| Updated:

Burberry sales grow in third quarter but slip in Hong Kong

British luxury brand Burberry had a good end to 2014, with retail sales rising 15 per cent to £604m in the third quarter.

The success was driven largely by strong digital growth in the Americas, Europe and the Middle East, but this progress wasn’t replicated in Asia – sales fell in Hong Kong, and there was single-digit percentage growth across Asia Pacific. During the previous three months, Burberry had notched up double-digit growth.

Why it’s interesting

The brand, best known for its trench coats and check pattern, was having a good time until 2013, particularly in terms of Asian expansion.

But this was interrupted when the pound became too strong, meaning exports and foreign expansion started to suffer. Since then Burberry has warned numerous times of currency headwinds.

The global brand is also being affected by geopolitical issues outside its control, with the corruption crackdown in China and pro-democracy demonstrations in Hong Kong raising fears of dampened sales in Asia.

The much-admired former chief executive Angela Ahrendts left last year for a new role at Apple, paving the way for creative director Christopher Bailey to take her place. The FTSE 100’s only openly gay chief executive, Bailey now holds both positions at the company and receives a controversially high salary as a result.

He is lauded for his creative skill within the industry, but some have been sceptical as to whether he has the operational nouse needed to head up such a large business.

What Burberry says

Bailey said the underlying growth in retail sales reflected a “commitment to every element if the customer experience, from product, to marketing, to service”.

Looking ahead, we will bring equal focus to maximising the opportunities of the final quarter – including Lunar New Year – while being mindful of what remains a challenging external environment.

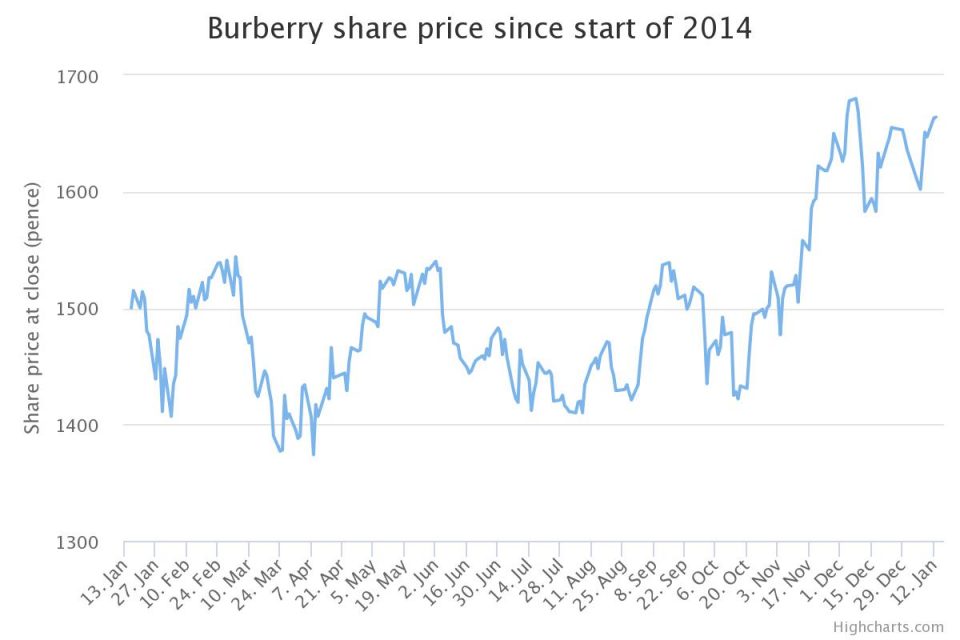

Despite the brand’s difficulties abroad, Burberry’s share price has been doing well over recent months. At the end of December, shares were valued at £16.45 – up from £14.83 six months earlier. However, after an initial spike its share price was down two per cent at pixel time this morning.