Bumper bullish bonzana: Lummis goes long, PayPal goes parabolic, Musk goes mad, and alliteration goes too far

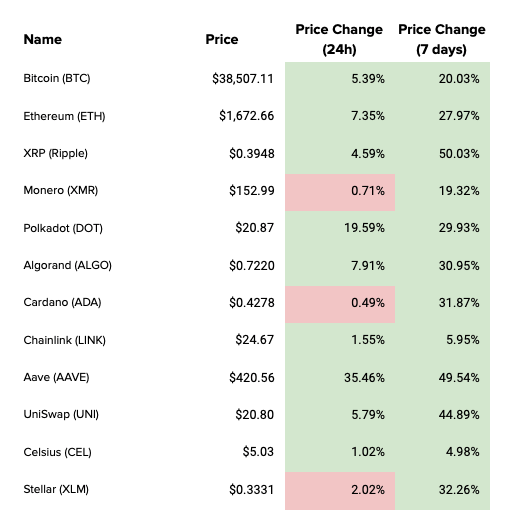

Crypto at a Glance

It’s all systems go at the moment. Ethereum is in uncharted territory and has entered price discovery mode, Bitcoin has decisively broken out of the $30-35k range and is charging back towards $40k, and Elon Musk is tweeting about Doge again so expect that to have another wild weekend. It’s now a top 15 coin. UniSwap is at 12 and not all that far off breaking the top 10. What a time to be alive.

If parabolic price rises weren’t enough to get you jumping naked into the ocean screaming with joy, there was a deluge of bullish news yesterday to feast on too. First, Wyoming senator Cynthia Lummis announced that she’d been appointed to join the committee tasked with the US financial legislation. In a statement, she said she hoped to “work with federal regulators to ensure that regulation of digital assets are structured to encourage innovation, instead of stifling it.” Then there was the news that Visa is to launch an API allowing every bank customer to offer Bitcoin through their existing services, PayPal held its first earnings call since it started offering crypto and said it had exceeded targets and was going to expand its offering, and Michael Saylor held his big Bitcoin shill to a room full of publicly-listed companies.

It’s exciting, right?

In the Markets

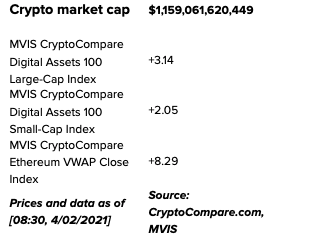

The Bitcoin Economy

What bitcoin did yesterday

We closed yesterday, 3 February, 2021, at a price of $37,472.09 – up from $35,510.29 the day before. That’s the highest daily close since 14 January and the sixth highest in history.

The bitcoin price has now closed over $30,000 for 33 days in a row and over $20,000 for 48 days in a row.

The daily high yesterday was $37,480.19 and the daily low was $35,443.98. It’s the highest daily low since 19 January.

This time last year, the price of bitcoin closed the day at $9,293.52. In 2019, it was $3,464.01.

As of today, buying bitcoin has been profitable for…

99.9% of all days since 2013-04-28.

Bitcoin market capitalisation

Bitcoin’s market capitalisation is currently $708,991,905,061, up from $671,091,782,600 yesterday.

Bitcoin volume

The volume traded over the last 24 hours was $65,102,226,508, up from $65,102,585,376 yesterday. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of bitcoin over the last 30 days is 97.31%.

Fear and Greed Index

Market sentiment remains high, in Extreme Greed at 80 – though relative to when the price was surging last month, it appears to have cooled a bit. This is likely a good thing, as it means this is likely a less hysteria-driven rise and more durable in the long run.

Bitcoin’s market dominance

Bitcoin’s market dominance is currently 62.54. Its lowest ever recorded dominance was 37.09 on 8 January, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 62.99. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“The volume of crypto traded on our platform greatly exceeded our projections. We’re excited to build on this early success by allowing customers to use their crypto balance as a funding source. … We hope to launch our first international market in the next several months.”

– PayPal CEO Dan Schulman speaking yesterday on the company’s fourth-quarter earnings call

What they said yesterday…

It’s happening…

Apparently 24 hours is ‘a while’ off Twitter in Musk’s world

It moved.

Welcome, publicly-listed companies. We’ve been waiting for you.

Thursday thoughts

Crypto AM: Longer Reads

City AM Markets: What is Decentralised Finance (DeFi) by Aave

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking in association with with Zumo

Crypto AM: Talking Legal in association with INX

Crypto AM: Spotlight

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Deeper Dives with Liam Roche

Crypto AM: A Trader’s View with TMG

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Definitively DeFi

Crypto AM: Events Spotlight

Crypto AM: Recommended Events

Bitcoin for Corporations – MicroStrategy

3 February 2021 – online – 12.00 – 16:45 EST

https://www.microstrategy.com/en/resources/events/world-2021/bitcoin-summit

6th Edition Global Blockchain Conference

9 February 2021 – Dubai

https://agoragroup.ae/events/global_blockchain_congress_6th_edition

Global DeFi Conference

10 February 2021 – Dubai

https://agoragroup.ae/events/global_defi_congress%20

CC Forum

Global Investment in Sustainable Development

3 – 4 March 2021 – Dubai

Global Technology Governance Summit

6 – 7 April 2021 – Tokyo

https://www.weforum.org/events/global-technology-governance-summit-2021

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.

Crypto AM Daily in association with Luno