Can asset management’s Covid-19 response help regain public trust?

The tenth anniversary of the Global Financial Crisis (GFC) back in 2018 sparked a deluge of articles recalling the days the financial system stared into the abyss.

They questioned just how close we came to complete collapse, but also whether it could happen again. Had anything changed in the decade that followed?

From some perspectives the answer was yes, a great deal. Bank balance sheets in the US and Europe, for example, are far more robust than they were pre-GFC.

The Covid-19 pandemic has arguably disrupted lives and economies even more drastically than the GFC. While the strength of the reinforced financial system has meant that any “systemic” threat was contained, the impact on businesses, especially small and medium-sized firms, has been profound. In many cases, it has been existential.

As stringent restrictions designed to stem the virus’ spread are re-imposed, we think we are entering a period of real hardship for UK businesses. A lot of companies are going to need cash injections in the next 24 months.

What is effective asset management?

We believe asset managers are in a unique position now to demonstrate their worth. This is an opportunity to support good businesses through hardship, and fuel growth when it is sorely needed. As responsible investors – stewards of capital – assisting companies through this gauntlet is both a duty and a chance to rebuild trust.

The next two years are going to pose major challenges for otherwise sound UK companies. Many of these good companies look cheap at the moment, and should recover strongly with the right help.

We think equity investing is the best mechanism for helping businesses confront the challenges of the pandemic, while also offering potential rewards to investors.

Discover more from Schroders:

– Learn: Can asset management’s Covid-19 response help regain public trust?

– Read: Think short-term for lockdown but not for investing

– Watch: How climate change could affect your investment returns?

Why equity not debt?

Equity investing allows an active interest in the operation of a business, and doesn’t shackle it to debt repayments. Debt has been an important source of funding for companies in the pandemic so far, with many drawing on bank loans or making use of various loan schemes offered by the government.

Figures show UK companies have applied for loans totalling £65.5 billion (as at 15 November) under the government’s three main coronavirus support programmes (Coronavirus Business Interruption Loan Scheme, Coronavirus Large Business Interruption Loan Scheme, and the Bounce Back Loan Scheme).

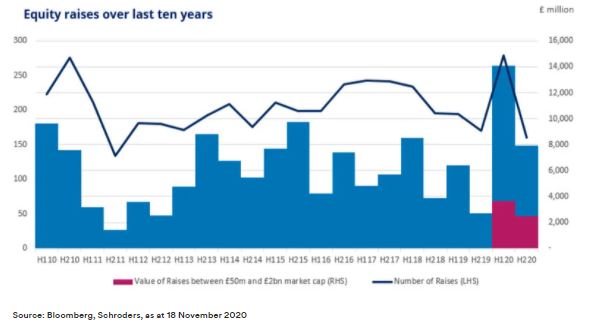

Meanwhile, a large number of listed UK companies have already turned to the stock market to raise more money this year, as the chart below shows. Many more will need to do the same. However, the total equity raised – around £22 billion – is far below the amount borrowed from the government.

What is notable is that small and mid-sized companies – those with a market capitalisation of £50 million to £2 billion – have raised very little capital this year (as shown by the pink bars). This is an area where we think there will be significant demand for fresh equity.

Ever-increasing amounts of debt cannot be the answer. Interest rates are currently very low in the UK, making debt manageable, but that could change in future. Even a small increase in rates could have a very severe negative impact.

Many businesses have had to borrow just to survive in the past few months, and some are reluctant to take on further debt to invest in future growth opportunities. Without business investment, the outlook for jobs and GDP growth in the UK would be dismal.

This is where both the stock market and private equity investors have a crucial role to play.

- Read more: Is the UK stock market doing its job?

Engagement is crucial in tough times

Active fund management is not just about actively selecting which companies to invest in (as opposed to buying a passive fund like an index tracker). It is also, crucially, about engaging with investee companies to help shape their strategy.

This is particularly important in challenging times like today. For many companies, surviving this temporary difficult period is clearly their primary focus. But we take very seriously our responsibility as stewards of our clients’ capital and this means retaining a long-term view. It is our duty to work with companies to find out how prepared they are for a changing world. We use our voice to make sure that companies are focused on what matters to their business.

By engaging with investee companies, we can help them look beyond the day-to-day and make the right decisions to drive innovation. This can help to promote jobs and growth in the future. We also engage with companies to ensure they have a long-term focus on the sustainability of their operations, taking into account their impact on the environment and other stakeholders such as suppliers and employees.

- Read more: How does an asset manager like Schroders actively engage with the companies it invests in

As investors, we can engage with our investee companies whether they are public or private.

There is a misguided view that engagement practices are not as developed or effective for private companies as they are for listed companies.

In some ways we think they can be better. Private equity allows for an ongoing dialogue to improve upon areas identified as below-par, whether operationally or in terms of being socially or environmentally conscious.

The fact that private equity investors often own controlling stakes in a business and typically hold portfolio companies for many years, means it can be easier to ensure adoption of better practices wherever improvement is needed.

What’s more, a relatively large portion of the privately owned companies are smaller companies, often focused on a single type of service or type of product. This can make it simpler to keep track of the positive or negative qualities of a company than might be the case with diverse conglomerates with different business lines and offerings.

The fact that there are hundreds of thousands of privately-held companies means that private equity investors can also be highly selective.

Protecting future growth

We see a wide range of companies in the UK, particularly in the small and medium-sized segment, where equity investment has the potential to make a significant difference both to investee companies and, ultimately, to investor returns. These opportunities can be found among listed companies and privately held firms.

Consumer-facing businesses have been some of the hardest hit by the pandemic. Many industries, from pubs to airlines, saw demand plunge to virtually zero overnight. Equity investors may need to be patient with such businesses, but we are confident that demand will return. The appeal of dining and holidaying exclusively at home will inevitably start to wear thin.

Then there are the businesses that may develop the products and technologies we will use in the future that deserve to survive, and we can help them do that. The UK is home to a number of innovative companies in the technology and healthcare sectors, for example.

For asset management to emerge from the Covid-19 pandemic in a better light than it did after the GFC it needs to demonstrate social value and contribute to sustainable future growth. And it can.

Responsible investors have the capacity to back companies that demonstrate good corporate behaviour and positively impact society. Crucially, not only do we think that this can be achieved without sacrificing investor returns, but that doing so contributes to better long-term investor outcomes.

– For more visit Schroders insights and follow Schroders on twitter.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.