the longer term.

Companies operating in different industries and geographies have their own complexities. Understanding these nuances are crucial to engaging successfully with companies.

“A nuance of French firms is that a joint chairman-CEO set-up is very typical, which is not the case in countries like the UK”, Scott said. “This doesn’t necessarily make it harder for investors to engage with such firms. It simply means engaging more with independent directors on the board to ensure that voices outside the management team are heard.”

Nicholette said: “Every company is different and so every engagement and investment decision is different. But fundamentally we don’t think there has to be a trade-off between investing sustainably and generating above-benchmark returns. Considering a company’s impact of all its stakeholders is crucial to our analysis of any potential investment.”

This article was published on 13 May 2021. Any company references are for illustrative purposes only and are not a recommendation to buy and/or sell, or an opinion as to the value of that company’s shares.

The article is not intended to provide, and should not be relied on, for investment advice or research.

– For more visit Schroders insights and follow Schroders on twitter.

Topics:

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.