Calculating the good, bad and boring in Defi

There is a feeding frenzy around decentralised finance (Defi). The most popular decentralised exchange Uniswap has surpassed more than $3bn locked in it, and there was a peak in October of more than $12.5bn of assets in Defi. Much of the excitement has been driven by the returns earned for providing liquidity for ‘automated market making’. This has meant individual token owners can act as market makers for specific pairs, with the potential of significant fees, by providing their tokens. The decentralised exchanges use the pooled tokens to provide a market, and a liquidity boom in response to this has driven huge crypto-market activity.

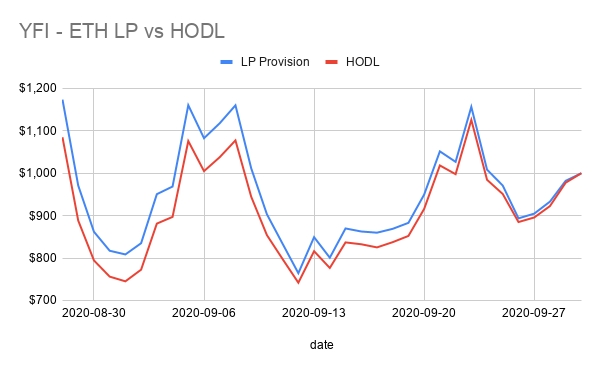

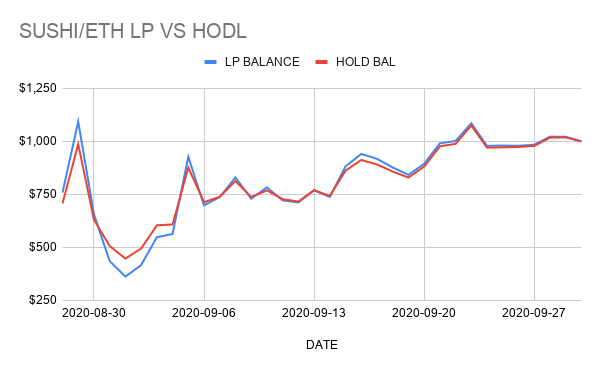

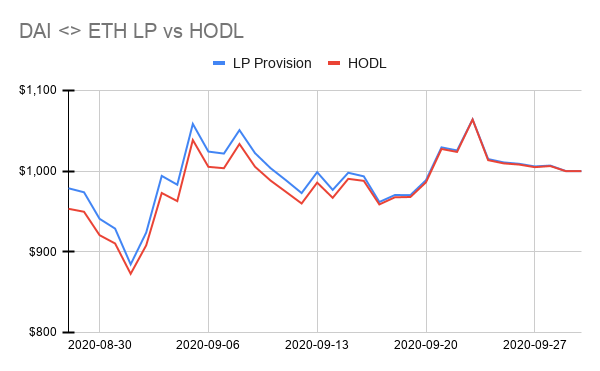

To demonstrate the kind of varied return – both positive and negative – which you can receive from this activity, Novum Insights chose three pairs; YFI/ETH, SUSHI/ETH and DAI/ETH. Yearn Finance (the good) was praised throughout August and September for providing regular, high yield, SUSHI (the bad) was the most famous project to become infamous over night, and DAI (the boring) a stable USD$ tethered token. All are shown against ethereum (ETH), which is one of the most popular tokens for liquidity providers to use.

Our free-to-access calculator (link at end of article) shows the impact of investing US$1000 in each of these pairs from the launch date of SUSHI on the 28th August until the end of September so slightly more than one month of providing ‘liquidity’ to the market. If your browser supports HTML5 (like Chrome for example), you can move the dates around within this range to experiment with different ‘buy’ and ‘sell’ dates to calculate the impact.

The results are of course ‘estimates’ as the prices of different tokens rise and fall throughout the day and we have taken daily averages but the results may surprise you. In addition, we should add a cautionary note about gas fees – the cost of transferring money and indeed doing anything on the ethereum network – which can fluctuate wildly, and reached $50 for providing liquidity across one pair during the summer. These calculations do not include any of these fees for ‘authorising’ your wallet to spend tokens or pairs as well as the cost of placing the tokens in or out of the ‘pool’. We would add that these gas costs do not vary with the amount involved, meaning that if the amounts are high enough the ‘gas fees’ are not significant.

With Yearn Finance providing liquidity to the YFI/Eth pair during late August to the end of September period was generally a more profitable strategy (gas, not included) during the period than simply buying and holding. Investors benefited from a surge in the price of the asset to mid-September of more than $40,000. However, it should be noted while YFI comes out very favourably in a late August to late September analysis, a torrid October for the token, would have led to a bath for those who kept on investing after the end of our tool’s analysis. All graphics calculate the ending value from the day a trade is made and assume the pair is held until the end of September.

For volatile tokens of the most speculative nature like Sushi, it appears better to simply hold the asset on the way up on Uniswap than provide liquidity. The way Uniswap’s ‘AMM’ works means that you are rebalanced with more of the token which is going up less in price, so you miss out on much of the gains. On the flip side you are compensated with proportionately more of the token as it declines, and so while providing liquidity would see you accumulating significant numbers of Sushi in fees and rebalancing, you end up holding the riskier asset. The analysis shows Sushi would have been very profitable to buy and hold between late August and before September 5, when the ‘SushiChef’ pulled the rug and the price halved in a day and then halved again in the next day. At the time of writing Sushi now sits at $0.67 from the high of $10.86.

The more boring but popular trade of providing liquidity or Hodling Eth and DAI, would see your dollar returns fluctuate from a circa 10% loss in many combos to a 10% gain should you have entered the trade towards the end of September. We anticipate liquidity provision will gravitate towards these kinds of pairs.

Yet to help traders at Novum Insights we intend to extend our analysis to look at the more than 500 pairs on Uniswap which have more than $10,000 in daily volume. This looks beyond the near 15,000 pairs that we have analysed, but many of these have negligible volume or could be scams. As we look to extend this analysis we would love the community’s feedback on what kind of analysis is helpful to understand trading.

For a wider look at the tool, click here to see the results:

https://defi-calculator.novuminsights.com

Novum Insights is a research firm of cryptocurrency, blockchain, artificial intelligence, fintech and the circular economy. Article by Toby Lewis, David Henderson and David Layton of Novum Insights.