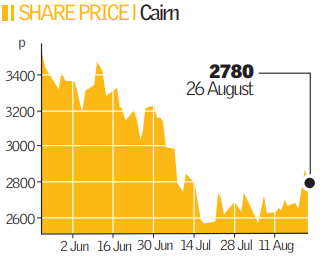

Cairn reports mixed results

Cairn Energy, the Scottish oil and gas explorer, reported a drop in first half post-tax profits yesterday as it sold fewer shares in its Indian unit.

Profit after tax dropped to $375m (£204m) in the first half, down from $1.5bn year–on–year, amid concern from investors that the Indian government could impose windfall taxes on its Indian arm, Cairn India.

But higher oil and gas prices drove operating profits to $44m against an $18m loss last year and the company said it was well capitalised.

Chief executive Sir Bill Gammell, a former Scottish international rugby player, said: “The group continues to demonstrate the balance sheet strength to deliver its strategy and meet the funding needs of both arms of the business.”

The Edinburgh-based company raised $358.7m in the first half by selling a four per cent stake in Cairn India, worth $636.8m, to Petronas and Orient Global Tamarind Fund. Cairn made a $1.5bn gain when it floated the unit last year.

The firm is now gearing up to begin drilling in India, with operations to exploit reserves in Rajasthan due to begin in the second half of 2009. And Cairn’s Capricorn arm has begun an exploration programme in Greenland, where it hopes to extract up to 50bn barrels of oil.