‘Burglar’ short-sellers under fire over Darktrace attack

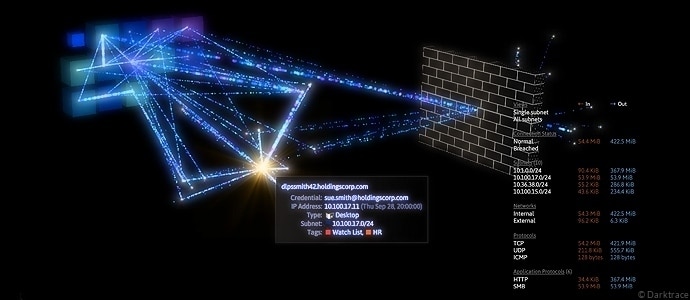

THG boss Matt Moulding accused regulators and the London Stock Exchange of turning a blind eye to “rogue” hedge funds and short sellers over the weekend, criticising US giant Quintessential for its attack on Darktrace last year.

Quintessential built up a short in the UK tech firm last year before publishing a research report alleging a host of irregularities in its reporting, including growth rates.

Shares tanked before an EY report, commissioned by Darktrace, gave the cyber security outfit a clean bill of health.

Quintessential hit back, with Gabriel Grego – the firm’s managing partner – defending short sellers as vital to “market efficiency and price discovery.”

Short-selling remains a contentious topic in the City. Moulding and others have previously suggested that the ease with which hedge funds can make short bets in the UK has contributed to the under-performance of London’s equity markets in recent years.

Moulding told City A.M. that proponents of short-selling – who argue that they improve the efficiency of markets – are like “burglars robbing homes and then arguing they are helping to declutter.”

“Because it’s so cheap,” Moulding wrote in his LinkedIn post, “you can make hundreds of millions by wreaking havoc against a company and its share price.”

The Mancunian entrepreneur said a “lack of action” by regulators contributes to the “sentiment that London is a backwater” and called on the City watchdog, the FCA, to crack down on short selling.

He also said MPs should be moved to take action.

The FCA declined to comment.